IV.

Effectiveness of Fiscal Policy

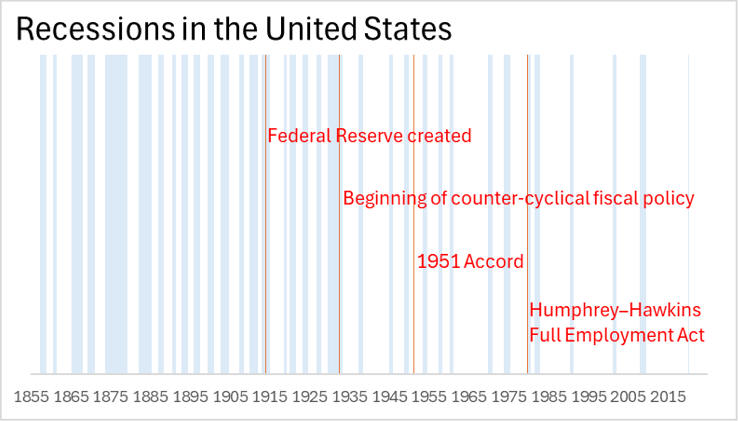

A. Timing

1.

Determining when recessions begin is difficult.

a. Disagreement over

whether the U.S. was in

a recession from 1989-1991 resulted

in little

fiscal action

being taken.

b. The 2001 slowdown happened so fast there

was not time for preemptive action.

2.

Fiscal policy takes time to implement

3. There will be a

delay because it takes business

time to expand capital investment.

B. Political

considerations

1.

Some spending programs are difficult to cut

(social security,

military, education).

2.

Expansionary bias: people vote to spend but

not to tax.

3.

Political business cycle: it is difficult

to accomplish anything

economically

constructive during

an election year

C. Recently, many

felt the federal

debt is too big

and has rendered fiscal policy ineffective.

Its success in

ending the 2001

recession has

yet to be determined although the Federal

budget surplus certainly makes it easier to

increase federal

spending and decrease

taxes although the expense of fighting three

wars has

again increased the deficit.

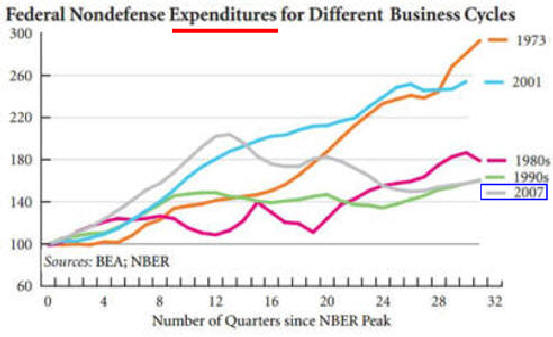

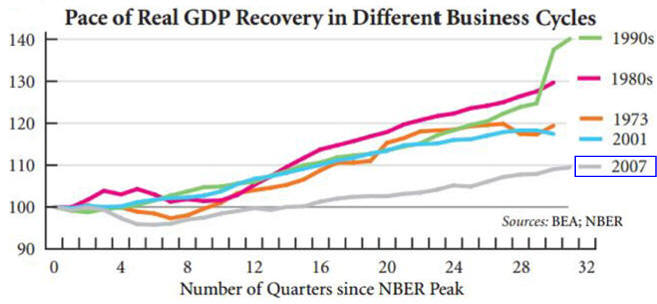

D. In 2012 People Fear the

Drag of Taking Away

the

Stimulus of 2009- 2011.

E.

Kansas Fiscal Policy

Tax Cut Failed

10//17

B Ritholtz

F.

Fed Uncertainty of Economic Effects Of Tax Cuts.

