|

C. Types of monetary policy

1. Quantitative controls affect the

money supply.

a. Required Reserve Ratio

1. Lowering the reserve ratio

creates excess reserves which banks may loan as newly created money. This is

expansionary.

2. Raising the reserve ratio eliminates

excess reserve so banks can not renew loans removing money and causing a

contraction.

b. Open-market operations

1. Buying and selling of U.S.

government bonds by the Fed from banks or in the open market to change excess

reserves affecting M1 supply

and interest rates is the primary tool.

2. Buying bonds is expansionary.

a) When buying from banks, the

Federal Reserve pays with reserves providing excess reserves banks can loan as

demand deposits.

b) When buying in the open market,

increased demand from the Federal Reserve pushes up prices sellers

receive, lowering the effective

interest sellers pay.

3. Selling bonds contracts the economy.

4. Review of Valuing

bonds

a) Suppose you buy a twenty year, $10,000 bond paying 5%

per year at face value of $10,000. Face value is called par value.

1) A few years go by and you need money and one

choice is to sell the bond.

2) If interest rates on this type bond have gone

down, people will be very anxious to buy, demand, will be high pushing price up

and your will receive more than $10,000.

3) If rate shave gone down, no one will give you

$10,000, demand will be low, so if you need the money, you will sell for less,

below par.

4) You can hold for twenty years and get par and get

the money some where else.

b) Therefore, interest rates and bond values (prices) go

in the opposite direction, if interest rates down, old bond price up because

they are

at the old higher rate.

c) This is called the interest rate risk for bonds. Other

risks have to do with issuer default and monetary inflation.

5. It is the most powerful of the

four tools.

c. Discount rate

1. This is the rate charged by the

Federal Reserve for loans to member banks.

2. It strongly affects the prime

interest rate paid by a bank's best customers.

a) Lower the rate to expand economy

as interest rates decrease.

b) Raise the rate to contract

economy as interest rates increase.

c) Another important interest rate

is the federal funds rate which is the rate at which banks loan funds to

each other.

d. Term Auction Facility

1. Initiated in 2007, it allows banks to add to their

reserves at low rates.

2. Done to increase bank liquidity which was low because of a

loss in reserve caused by a housing crisis.

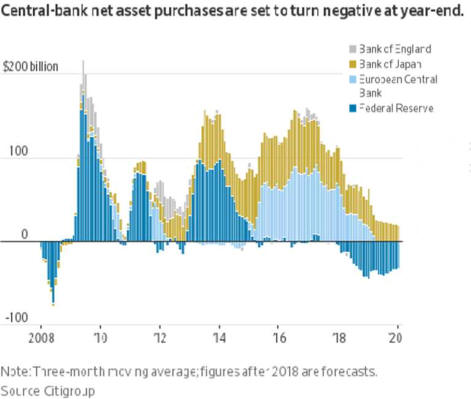

f. Federal reserve balance sheet.

2. Qualitative controls affect the actions of market participants.

a. Moral suasion or jawboning

1. This social pressure by influential

people to encourage specific people

to act in the public interest.

2. It is used to influence public opinion and political attitudes.

3. An example is when the Chairman of Board of Governors makes his

Semiannual

Report to Congress on the economy and

monetary policy.

b.

Margin Requirements, the down payment required on stocks which is

now

50%, is seldom changed.

c.

Consumer Credit Controls credit cards work so well they are seldom used.

d.

The Federal Funds Rate

1. Most controllable

interest rate

2. Targeted by monetary policy

3. It is the overnight interest rate banks with excess fed reserve charge

each banks

short of fed reserve to keep the system in balance.

4. By controlling reserves, the fed controls this rate.

5. This allows them some control over short-term rates.

6. For more information visit

Federal funds rate - Wikipedia

7. Taylor rule

affected by Fed's

QE policies. 2/3/14

.

Taylor rule would have

kept millions out of work (Minneapolis

Fed)

