Financial Aid:

Welfare

for the Rich,

the Poor,

and

Schools?

Return

to

Education Libraries 8/9/22

|

Financial Aid:

|

|

For the Wealthy

Four year

American Opportunity Tax Credit

Eligible

student include individuals and a spouse or dependent

claimed

Maximum annual credit of $2,500/student for those

with modified adjusted The credit is phased out for taxpayers with incomes above these levels.

Forty-percent is

refundable so taxpayers not owing taxes can get up to $ $2,000 tax credit for qualified education expenses paid for all students enrolled in eligible educational institutions with no limit on the years so this is particularly helpful to graduate students, students who are only taking one course and those who are not pursuing a degree. Did this extend the traditional bachelor's degree from six years to seven, eight ...?

Some students are attending school for

the money and quickly drop out and keep the grant money. Only the academically

gifted and ambitious earn complete a degree. Others stay enrolled for something to do

and spending money with little chance of failing because teachers have many

reasons for not flunking them.

|

For the Not Wealthy

Lake County CC in

Leesburg Florida reports.

PELL Grants of up to $5,775/year Grants Not Well

Spent It is an outrage that our lending programs encourage schools like USC to charge $107,484 (and students to blithely enroll) for a master’s degree in social work (220 percent more than the equivalent course at UCLA) in a field where the median wage is $47,980. It’s no wonder many borrowers feel their student loans led to economic catastrophe. The federal government gutted accountability rules; treated online programs as if they were the same as traditional brick-and-mortar schools; extended credit to students and parents well in excess of financial need or ability to pay; and raised and then eliminated limits on loans to parents and graduate students, allowing many to accumulate eye-popping, unpayable amounts. The government allowed—and often encouraged—people to make bad choices. A better way to provide relief to student loan borrowers 4/19 |

h

|

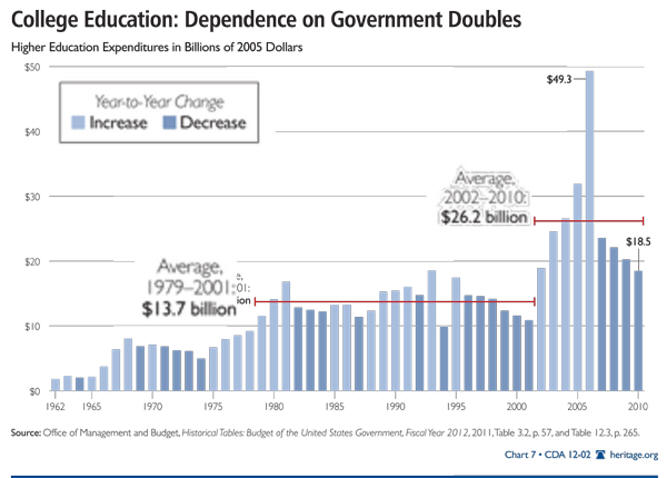

The More Government

Spends, The More Tuition Went Up

|

|

Obama Wants to End VA Exemption from 90/10 Rule. The VA announced that 17 for-profit colleges have failed the 90/10 rule, which states that for-profit colleges may not derive more than 90% of their revenues from federal student aid programs such as Pell Grants and direct loans (collectively called “Title IV” funding). Violators of the rule for two consecutive years will lose access to Title IV. The Department of Veterans’ Affairs and the Department of Education found that including veterans’ benefits in the restriction would increase to 200 the failing for-profit colleges. The 90/10 rule applied to all colleges would provide a useful safeguard against schools relying on government programs to finance academically and motivationally average students. Lobbyists be able to stop this Obama proposal.

