The Dark Side of

Thomas

Jefferson

A new portrait of the founding father challenges

the

long-held perception

of Thomas Jefferson

as a benevolent slaveholder.

...

"The very existence of slavery in the era of the American Revolution presents

a paradox, and we have largely been content to leave it at that, since a

paradox can offer a comforting state of moral suspended animation. Jefferson

animates the paradox. And by looking closely at Monticello, we can see the

process by which he rationalized an abomination to the point where an

absolute moral reversal was reached and he made slavery fit into America’s

national enterprise."...

"The critical turning point in Jefferson’s thinking may well have come

in 1792. As Jefferson was counting up the agricultural profits and losses of

his plantation in a letter to President Washington that year, it occurred to

him that there was a phenomenon he had perceived at Monticello but never

actually measured. He proceeded to calculate it in a barely legible,

scribbled note in the middle of a page, enclosed in brackets. What Jefferson

set out clearly for the first time was that he was making a 4 percent profit

every year on the birth of black children. The enslaved were yielding him a

bonanza, a perpetual human dividend at compound interest. Jefferson wrote,

“I allow nothing for losses by death, but, on the contrary, shall

presently take credit four per annum, for their increase over and

above keeping up their own numbers.” His plantation was producing

inexhaustible human assets. The percentage was predictable."

We can be forgiven if we interrogate Jefferson

posthumously about slavery. It is not judging him by today’s standards to

do so. Many people of his own time, taking Jefferson at his word and seeing

him as the embodiment of the country’s highest ideals, appealed to him.

When he evaded and rationalized, his admirers were frustrated and mystified;

it felt like praying to a stone. The Virginia abolitionist Manicure Conway,

noting Jefferson’s enduring reputation as a would-be emancipator, remarked

scornfully, 'Never did a man achieve “Never did a man achieve mo re fame

for what he did not

do.' ”

smithsonianmag.com

|

|

|

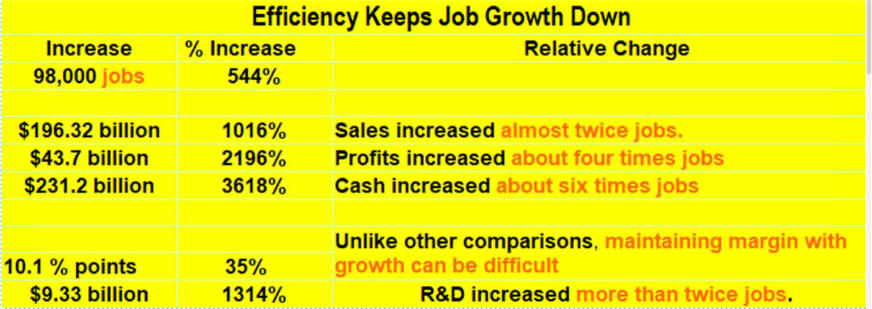

Largest Advanced Manufacturing Firms by Revenue

Advanced Manufacturing Vital

| |

National |

Eighth District |

|

1 |

Apple (3342) |

Emerson Electric (335) (St. Louis, Mo.) |

|

2 |

Johnson & Johnson (3254) |

MilliporeSigma (3254) (St. Louis, Mo.) |

|

3 |

Gilead Sciences (3254) |

Energizer Holdings (3359) (St. Louis, Mo.) |

|

4 |

Intel (3344) |

Hillenbrand (3339) (Batesville, Ind.) |

|

5 |

Cisco Systems (3342) |

American Railcar Industries (3365) (St. Charles, Mo.) |

|

6 |

General Motors (3361) |

Esco Technologies (3345) (St. Louis, Mo.) |

|

7 |

General Electric (335) |

FutureFuel (3251) (Clayton, Mo.) |

|

8 |

Amgen (3254) |

Kimball Electronics (3344) (Jasper, Ind.) |

|

9 |

Pfizer (3254) |

Escalade (3399) (Evansville, Ind.) |

|

10 |

Exxon Mobil (3241) |

Sypris Solutions (3363) (Louisville, Ky.) |

SOURCE: Compustat.

|

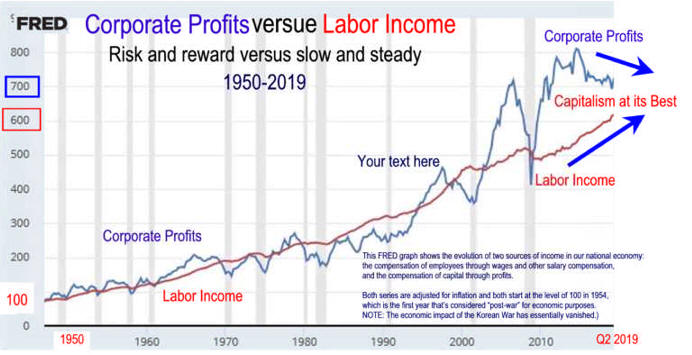

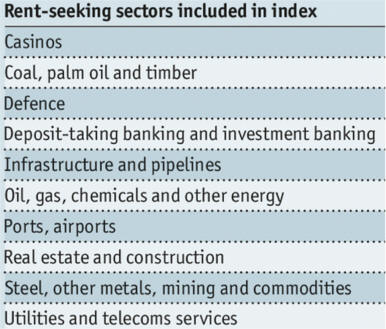

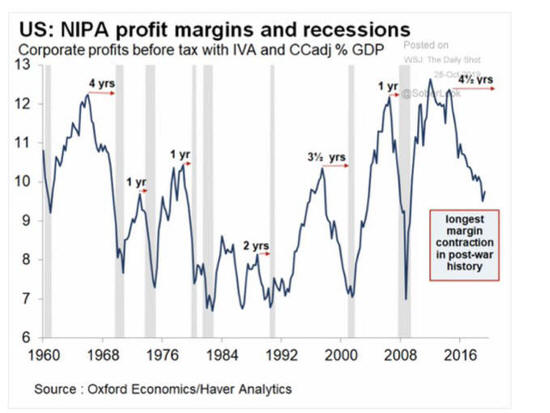

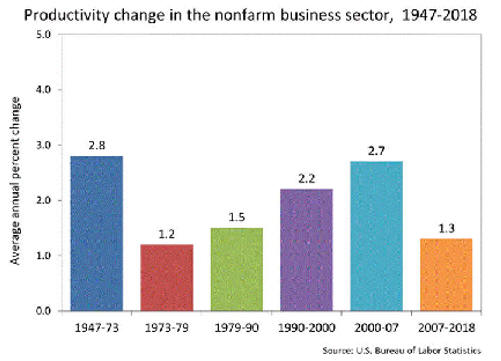

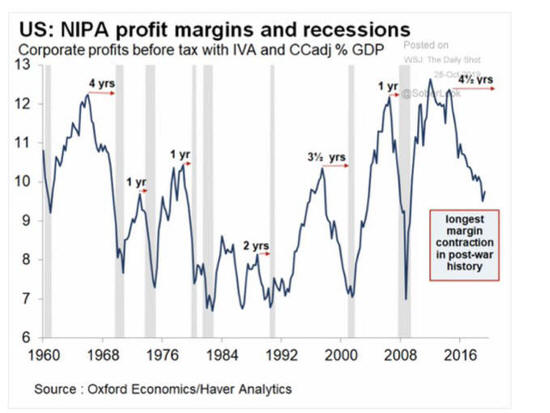

These have got to be related?

antonw@ix.netcom.com

|