1/17

b

A Taylor Rule for Public Debt

|

|

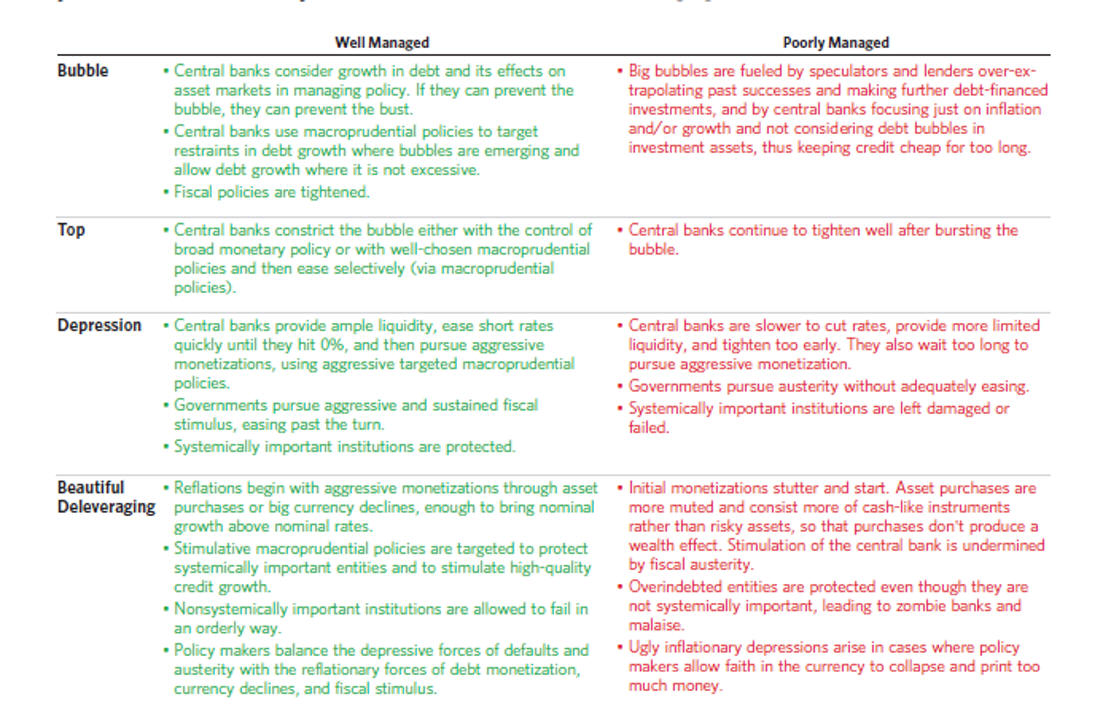

III.. Effectiveness of Monetary Policy

A. Strengths

1. Speedy and flexible

2. Somewhat isolated from political

pressure

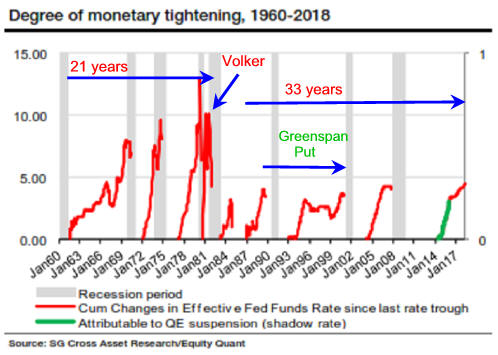

3. Hard money, restrictive Federal

Policy, has worked well recently,

but the high

unemployment opportunity is substantial

B. Weaknesses

1. Easy money has not worked well with substantial

downturns.

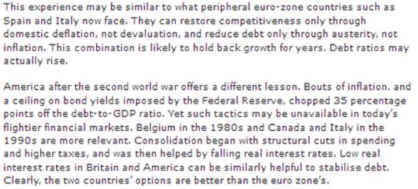

a. In the

early 1900's, it didn't stop a recession.

b. In early

80's cost was very high unemployment.

c. Low profit

expectations by business and fears

over possible employment loss by workers make

lower interest rates ineffective.

d. Interest

rate cuts in 2001 were not able to stop

a recession as borrowing as indicated by velocity slowed.

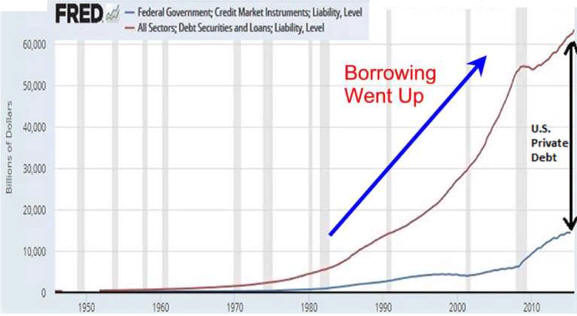

2. Bank deregulation has made commercial banks a less

important supplier of

investment funds thus diminishing

the effectiveness of monetary

policy.

3. Changes in money velocity may negate some effects

of monetary policy.

4. Fall in real interest rates increase demand for fixed assets

E.

Summary

Quantitative: affect

the money supply: with required reserve, open-market

operations, discount rate, term auction facility

Qualitative: affect financial

participation with moral suasion, margin requirements,

consumer credit

controls

|