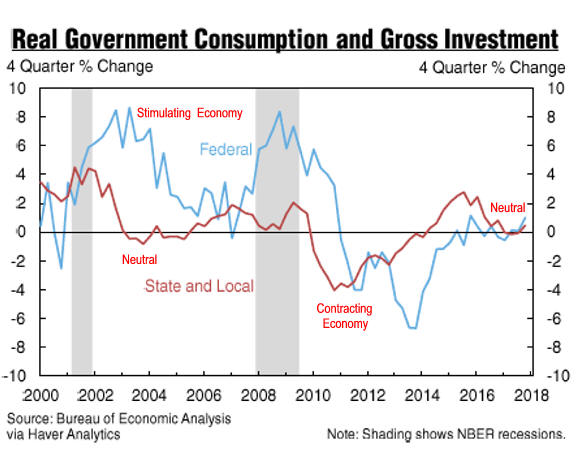

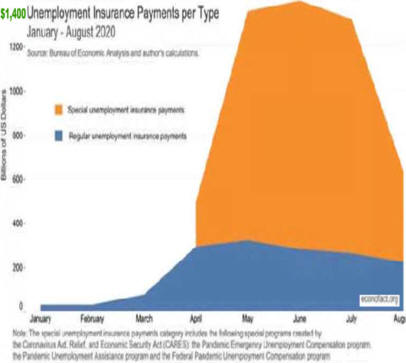

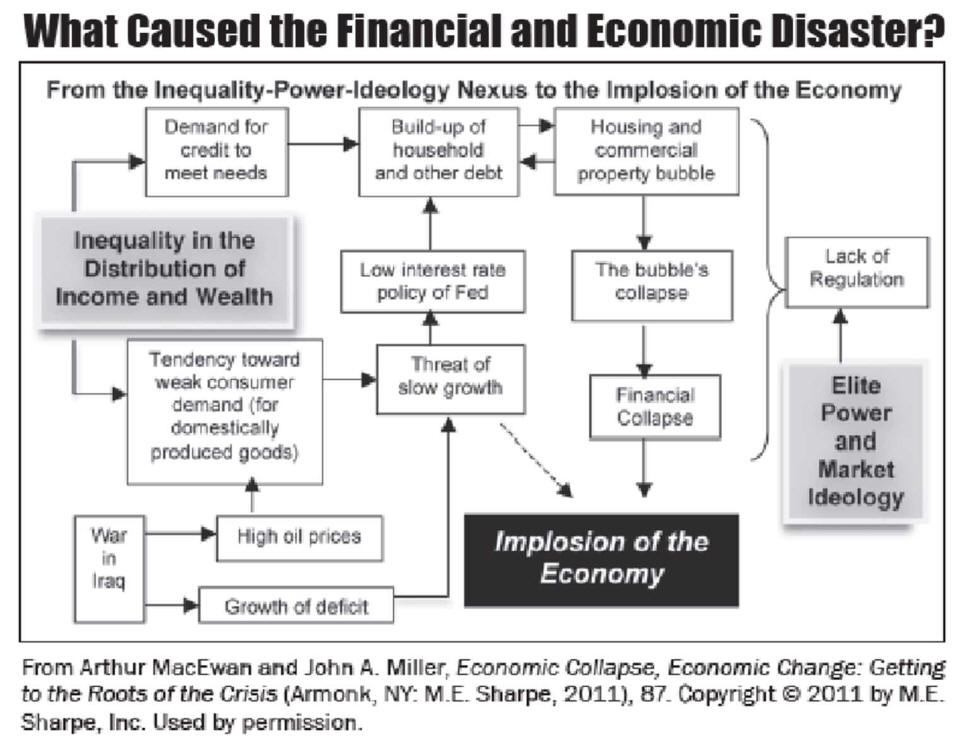

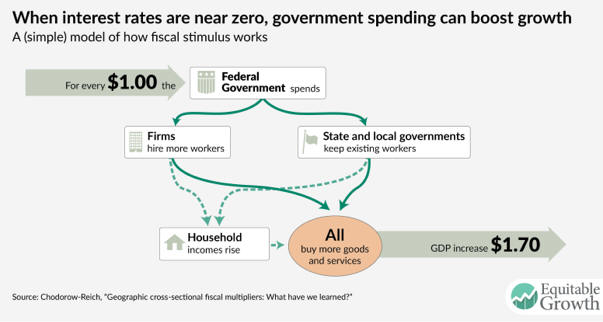

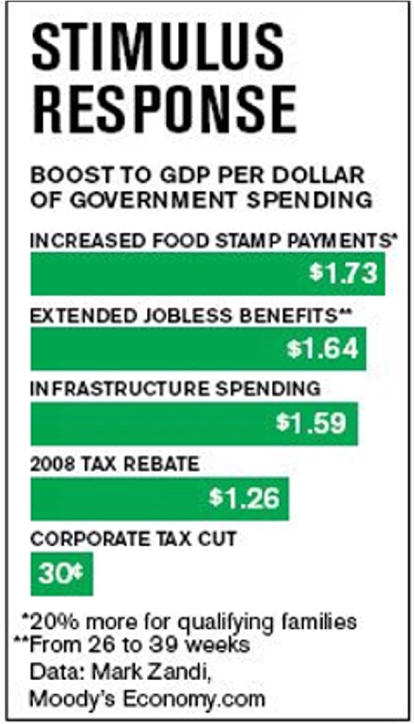

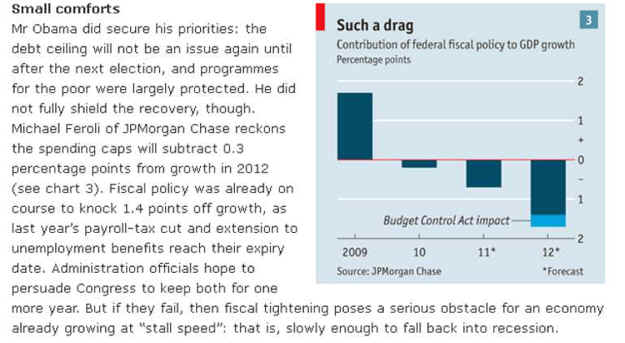

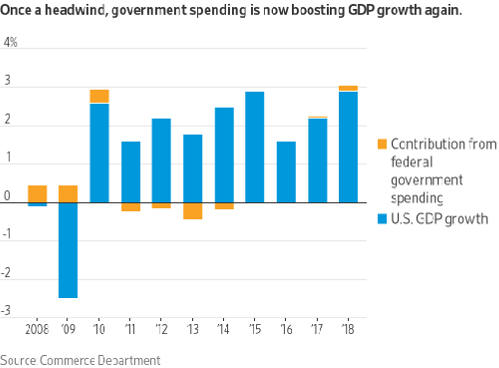

See Chart State and local cuts have very nearly run their course at this

point, but the economy now faces the run-off of stimulus programmers, as well as

the expiration of emergency unemployment benefits and, potentially, the

expiration of lots of other tax proposals. The President's latest plan aims to

move the total government impact on growth from a drag of about 1.5 percentage

points of GDP to approximately even. When the economy is growing at between 1%

and 2% per year, a 1.5 percentage point drag on output is a very big deal

indeed.

See

Government Spending Might Not Create Jobs Even During Recessions

V.

