|

|

Longest Bull Market Since WW 2 |

|

|

Return to Current Economic Questions 10/2/19 Please link and share. |

|

|

|

||

|

Has Monetary Policy Been Too

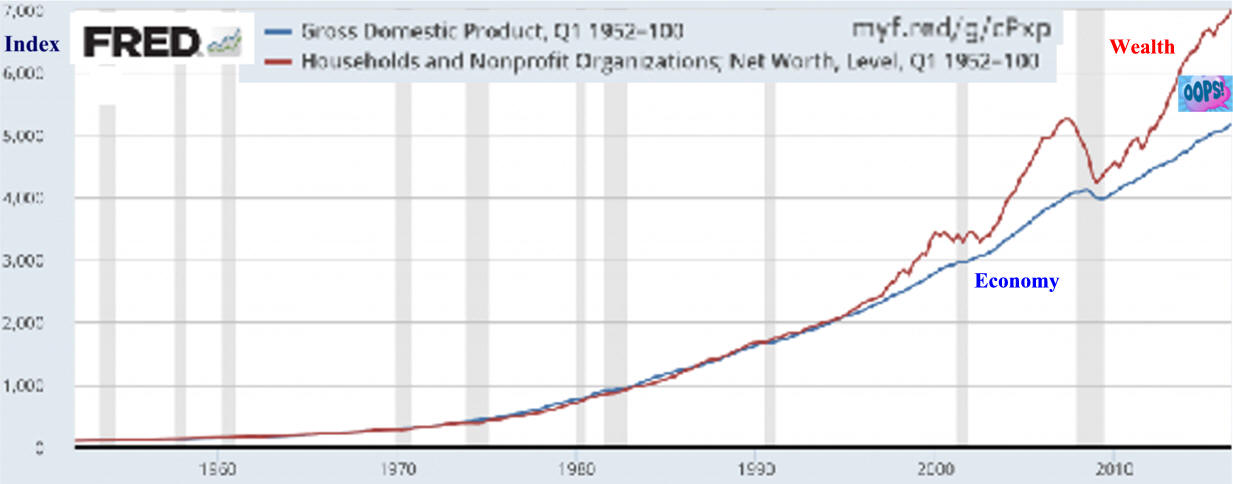

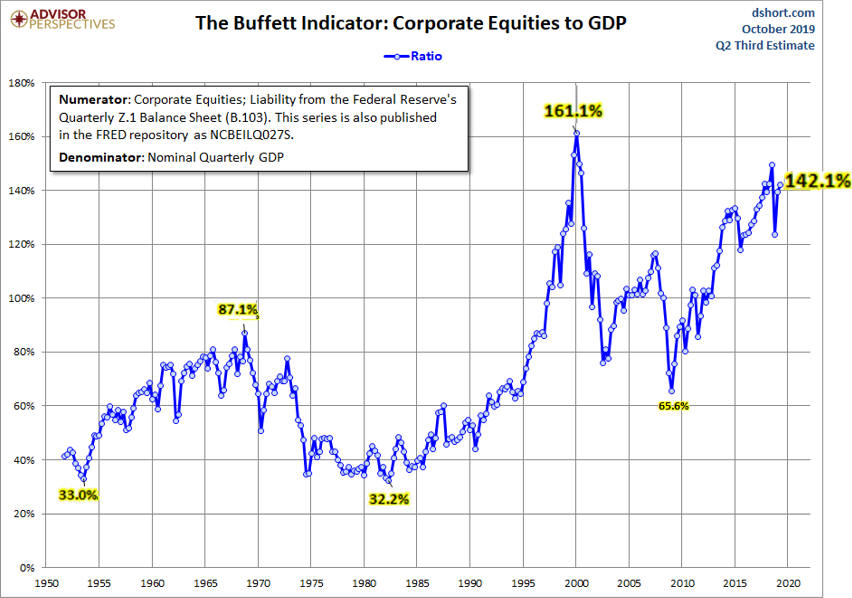

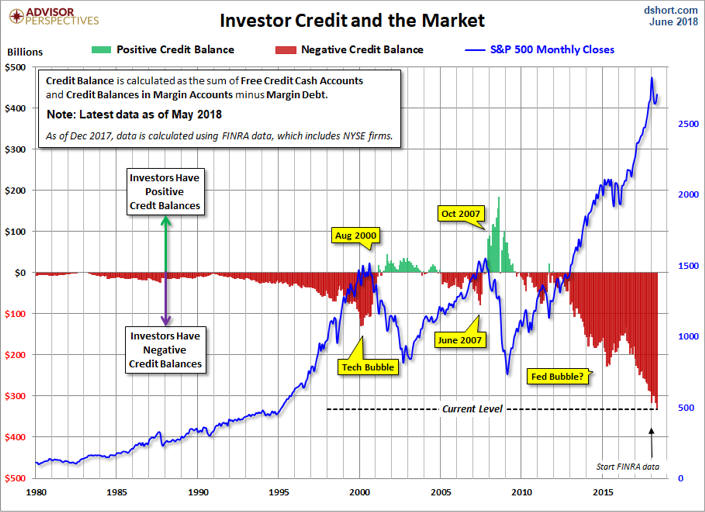

Easy "Larry Summers is choosing to write op-eds claiming that Janet Yellen could not have left Jerome Powell with a better legacy. Nobody seems to have told Summers that in 2017, Yellen's Fed did not alter the Fed's interest rate path. It failed to do so despite the strong boost that a close-to-full-employment U.S. economy was receiving from the combination of a 25 percent increase in U.S. equity prices, a 10-percent dollar depreciation and the large unfunded Trump tax cut. In all probability, this has left the Fed well behind the interest rater rising curve, which realization is now |

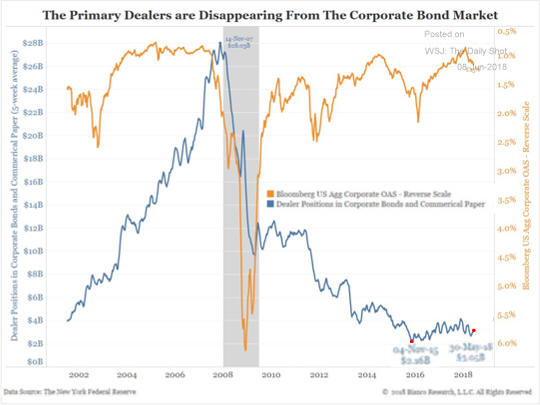

roiling the U.S. bond market. More disturbingly yet, no one seems to have told Summers that by keeping monetary policy too low for too long, the Yellen Fed, along with the world's other major central banks, have created a global financial market bubble of epic proportions. This bubble is to be seen in global equity valuations at lofty levels experienced only three times in the last 100 years, in government bond yields at historic lows, and in serious credit market mispricing." 2/5/18 Source | ||