Macroeconomics Review #2

Chapters 8-14

Understanding Total Economic

Activity

Retired teacher, suggestions to

antonw@ix.netcom.com

Thanks for using! Walter

Please

Share updated

7/1/24

The Business Cycle Ch 9

Macro Equilibrium Ch 10

Competing Macro Theories and Issues Ch 12

Keynesian Economics: An Expanded Review Ch 12

Money, Banking, and the Creation of Money Ch 13

AP 15 Min Macro Review Video

More Free Econ Stuff

Use

Economics Video Lectures

to Quickly review important concepts

Measuring Total Economic Activity Review

Chapter 8

A. Gross domestic product (GDP)

1. The sum of all the goods and services

produced within an economic unit (country, state)

within a

period of time (normally a year)

2. Excludes non-productive transfers

a. Stock market sales

b. Working at home

c. The "Underground

Economy" (unreported taxable income)

3. Two approaches to calculating GDP

a. Expenditure

approach

1.

GDP equals Personal Consumption plus Business Investment plus Government

Spending plus Net Exports (exports minus imports)

2.

GDP = C + I + G + XN

3. I is gross investment which is new capital

and replacement capital (depreciation)

4.

Q1

2010 GDP 3rd revision - 2.7%

from the economicpopulist.org blog

give some

current information on the national income accounting calculation process.

b. Income approach

1.

GDP equals Rent plus Wages plus Interest plus Profits plus Depreciation plus

Indirect Business Taxes

plus miscellaneous

2.

GDP = R + W + I + P + Acc. Dep. + Ind. Bus. Taxes + Misc.

B. Interpreting national income account data

1. Comparing data over

time requires adjusting for inflation, population

increases, and number of people working.

2. National income accounts

do not consider leisure time.

3. Positive and negative

effects of economic activity upon the environment are not measured by national

income accounts.

C. Money vs. real GDP (taking inflation out of financial data)

1. A Price Index measures

price changes for a basket of commonly used goods over a period of years.

a. One year is chosen as

a base year, set equal to 100 and years before and after are expressed as a

percent of the base year.

b. For convenience all

index calculations are multiplied by 100 allowing the percent sign to be

dropped.

c. Two important

indexes are the Consumer Price Index (CPI) and the Producer Price

Index (PPI) which respectively

measure the inflation associated with consumer and producer goods.

2. An index can be used to

determine whether someone's salary, a consumer good, and other items of interest

have changed

more or less than inflation.

a.

Nominal salary is salary measured in current dollars.

b. Real

salary is salary adjusted for inflation.

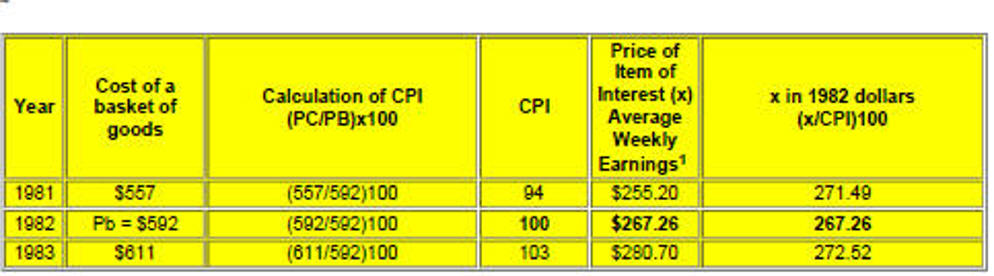

3. This example uses actual consumer

price changes and 1982 as the base year (PB).

The item of interest could be

someone's

salary, the price of a new car, etc. (PC is price in current year).

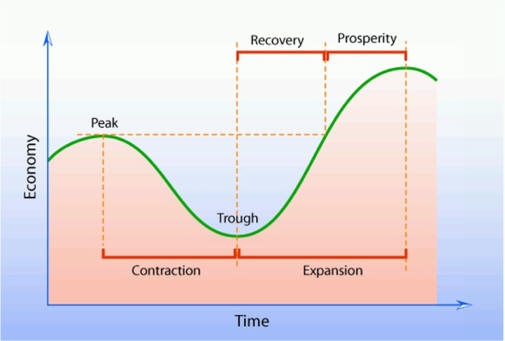

The Business Cycle Review

describe the business

activity over time.

View Entire Chapter 9

A. Recession: commonly accepted definition is two

consecutive quarters of negative

growth in Real GDP.

B. Why business activity fluctuates

1. Inventory Recession:

Excessive optimism causes inventories to over expand and

eventually they must be worked down causing a recession.

2. Rolling Recessions:

Economic downturn is limited to areas or sectors of the economy.

3. Innovation Cycle:

railroads, computers, bio-technology

4. Political Events: wars,

international trade

5. Misuse of Monetary and Fiscal

Policy: government creates and/or borrows an

incorrect

amount of money

6.

Non-cyclical Fluctuations

a.

Seasonal variation: Christmas buying rush, spring construction

b.

Long-Term Secular Trends: the expansion or contraction in the level of

economic

activity over a long period of years (the dark ages, the industrial revolution)

7. Durable Goods have a long

useful life (houses, equipment, etc.) Sale of durable goods

contract

substantially during a recession as their purchase may be easily postponed.

C.

Leading, coincidental, and lagging indicators

are measures such as the

unemployment

rate, which respectively change before, with or

after general economic activity. Economists

use to predict future economic activity.

D.

Unemployment Types and special topics

1. Frictional is

caused by time lags in the operation of labor markets.

a.

Workers are between employment because they have been fired, are changing

careers, are seasonal workers, have been temporarily laid off, etc.

b.

Short-term, inevitable, temporary, and is eliminated with time.

2. