|

IV. Antitrust

prosecutions

A. Enforced by the antitrust division of the

Justice Department

B.

THEODORE ROOSEVELT

took on the corporate monopoly

Trusts that control

railroad rates and routes and thus destroyed

small towns and

farms

C.

Rule of Reason

1. Applied by the Supreme

Court in a 1911 antitrust case

against Standard Oil of New Jersey and the American

Tobacco Company

2. Court stated that

behavior must be unreasonable in a competitive

sense and anti-competitive effects must be demonstrated.

3. Both companies were

found guilty.

4. The Court ruled that

bigness alone was not against the law in

1921 when it ruled that U.S. Steel was not a monopoly even

though it controlled 50% of the market.

5. Bigness alone was

prosecuted by the Supreme Court in 1945

as it broke up Alcoa

because it controlled 90% of the aluminum

market.

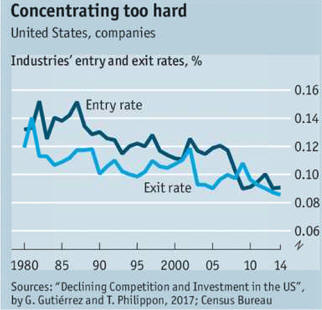

D. Tight enforcement, which began

in 1914, ended in the early 1980's.

E.

For more information read

1.

Rule of reason

- Wiki

2.

Executive Summary Of The Anti Trust

Laws

F.

Videos

1.

No Recent Prosecution of Financial Fraud

2.

Reinstating Glass-Steagall

V. Internet Readings

A.

The Great Recession

was aided by poor government regulation. 12/27/14

B.

Who Makes the Rules 4/13

Economics Intersection

C.

Democratic

Capitalism vs. Capitalistic Democracy

D.

Documentary-of-the-week-FINRA- Madoff history video

E.