Recent Efforts to Modify the 90-10 RuleWith again increasing scrutiny of the for-profit school industry, the 90-10 rule has again become controversial. Many advocates are pushing efforts to modify the 90-10 rule. |

Few Graduate from AA Programs

BS Success Rate Gets Better as Students Get More Academic

|

|

Include Military and Veteran Benefits in the 90-10 Cap

Efforts to make this change continue. In November 2015, Senator Dick Durbin [D-IL] introduced legislation to include military and veteran benefits in the 90-10 cap. The bill remains stuck in the Senate Health, Education, Labor and Pension Committee.[13] President Barack Obama expressed support for the bill shortly after its introduction.[14] In 2015, Secretary Hillary Clinton expressed support for the inclusion of military and veteran education benefits in the 90% cap.[15]

If military and veteran benefits were included in this

lower cap, the Center for Investigative Reporting found that an additional

292 schools would fail this lower standard.[12]

The change was included in the stalled Protecting Our

Students and Taxpayers Act of 2015, introduced by Senators Dick

Durbin, Jack

Reed, Elizabeth

Warren, and Richard

Blumenthal.[13] The Ball is now in President Trump's court. |

Economic Rewards Low for Many Graduates

|

|

|

|

Federal Government Helps Big-time

Source

On 30 March 2010, President Obama signed the Health

Care and Education Reconciliation Act of 2010,

which resulted in the U.S. government taking

over the student loan

industry from the private sector.

President Barack Obama signed a law Tuesday that he said will end subsidies for banks that guarantee federal student loans, saving $68 billion over 11 years by making loans directly through the U.S. Department of Education.

The overhaul of the student loan industry is part of the Health Care and Education Reconciliation Act of 2010, which was passed by Congress to reform the nation's health care system.

According to the White House, starting July 1 all federal student loans will be direct loans administered through private companies that have performance-based contracts with the DOE.

|

|

| * Amount spent by the college to educate first-year

undergraduate students (first-time, full-time) who did not begin a

second year. ** Median starting pay data presently available for 949 of the 1,576 colleges featured on this website. Epilogue Those in favor of governments programs have no interest in cost effectiveness. |

|

Smaller Schools Need Financial Aid to Attract Students Editor's Note: While data shows that AA graduates earn about 50% more than HS graduates, recent data indicates that first-year top AA earners make about $40,000 and those at the bottom less-than $20,000 annually. Source Is College Economically Worthwhile? |

|

|

Graduation Rates and Employment for Familiar Colleges.

Achievement Rates |

|||||||

|

Harvard where sister graduated |

University of NH where lived |

Saint Anselm local private school in NH |

Marietta College, Ohio Earned BS |

S N H U private college taught there |

Franklin Pierce

University |

||

| Goal | Strategic Measure | ||||||

| Completion and Progression | Graduation Rate | 97 | 78 | 74 | 63 | 59 | 49 |

| First-year retention rate | 97 | 86.0 | 88 | 75 | 73 | 63.0 | |

| Efficiency | Cost/student (FTE) | $84,000 | 14,900 | 25,500 | 23,800 | 13,731 | 19,000 |

| Productivity | Cost per degree | $264,000 | 57,500 | 125,000 | 107,000 | 49,679 | 62,000 |

| Cost of attrition* | $4.0m | 6.1m | 1.7m | 2.2m | 3.5m | 2.8m | |

| Gainful Employment | Student loan default rate | 1.5% | 2.1 | 1.4 | 4.3 | 5.1 | 4.7 |

| Ratio of student loans payments to earnings per recent graduate** |

2.9% 12/21/16 |

8.9% 12/21/16 |

11.2%12/21/16 |

No Data 12/21/16 |

No Data 12/21/16 |

No Data 12/21/16 |

|

| * Amount spent by the college to

educate first-year undergraduate students (first-time, full-time) who did

not begin a second year. ** Median starting pay data presently available for 949 of the 1,576 colleges featured on this website. Epilogue Those in favor of governments programs have no interest in cost effectiveness. |

|||||||

Source Why College Tuition is Not Going Up Rapidly

|

Thanks!

Walter Antoniotti, creator of the

Free Internet Libraries,

textbooksfree.org/,

author of the free

Quick Notes Learning System

books series, and President of

21st Century Learning Products

which enhanced his extensive college

admissions experience with an education concerning the college book

business and

home schooling.