|

FED Inflation in the Future?

Fed Warns About Coming Spike in PCE Inflation

Snapshot from the FED

has much data

|

Latest Data Agrees

ycharts.com/

|

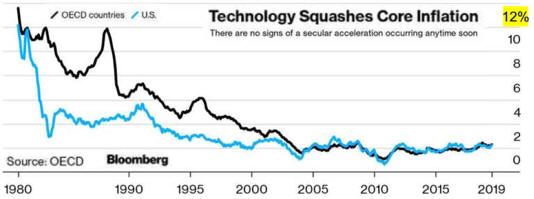

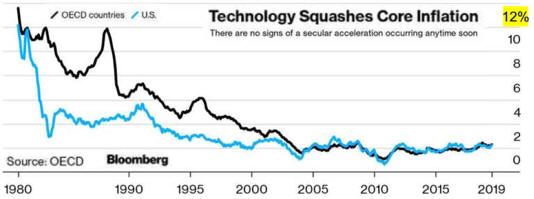

Some Disagree

There's more to low yields than

monetary policy rates, and those factors are likely to stay

in place for some time, Jim Bianco writes for Bloomberg Opinion.

Technology makes companies more efficient and price competitive,

while a global savings glut is fueling massive bond buying that's

resulting in yields dropping below inflation almost everywhere. For

those still hoping for a previous cycle to return, just be happy

U.S. yields are not negative—yet.

|

|

Trade War Could Be

Inflationary

Trade

wars are often inflationary,

and could cause an increase in

the inflation-risk premium on debt.

The interest rate effect could be distorted by a flight to safe and

liquid assets thanks to deep do-do between the U.S. and

China.

Trade concerns increased in June,

but

inflation compensation moved slightly lower.

9/23/19 Trade War has

Slowed the Economy and inflation.

|