|

Individual Taxes

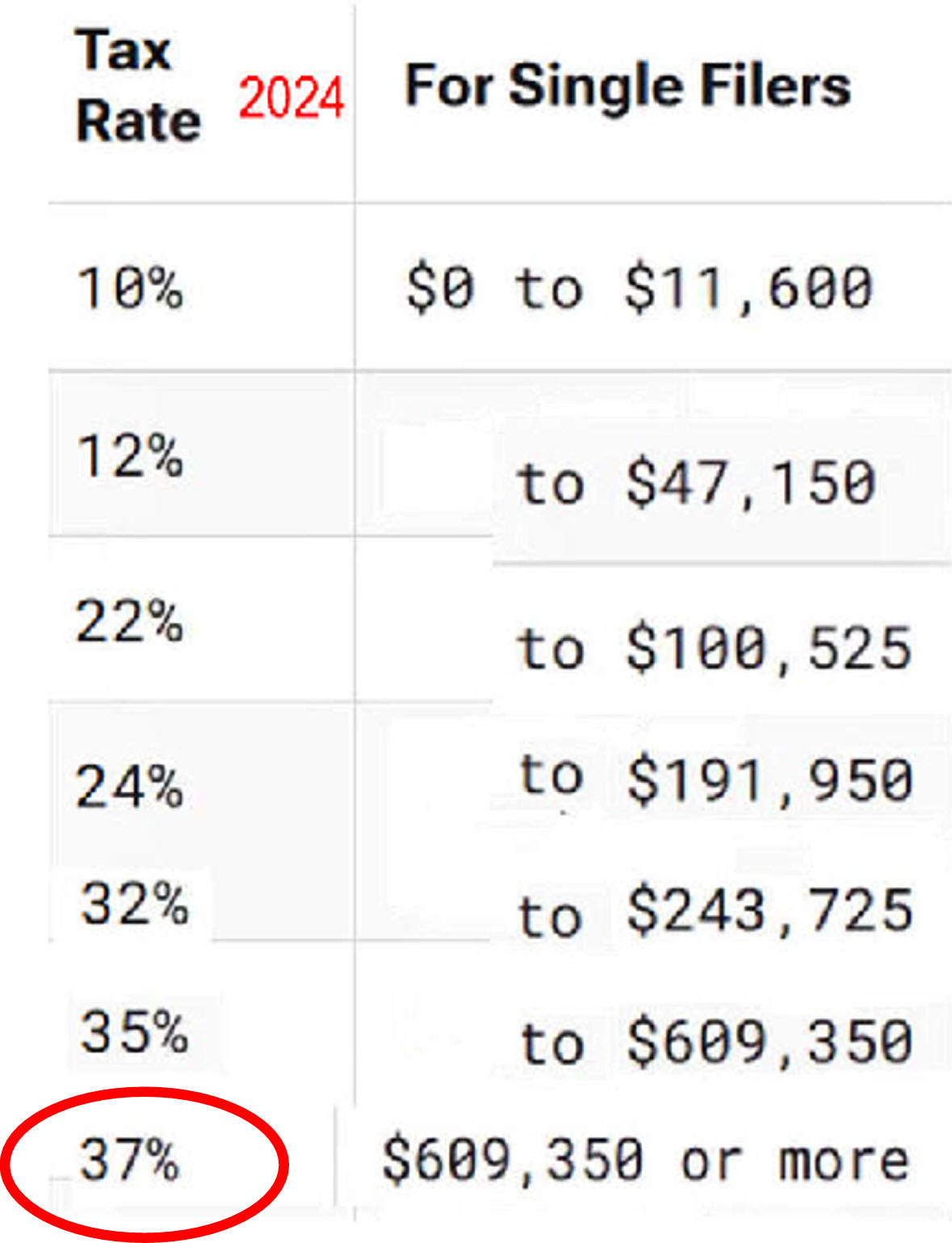

The 2017 federal law reduced

the top marginal tax rate

to 37% from

39.6%

|

|

Individual Taxes

The 2017 federal law reduced

the top marginal tax rate

to 37% from

39.6%

|

|

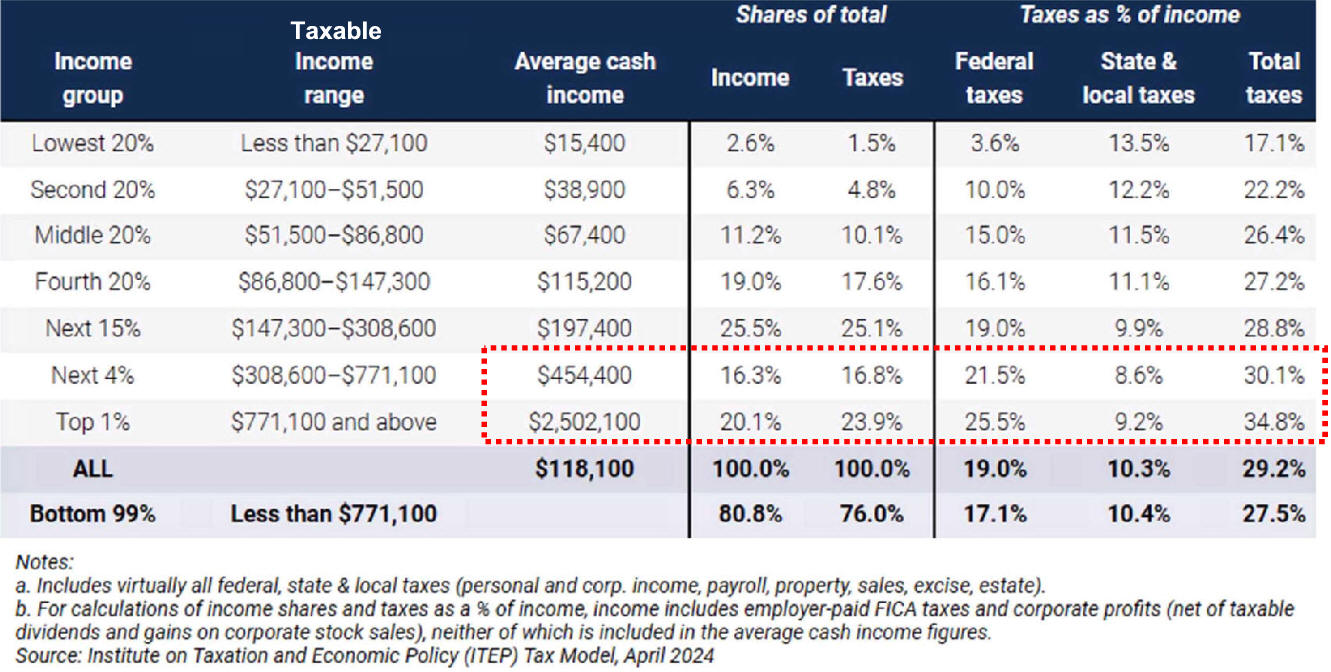

3.

Who Should Pay More?

|

Top 1% > $771,100