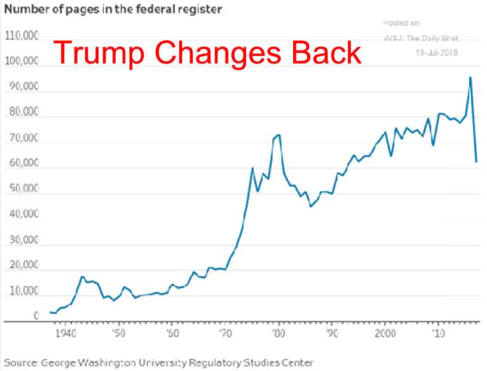

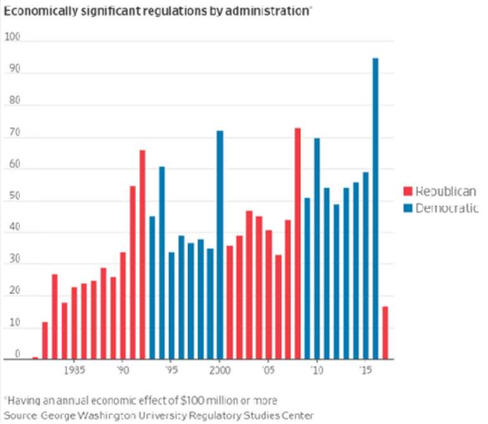

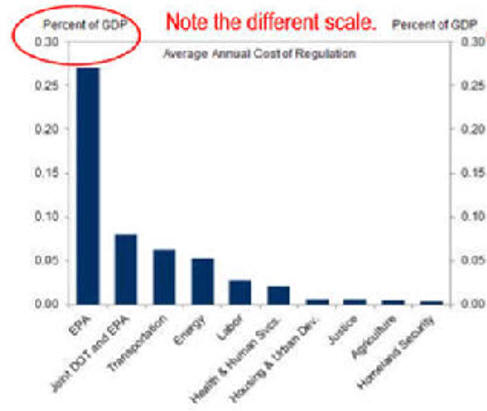

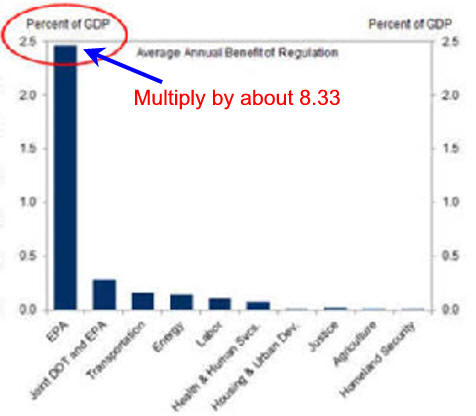

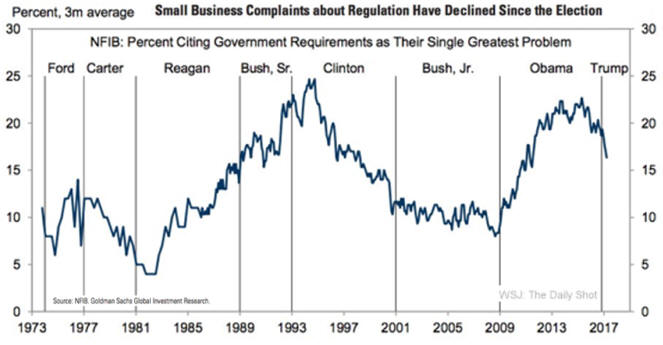

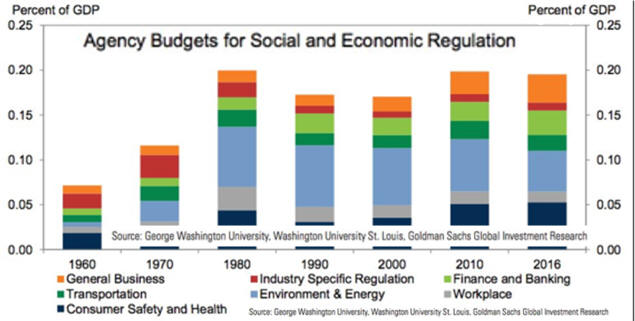

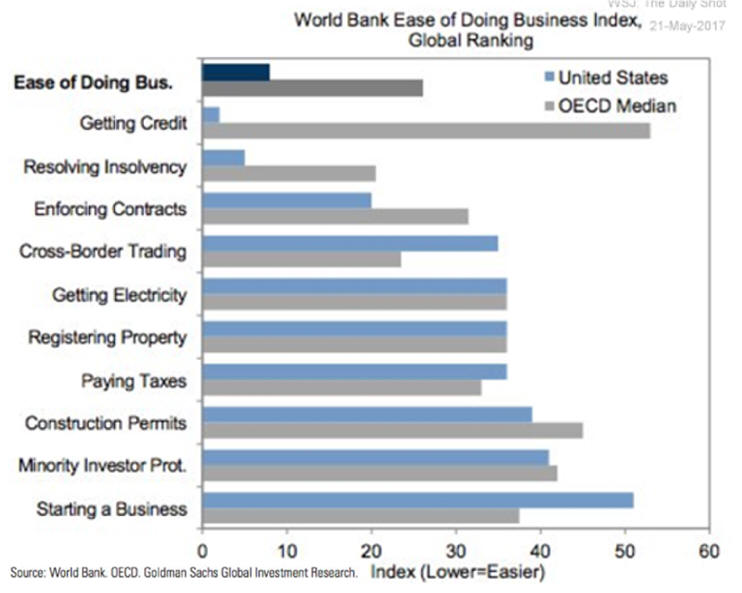

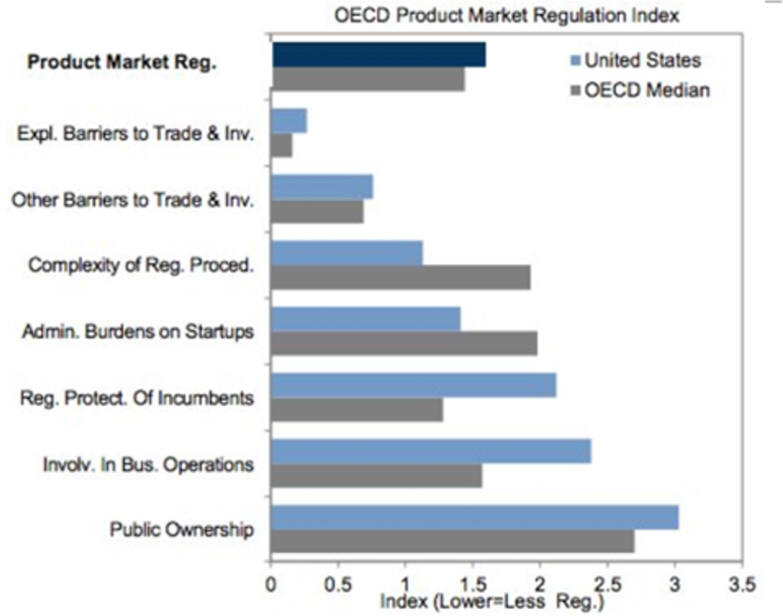

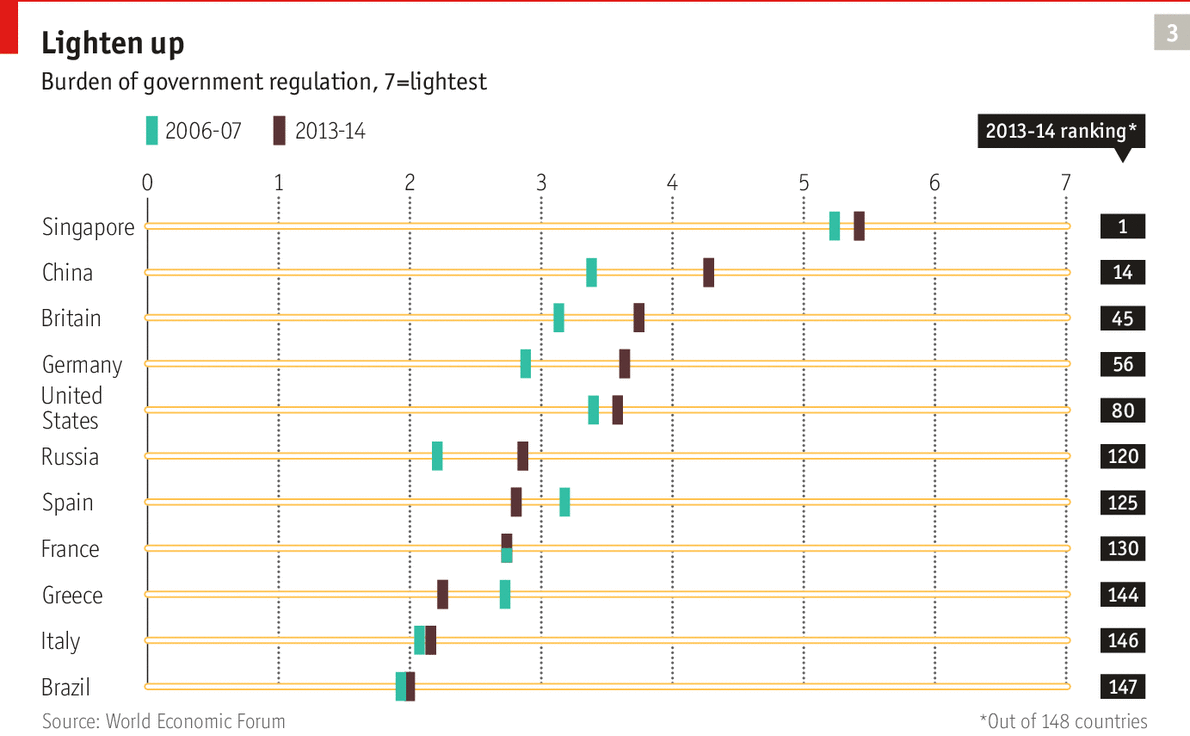

Rich world needs to cut red-tape and encourage business 2/22/14

See chart

F.

Why Regulation Goes Astray

5/21/14

G.

Economic Normality1945-2015 |

Ida

Tarbell and other

investigative

journalists were called

Muckrakers.

She exposed

Standard

Oil Trust. Working for

McClure

Magazine and other monthly magazines they help educated the public

from 1890 to 1929 in what is known as the

Progressive Era.

Books also help the education process.

The Jungle

exposure of health violations and unsanitary practices in the

early 20th century American meatpacking industry.

The Octopus

exposed a large interlocking network of

criminal conspiracy that reaches into every part of the U.S.

government, other national governments, and most of sector's of societies.

The

Bitter Cry of Children exposed the terrible child working conditions.

