|

Middle Class Treated Fairly?

1. Effective Corporate Tax Rate Down |

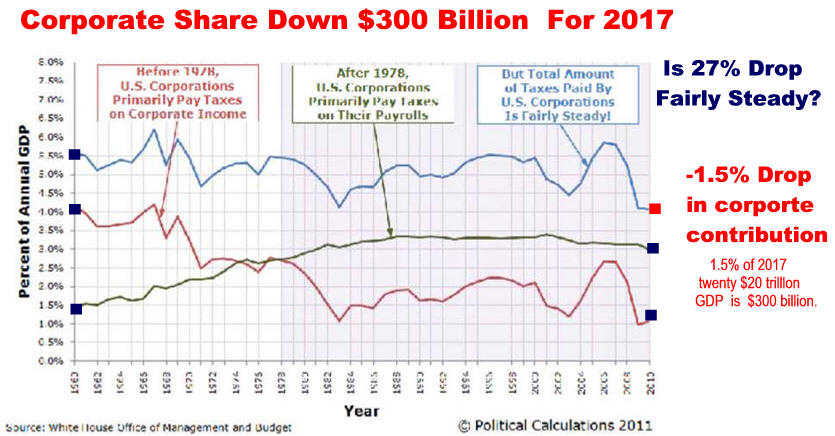

|

||

|

|

Prelude: Class Structure Must Be Defined

|

|

|

1. Effective Corporate Tax Rate Down

|

||||

|

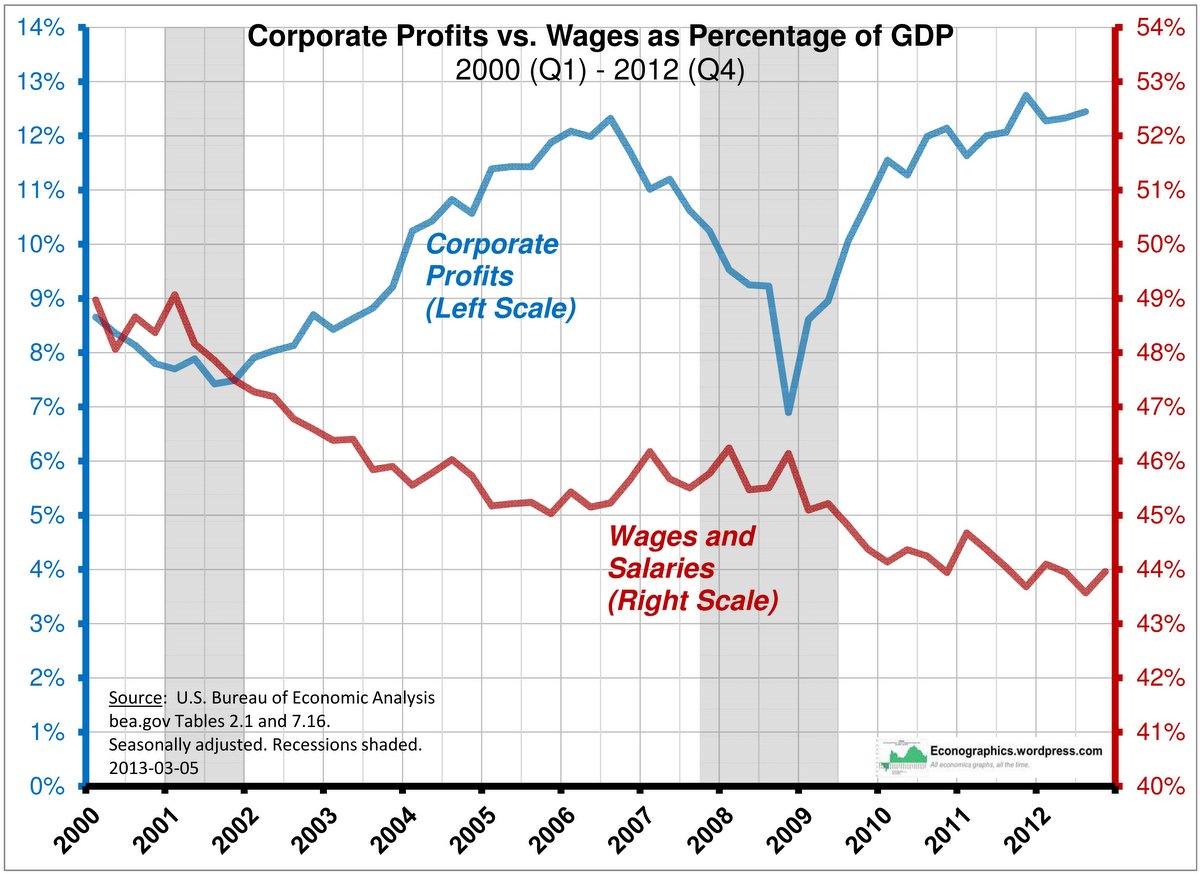

2. Corporate

Profits Up 1.2 Trillion Dollars

|

||||

|

3. But Corporate America's Total Tax Share Down By 27%

|

||||

|

|

||||

|

|

|

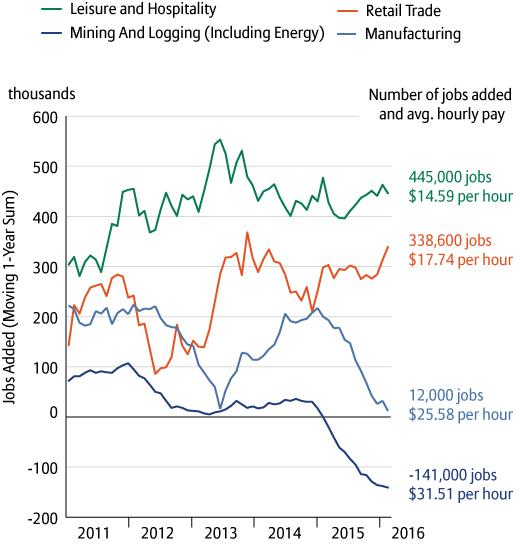

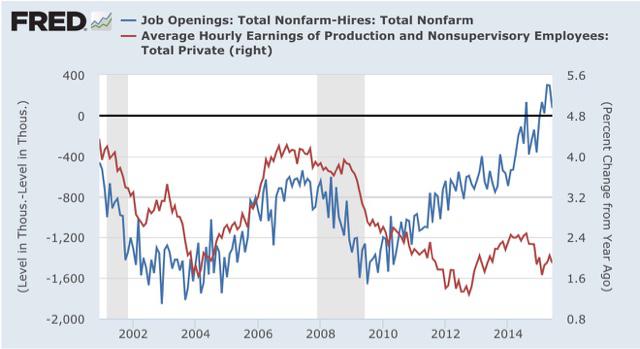

US Workers Contribute Much to Corporate Revenues

5-ways-americans-and-europeans-are-different/ft_16-04-22_usindividualism/

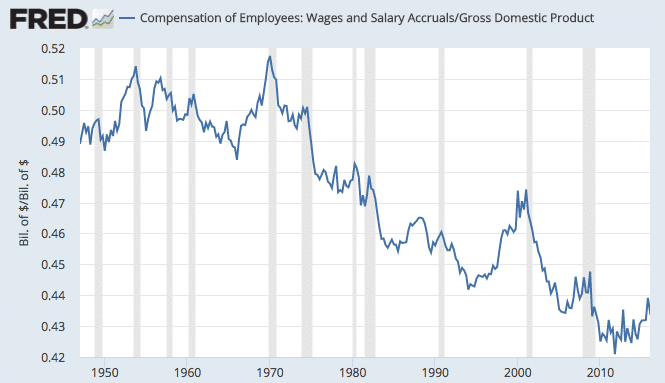

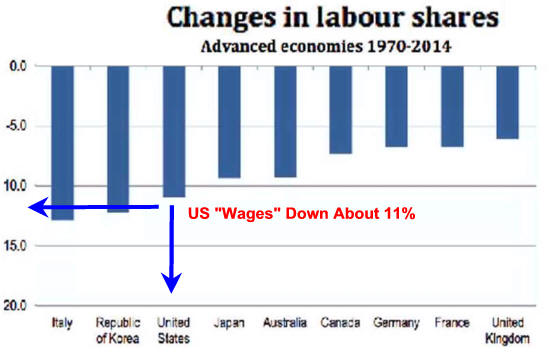

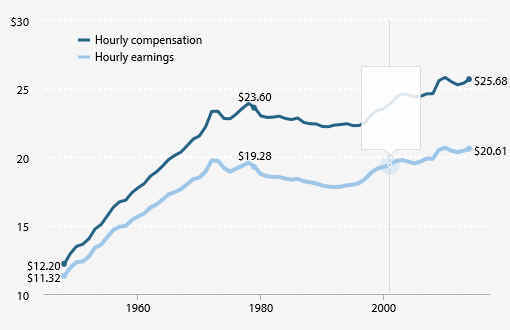

