Microeconomics Review 1

19. Demand Elasticity Affects Revenue

20. Consumer Behavior Demand Theory

|

Microeconomics Review 1

|

|

|

19. Demand Elasticity Affects Revenue 20. Consumer Behavior Demand Theory |

|

|

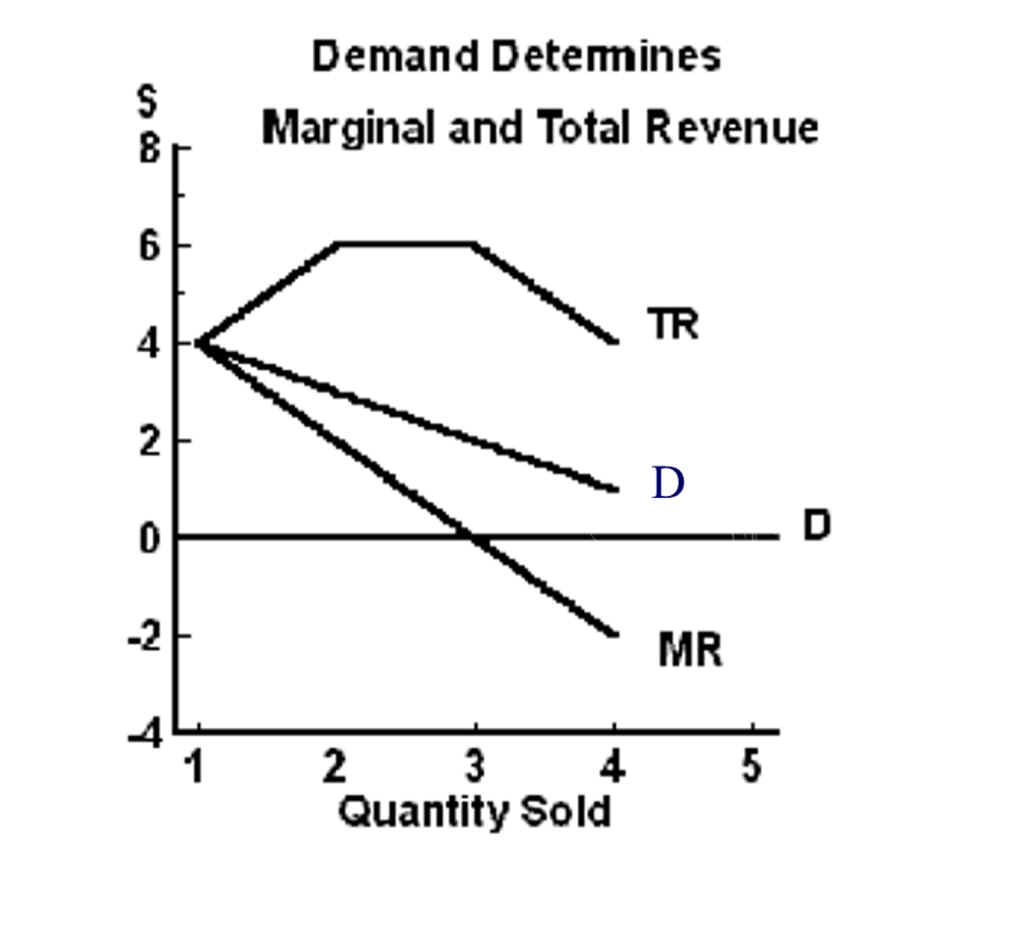

19. How Elasticity of

Demand Affects Total Revenue Review A. Elasticity of demand measures the responsiveness of quantity demanded to changes in price, income, and the price of related goods. B. Price elasticity of demand the effect of price changes on quantity demanded. C. Coefficient of elasticity of demand for product xits price elasticity. |