Fiscal Policy Affects the Private Economy

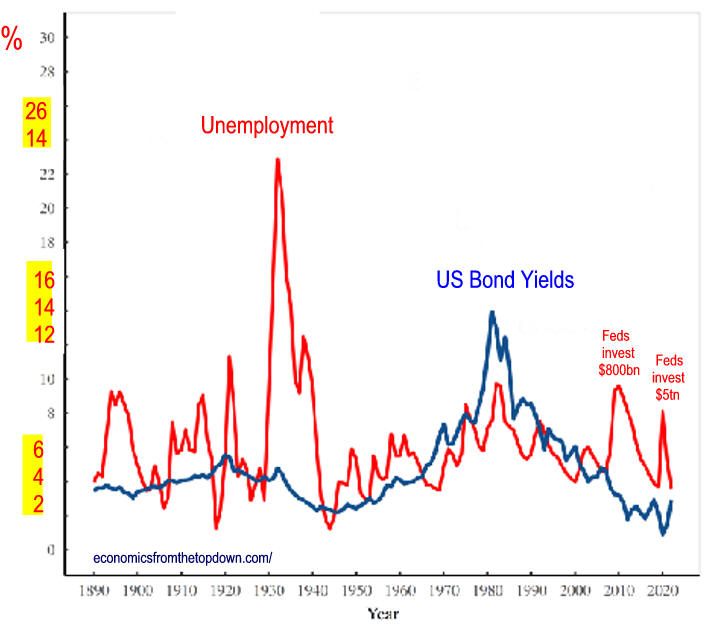

A. Until recently,

government borrowing increased the

demand for loanable funds causing higher long-term

interest rates.

1. Crowding out is

the term used to describe how

high rates due to government

borrowing lower

private investment.

2. Many feel

high economic growth of the late

1990's resulted because of low interest rates

caused by federal fiscal responsibility.

B. In the early 1990 people were people are concerned

about the fiscal

drag caused by a federal surplus.

C.

Can

Fiscal Policy Stabilize Output

D.

