|

A. Five Reasons China Isn't Backing Down K. Rudd

1.

Trump’s trade war confirms China's belief that Barack Obama’s “pivot to

Asia,”

was an expansion into China’s sphere of influence.

2.

Recent actions means trade talks must be delayed at least

until after US midterm elections.

3.

Xi Jinping's ability to consolidated more power is partially

based on fulfilling a “China Dream.” He can’t back down.

4.

China’s economy will suffer little, much less than 0.5

percent of GDP.

5.

China believes she has

less near-term political vulnerability

but greater long-term economic vulnerability as

China’s authoritarian state-dominated capitalism better absorbs economic

shocks. Coronavirus will test this belief.

The bottom line: Trump and Xi believe near-term fallout can be managed

so

this trade war will probably last longer and inflict damage.

Kevin thinks

keeping

Chinese students in America is very important to long-term political

security.

Australia has relatively many more Chinese students.

Editor's Note: Historically, not listening to our allies, has not worked

out well.

Think Vietnam and Iraq/Afghanistan/Syrian wars.

B.

Kevin Rudd: China will not over react to Trump's trade policy

1. She will lower trade balance.

2 . Her relatively low tariffs of about 9% will be lowered.

3. China could propose zero tariffs in both countries and could make same

offer to others.

C.

Relations

With Russia

Bremmer video

See

21st Century

Free Trade Analysis

|

D. Trade

Thoughts from

China Crisis

of Success

video

by Dr. William Overholt

|

|

|

|

|

|

|

Three Categories of US Desires

|

|

|

Affect of Trade War on China's

Trade Policy

|

1. Trump's 90-day Tariff Deal 12/18/19

2. Three small numbers are making big waves in China. The digits 9-9-6, a

shorthand for 9am to 9pm, six days a week,

have

become a rallying cry for tech workers frustrated with their bruising

work schedules 4/17/19

Source

3. From Bloomberg's New Economy Forum 4/19/19

China has no desire to scale back its

winner-take-all industrial ambitions

or to make

fundamental changes to its authoritarian capitalism.

A mix that includes subsidies for state

industrial champions and economic

policy

favoring local over foreign players, has

succeeded.

Any final agreement will have

Chinese pledges to buy more U.S. products

but few

promises to restructure the economy.

A trade deal won’t end China-U.S. frictions. In fact, the conflict has only just begun.

A 2018

report from Freedom House, a democracy watchdog, noted that 18

countries (so far)

now use Chinese-made intelligent monitoring systems

and 36 have received training in topics

like "public opinion guidance,"

a euphemism for censorship. The list of countries includes

the UAE,

Zimbabwe, Uzbekistan, Pakistan, Kenya, and Germany.

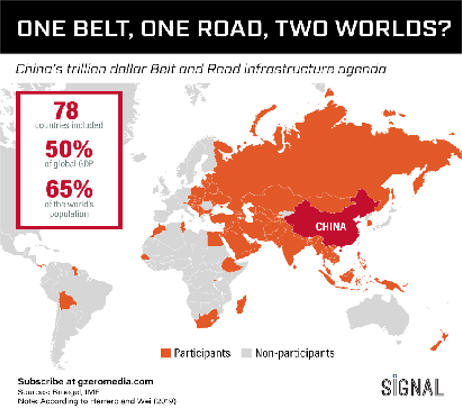

The worldwide infrastructure-building

project "has pushed China’s huge construction, telecommunications and

shipping companies to go global at a time when a cooling domestic

economy means less business at home."

Editor's

Note: One common problem in centrally planned economies is

data on the cost of misadventures China's overbuilding housing at home.

Japan

rushed into HDTV while US, very profit dependent, waited for digital

technology.

|

|

The Impact of Chinese Trade on U.S. Employment:

The Good, The Bad, and The Apocryphal

by

Chinese competition on US manufacturing had a striking regional variation from 2000-2015.

In high-human capital areas like West Coast or New England, manufacturing job losses saw industry switching to services. Companies changed to research, design, management or wholesale. Hence, redistributed of jobs went from manufacturing in lower income locations to services in higher income locations.

In the low human-capital South and mid-West, manufacturing plants closed without much increased service employment.

Offshoring appears to drive these manufacturing job losses.

This employment impacts was strongest between from 2000 to 2007

Ling Chen: New

Insights on the 'Made in China' Model

1. Began with

Top Down Trade which succeeded using cheap labor

2. Success cause companies to move to other

Asian companies

3. Bottom up home grown Gorilla Investors

will contribute to

Made in China_2025

4. Ling Chen's analysis supports the

Beijing Model. See

Washington Consensus vs. Beijing Consensus/

History of China: What is China, Anyway?

Modern

Western Civilization Economic History

China was part of the Colonial Empire of Great Britain

Opium Trade was a Big Money Maker for England.

|