|

| D. Interpreting Elasticity of demand |

|

||||||

|

Relative Change |

Terminology |

ED Parameters |

|||||

|

None, will pay anything, numerator is zero. |

Perfectly Inelastic |

ED = 0 |

E . Total Revenue Test |

|

|||

|

Small |

Inelastic |

0 < ED < 1 |

When Price Increases |

Total Revenue |

|||

|

Q demanded and P change same percentage |

Unitary Elasticity |

ED = 1 |

ED >1 |

Somewhat |

Quantity Changing a Lot so you could lose lots of money. |

decreases |

|

|

Large |

Elastic |

1 < ED < |

ED = 1 |

Unitary |

Quantity/Price Changing Same % |

no change |

|

|

Infinitely Large, price doesn't change, denominator is zero |

Perfectly Elastic |

ED is undefined, can't divide by zero. |

ED <1 |

Somewhat Inelastic |

Quantity Doesn't Change Much, so you could make lots of money |

increases |

|

|

Chapter 20

Consumer Behavior and

Demand Theory Review

Chapter 20

Allocation efficiency exists at the equilibrium quantity and at other quantities, there are efficiency losses or Deadweight Loss

I. Understand cost of production is necessary to understand profit.

|

|

|

21. How Cost of

Production Affects Supply Review View

Entire Chapter 21

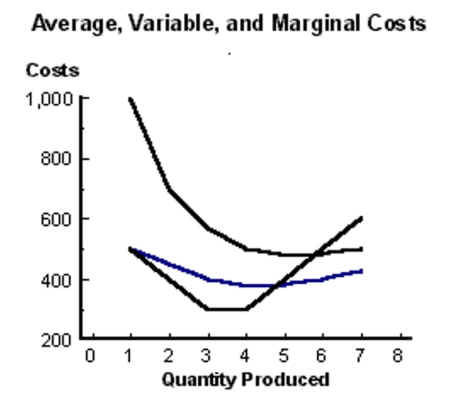

with videos A. Understanding costs 1. Costs are the dollars paid for the factors of production. 2. Opportunity cost is the value of the best alternate use, e.g., the cost of labor is the value that could have been received from using capital. 3. Explicit costs versus implicit costs a. Explicit costs require an out-of-pocket expenditure, e.g., wages, materials, and overhead. b. Implicit costs do not require an outlay, e.g., forgone wages for uncompensated efforts by family members in a. family-operated business, included a normal return on investment, which is the minimum amount required to keep resources employed at their current use. 4. Short run costs are both fixed and variable, in the long run, all costs are variable a. Fixed costs do not vary with production, e.g., plant and equipment, property taxes, most overhead, etc. b. Variable costs vary directly with production, e.g., labor and materials c. Marginal cost is the change in total costs which results from making one more unit. 5. Diminishing returns: a. Adding a variable resource (labor) to a fixed resource (capital) will increase production for a while. b. At some point the rate of increase declines and eventually becomes negative. c. Diminishing returns affect both the production of labor and cost of production. d. Example: Using three people to do the dishes didn't make sense because the third person just got in the way. Mom did agree so she relaxed. B. Accounting profits versus economic profits 1. Accounting profit is revenue minus explicit costs and economic profit is revenue minus explicit plus implicit costs. 2. Since implicit cost includes a payment for the risk factor part of interest and payment for entrepreneurial skill. 3. This means Normal Profit is a cost to economists and paid for as an explicit cost, in the long run competition causes economic profit to be zero. |

In analyzing profit, |

|

|

Total product of labor (TPL) measures total

production occurring as more workers are added to a production process

containing fixed resources. because of worker specialization. Stage 2

Decrease marginal

returns to scale because of fixed resources. Analysis:

At low quantities MC is below AVC so AVC is falling. As MC starts to rise

AVC flattens but |

|

|

22. Understanding Profit Review

View Entire Chapter 22

with videos

|

|

||

|

Maximizing profit using marginal analysis

Maximizing profit using total analysis of revenue and cost

|

|

Economies and diseconomies of scale affect profit

Long-run costs

|

|