#5

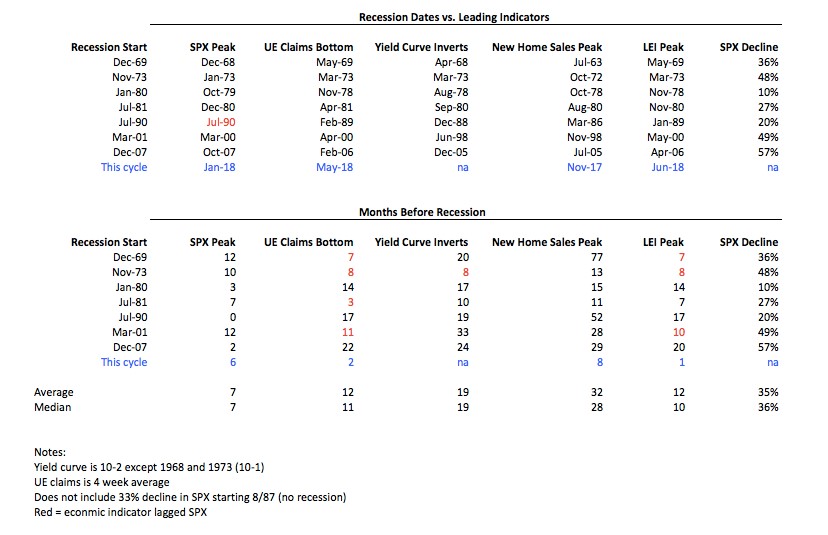

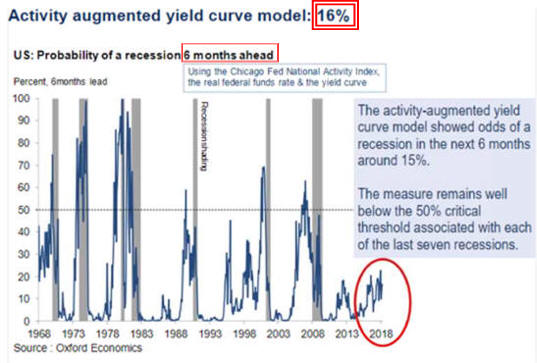

U.S. Headed for a Recession?

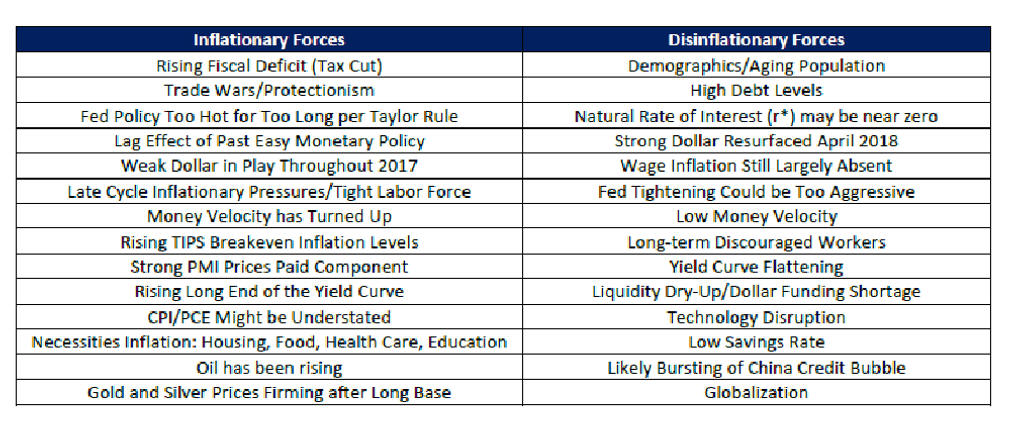

Late in Cycle is About Liquidity

Current Data

Weaker Counter Cyclical Measures

Predictions

Recession

Investment Alternatives

Return to Latest Economic News Updated 12/21/19 Please link to, use to educate and share.

Return to Latest Economic News Updated 12/21/19 Please link to, use to educate and share.

Profit Margins Headed South

Increased Interest Rates Will Hurt Profit

and Consumers as Demand Will be Affected

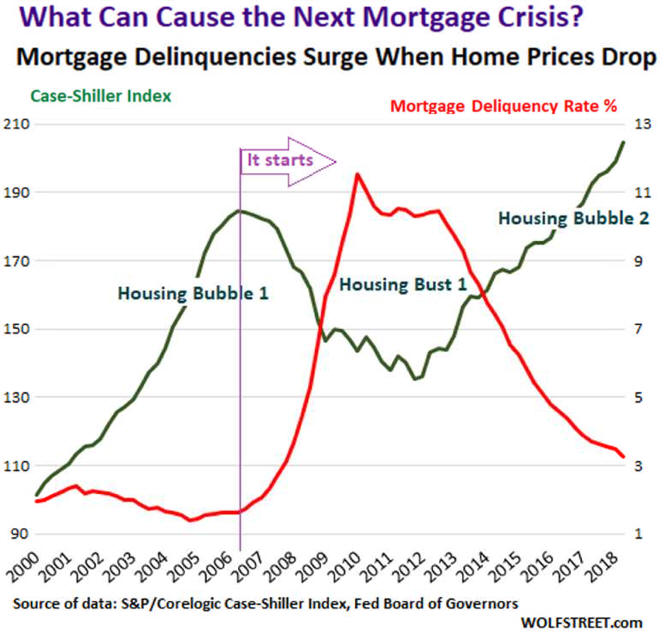

So Will Mortgage

Refinancing

Source

wolfstreet.com/

Auto Sales Already Affected

Increased Refinancing Needs Will Affect Profit

Vulnerability to Recession

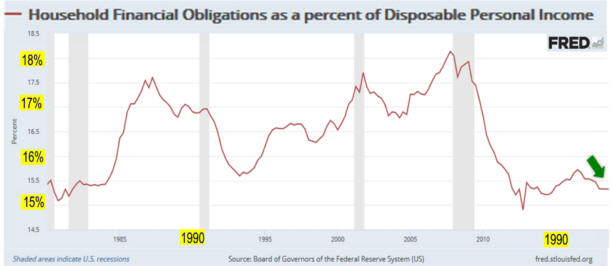

U.S Consumers Returned to Trend

Most Developing Countries Vulnerable

The Emerging Market Crisis is Back. and This Time it's Serious Global Output Growth is Little Changed in First Quarter

US Companies Move from Bank Loans Into High Risk Specialty Credit and

Out of Equity Capital

Recession Hurts Workers

This Key Counter Cyclical Measure is Very Weaker

"

"