|

|

|

|

|

Looking for Tax Revenue

2. Tax

Expenditures, Benefits Excluded from Taxable Income, Cost US LOTS, More-than Social Security 17% go to Top 1% |

|

|

|

See |

|

|

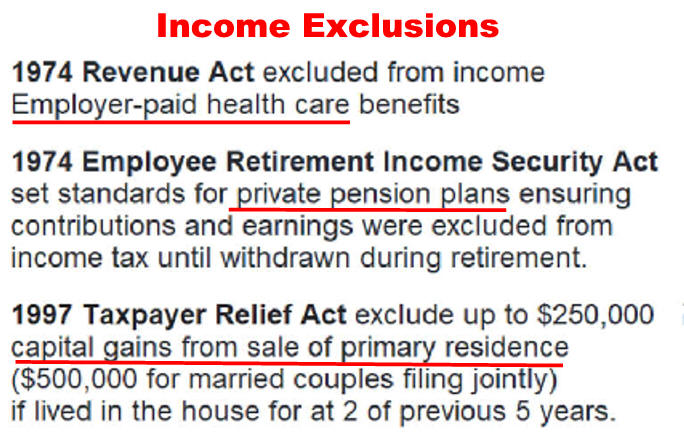

A WW2 wage freeze

was avoided with a Make Employer Paid Health

Insurance Taxable Income over 5 years |

Hopefully, the $6000

|

|

|

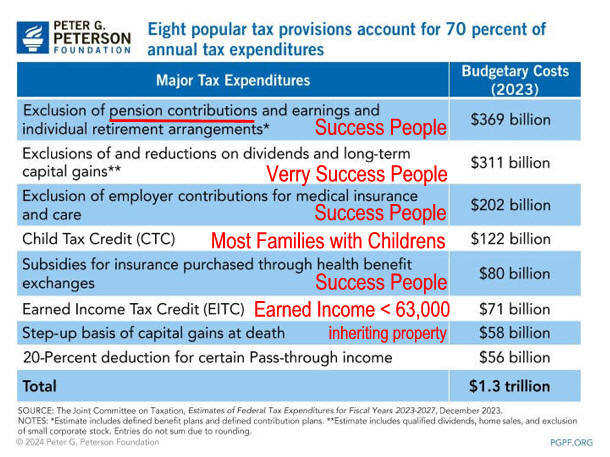

Tax Expenditures are Very Expensive

Benefits Excluded from Taxable Income, |

||

|

|