Suggested by Christian Zimmermann.

Does Income Inequality Affect Economic Growth?

Return to

Current Political Economy Issues

Updated 8/16/18

Please link to,

use to educate and share.

|

Does Income Inequality Affect Economic Growth?

Return to

Current Political Economy Issues

|

|

At some

point, Business Takes Too Much, Growth Slows, and Politics

Becomes Unstable

|

||

|

Growth is Still Increasing, Inequality Is Up, Is a Turn Coming?

|

||

|

|

||

|

This FRED graph shows the

evolution of two sources of

income in our national

economy: the compensation of

employees through wages and

other salary compensation, and

the compensation of capital

through profits. Both series

are adjusted for inflation and

both start at the level of 100

in 1954, which is the first

year that’s considered

“post-war” for economic

purposes. (NOTE: The economic

impact of the Korean War has

essentially vanished.)

Eyeballing the data leads to

two major conclusions. First,

corporate profits move a lot,

especially in response to

general business activity.

Profits tend to tank during

recessions (noted with gray

bars), which is

understandable. After all,

it’s well understood that

investing in a business is a

risky undertaking that

deserves and often acquires

compensation. Employee income

is much more stable, but still

suffers during recessions. Second, the trends of the two series tend to track each other over several decades, reflecting the general growth of the economy. The past decade and a half seems to be different, though Never have corporate profits outgrown employee compensation so clearly and for so long. Is it because there’s been a particularly risky climate for investment, or is something else afoot? How this graph was created From the release table about national income by type of income, check the two series and click on “Add to Graph ” From the “Edit Graph” panel, add a series by searching for and selecting “GDP deflator,” apply a and finally set the index value of 100 to 1954-05. Repeat for the second line. Suggested by Christian Zimmermann. |

|

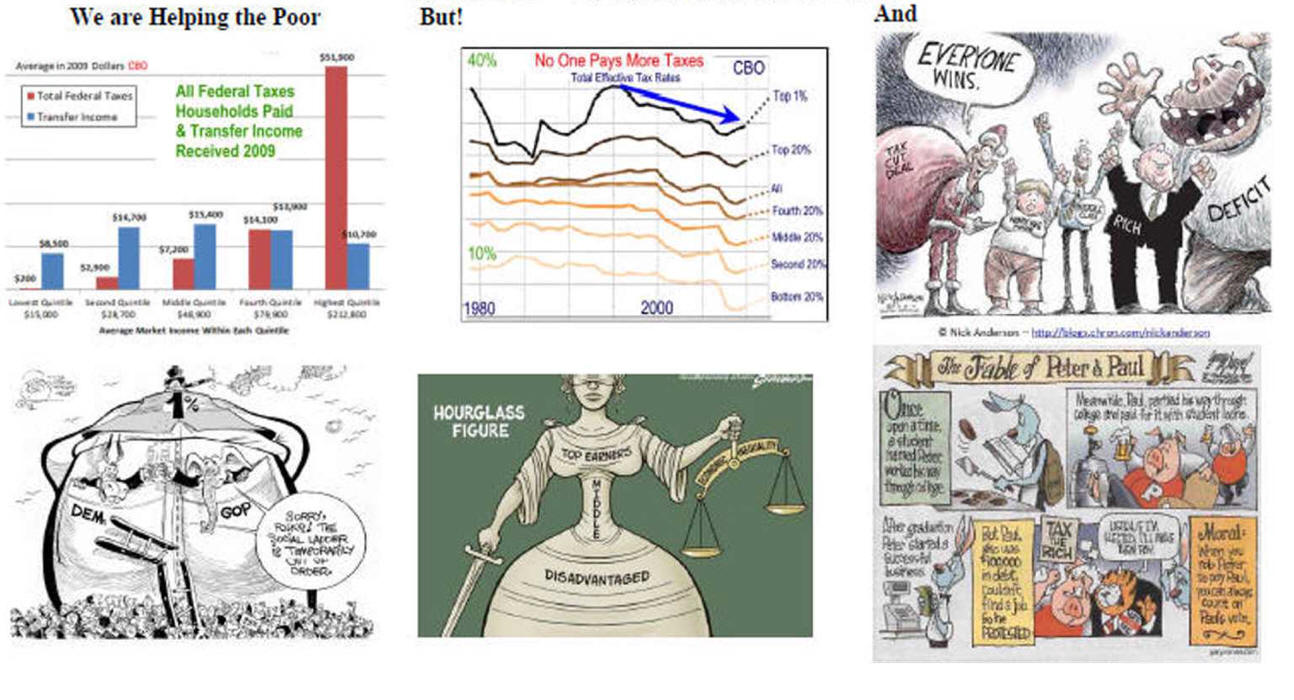

Liberals Want More Redistribution, Conservatives Not So Much