Wage "Compensation" Down About 15%

|

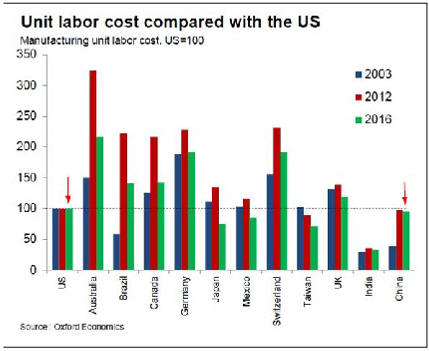

US Labor Costs Are Low

More Than Most Competitors

|

|

|

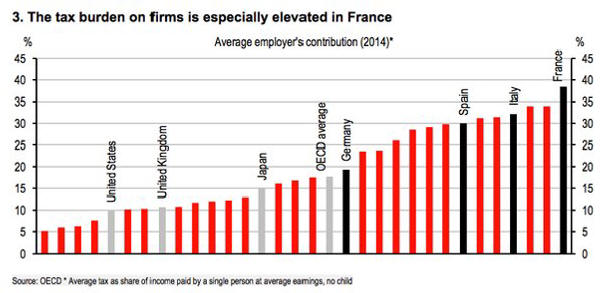

Most Foreign Companies Pay More

d

|

See

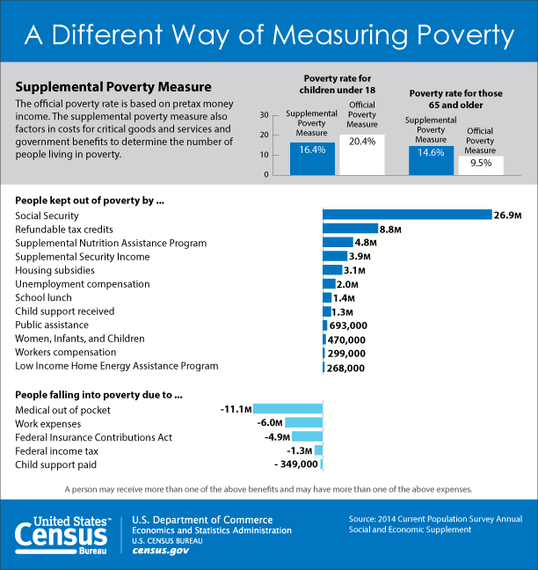

Why is Poverty So Controversial? Poverty

|

|

||

|

large and increasing share of medical costs are paid by third parties (private health insurance, Medicare, Medicaid, Department of Veterans Affairs, etc.) and only a small and shrinking percentage is paid out-of-pocket by consumers 2. Chart of the Day II (above) shows aggregate spending in the US on “life’s basics” — a) food, b) clothing, c) cars and parts, d) household furnishings (appliances, furniture, etc.), e) housing expenses and utilities, and f) gasoline and other energy products (data here), as a share of US personal disposable (after-tax) income (data here). Consider that back in the “good old days” of the 1950s, Americans as a group spent more than 50% of after-tax income on “food, clothing, and shelter,” and before that it was even higher. Over time, as manufactured goods have become less expensive relative to our income, the share of disposable income spent on “life’s basics” has fallen, and reached an all-time low last year of slightly below 34%. We can always find a lot to complain about, but we should be thankful that as a country we now spend less of our disposable income on “food, clothing, and shelter” than at any time in US history. |

|

|

|

|

|

Table 2

|

|