Trump Tax Act Still and Trickle Down Economics

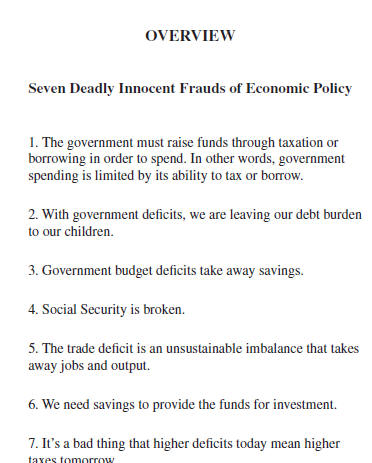

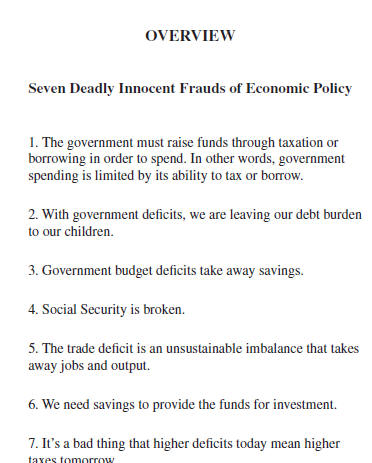

Source: Seven Deadly Innocent Frauds of Economic Policy - Warren Mosler pdf

Lecture

from W. Moster 62 min video

Video Interview

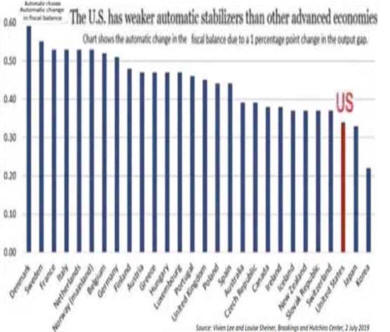

VI. Deadly Innocent Sins Frauds of

Economic Policy

|

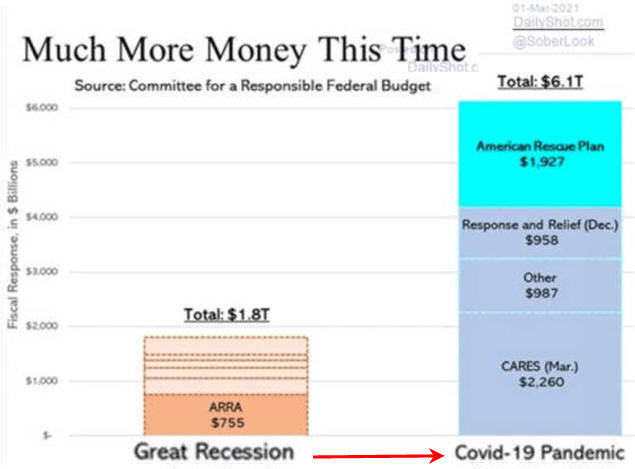

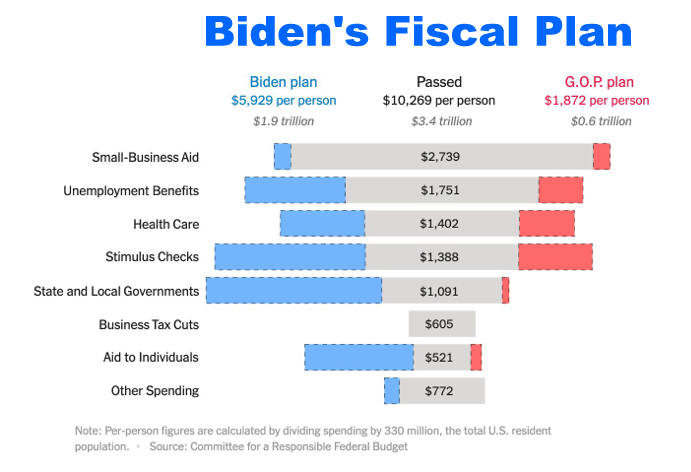

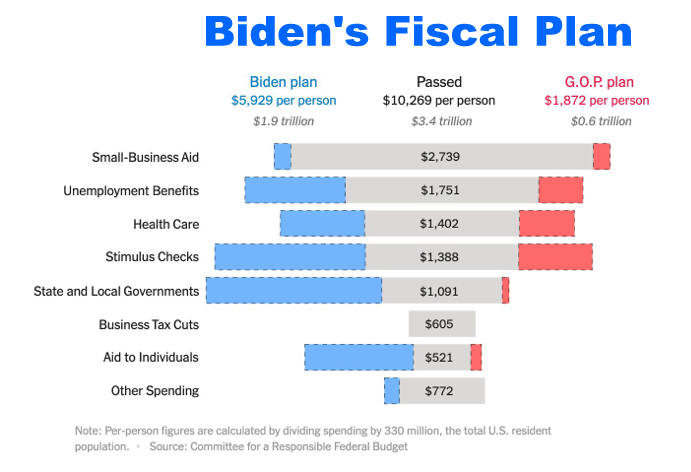

Biden Wants More

Here is Why

Hutchins Center Fiscal Impact Measure

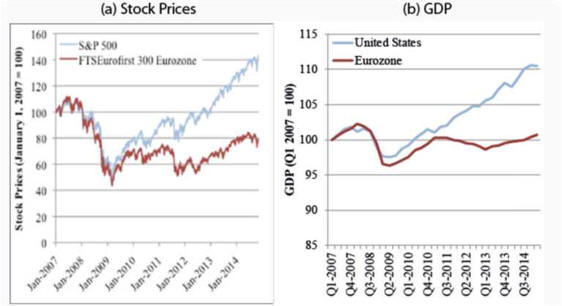

Modern Money & Public Purpose

1: The Historical Evolution of Money and Debt

2: Governments Are Not Households

3: The Eurozone

4. Real vs. Nominal Economy

The Other Side of the Story

MMT vs. Austrian School Debate

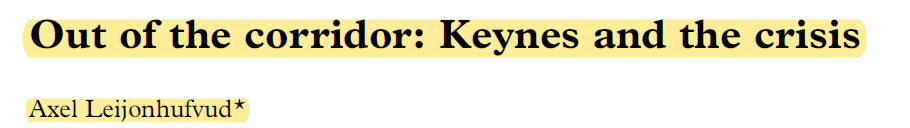

Minsky, Inequality, and the Monetary:Fiscal Policy Outlook

Modern Monetary Theory Videos

Demystifying Modern Monetary

What Modern Monetary Theory Tells Us About Econ Policy

Why the Elite are Living In an Economic Fantasy

|