Taxable Income Next 4.0% > 308,600

Taxable Income

|

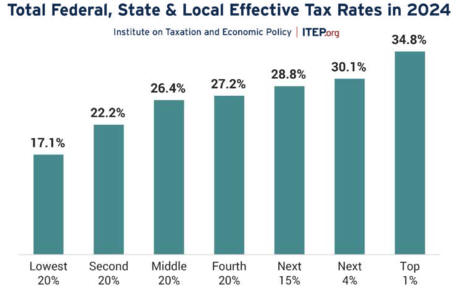

Total Federal, State and Local Taxes Paid by Quintile

|

|

|||

How

Marginal Tax Rates Work

Earn

another $1000

taxable income, See Taxing the Rich

|

|

||

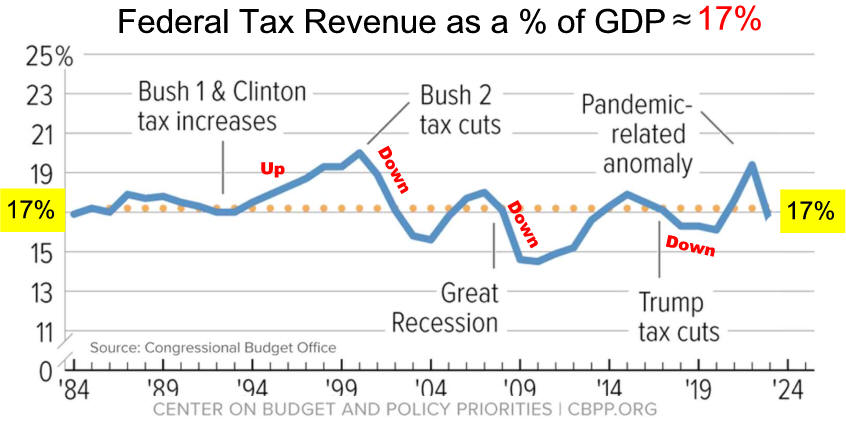

System Seems Progressive

|

If 2017 tax law not extended

|