|

Lecture Notes

One-page printable

I. Overview

A. A purely competitive market exists when

the number of independently acting buyers and sellers

is so large that individual participants have no affect on

market price and quantity.

B. Products sold are virtually identical. Agricultural products such as potatoes and wheat

are examples of competitively sold products.

C. Pure competition industries as defined is difficult to find because some

monopoly power usually exists.

D. Price is determined by intersection of industry supply and

demand.

E. Individual firms are

Price

Takers as they inherit a horizontal

demand-marginal revenue curve from

their industry.

1. A firm can not sell above market as products

are identical and no one will buy higher than

market.

2. There is no reason to sell below market

as it would

mean less revenue and less profit.

Unit I. Review PC requires many independent competitors

selling virtually identical products.

From

chapter 22 on Understanding

Profit

II. Purely Competitive Adjustment

A. Suppose industry demand and

supply yield an equilibrium price P at which a firm's

economic profit is zero.

1. Step 1

An increase

in

demand to D' causing

economic

profit.

2. Step 2

Market entry is relatively easy increasing industry

economic

profit draws in new firms

increasing

supply to S', lowering and economic

profit disappears.

3. This automatic

purely competitive adjustment causes long-term economic profit

for pure competition

move toward zero.

4. Many feel a zero long run

economic profit represents an ideal economic model

as all the company earns is a normal return on

investment.

Review Price equal ATC where MR = MC with no profit

B. Suppose a Purely

Competitive Company Makes a Profit

1. Price is higher than average total cost so total

is greater than total

cost.

2. Cost includes a reasonable return on investment called

"normal profit"

so under this definition of cost, any profit is an excess.

Review PC making a profit doesn't last

long a people see the abnormal profit and try to get some.

|

Please Visit

Economics Internet Library

Political Economy

Stuff

Examples

1.

Post WW2 International Economic Competitive Adjustment

2. Mark Blyth:

Competitive Adjustment in

European Market Area at 1 min

3.

Competitive Adjustment Applied to Trumpism

begins at 4 min 15 sec

Competition in the Grocery Business,

Finance-Not-So-Much

Source

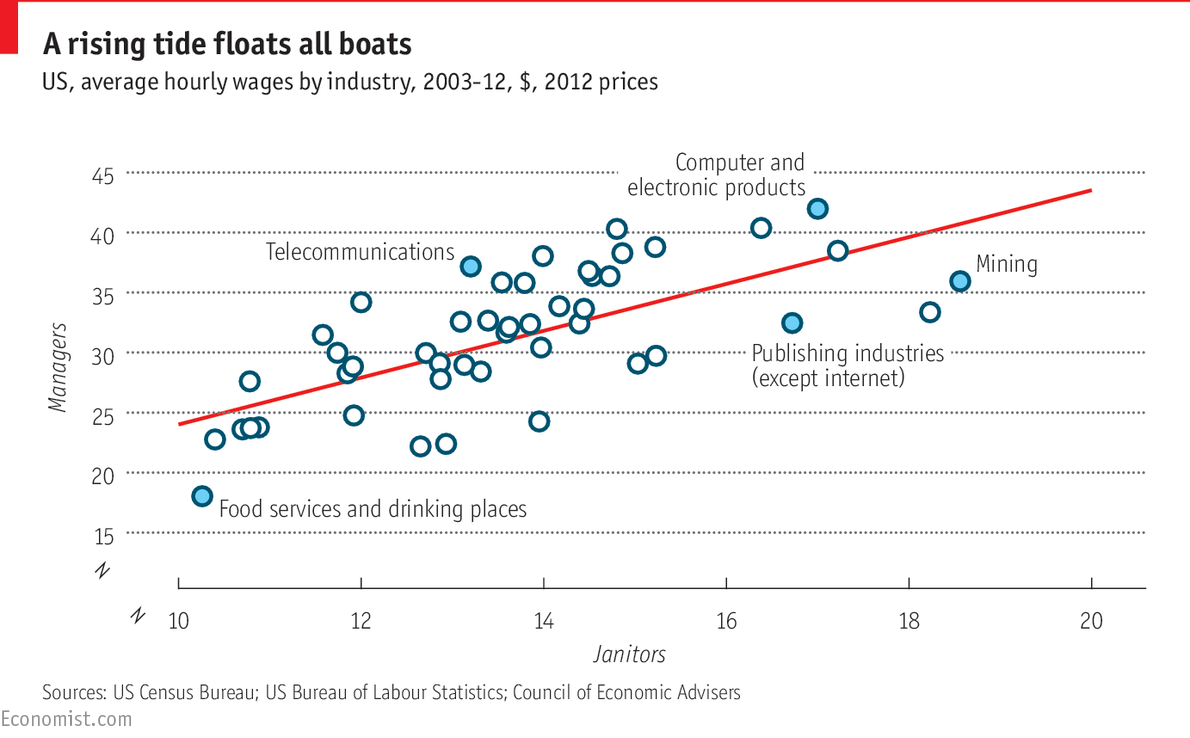

U.S. Economic Growth Over?

from

economist.com

Videos

1.Profit

Maximization for a Competitive Firm

D. Kaufman Wisconsin-Parkside.

2.

Profit Maximization in Perfect Competition

F. MacLauchlan

3.

Perfect Competition Graphing Practice Econ in 60

seconds

3.

Perfect Competition in the Long Run from Econ in 60

seconds 4. Market

Equilibrium in the Long Run from Dennis

Kaufman Wisconsin-Parkside

5.

An Invisible hand

provided by

competition, regulates the market. |