|

Income Inequality Analysis Updated 5/2/19 Please link to, use to educate and share. |

|

|

|

Income Inequality Analysis Updated 5/2/19 Please link to, use to educate and share. |

|

|

|

The Very Very Rich THE CENTER FOR EQUITABLE GROWTH "The bulk of this growth was concentrated at the very top… above the 99.99th percentile, a group that contains only about 12,000 households. The share of incomes above the 99th percentile (around $372,000 in 2012) but below the 99.99th percentile (around $7.2 million in 2012) has barely changed in the last two decades…" posted by Brad DeLong Will Trump "trump" This Rich Hand?

See

American Income Inequality Perfectly Explained by M. Blyth |

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Group One

Increased

Income of the top 1% was high, but reasonable but those earning in the top 1/10 of 1%

Going After the Top 1/10 of 1% or even the top

1%

See

Noam Chomsky on Madison and Aristotle

|

Top Income Tax Rate and Capital Gains Rate Both Down

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Group Two

|

Editor's Note: Peterson's Foundation estimate for the highest tax

expenditure employer paid health care is twice that of the Joint

Committee on Taxation. Since most of Peterson's are similar

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Size and redundancy of Safety Net should be analyzed for efficiency. |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Group Four Most Gained Market Income

Most Recovered from the Great Recession

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Our

Democratic Federalist Capitalistic Republic

|

Guns are protected by the NRA. God is protected by relegiouse rights groups.

Greed is

protected by

the Chamber of Commerce,

Government

is protected unionized employees, |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

As GDP Growth Continues , Will It Eventually Go Down?

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

1) College Only Helps Our Brightest Who Must Work Very Hard. Our education system must change from maximizing the math and verbal ability of all students to maximizing a student's special intelligence, that which they do well. Career and life preparation requires a new Education Manifesto. |

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

2) There is No Solution for Too Many Low Paying Jobs

The more capitalist the system See World Changed and Good Jobs Disappeared

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

3) Political Solution, Voters Gave Entitlements More, Poverty Less

|

||||||||||||||||||||||||||||||||||||||||||||||||||

The bigger the economic surplus, the

more there is for people with high

motivation, drive, and intelligence combined with education, alpha personality

traits,

connections ...

Income Inequality

is made most important by Media and Politicians.

It is based on

Market Income which is Not the Most Appropriate Measure.

|

Well-Being is UP

2) Scientific achievements have continuously added to citizen

well-being.

Think public health, smart phones, streaming audio-video,

Gillette Stadium ...

See

Health Problems Solved

|

Replacing market income with wellbeing which included the Safety Net.

See

Income Inequality Analysis and Cures

Public Policy Affects Income Inequality

Income Inequality Exposed

Middle Income

Stagnates

Solving the Lack of Good Jobs

Tax Expenditures

Interesting but for a Peasant I live well.

What I learned today

7/27/16

Before Slavery those captured in war

were killed or eaten!

|

Income Data Summary

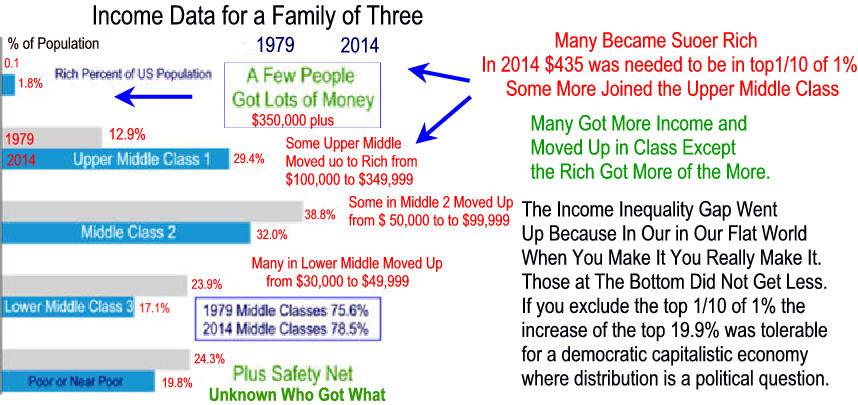

from Chart 1979-2914 in thousands of dollars Source Urban Institute Super Rich earning over $350 Grew to 1.8% of Population. How Donald Trump and Other Real Estate Developers Pay Almost-Nothing in Taxes/ Most Agree with Warren Buffett's 5% Tax Over $5 Million Income Which Would Brings in $20 Billion. Source Upper Middle Earned $100-$349 Grew Dramatically to 29.4 Taxing Upper Middle Income Class say 5% would bring in more than $20 Billion. Would it affect the American Dream? Middle Middle Earned $50-$99 Decreased to 32.0% Lower Middle Earned $30-$49 Decreased to 19.8% Poor $30 Decreased to 19.8% Plus a Higher Safety Net |

Do We Need to Know For All

Income Classes |

|

VI.

Effectiveness of Government Poverty Programs

|

|