Some tried night school but after working ten hours learning to read was

difficult.

Business Progressivism of the 1920's typified by Henry Ford and

Herbert Hoover

put an emphasis on efficiency.

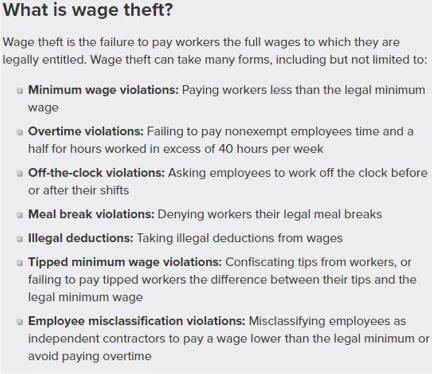

As of 2018, at least 18 states have enacted joint-employer

shield laws specifically designed to protect one very wealthy special

interest group: corporate franchisers. Corporate

franchisers are the big companies—like McDonalds, or Marriott, or Carl’s

Junior—t These state joint-employer laws are intended to shield the

corporate owners of the franchise from bearing joint responsibility with

their franchisees for complying with minimum wage, overtime, health and

safety, and other laws applicable to the employees who work at the

franchisee’s stores. In simple terms, the joint-employer shield laws

preclude applying the joint-employer legal doctrine to hold franchisers

jointly responsible for violations of employee rights.

What states have joint-employer shield laws?

The 18 states as of January 2018 are Alabama, Arizona,

Arkansas, Georgia, Indiana, Kentucky, Louisiana, Michigan, New Hampshire,

North Carolina, North Dakota, Oklahoma, South Dakota, Tennessee, Texas,

Utah, Wisconsin, and Wyoming.

|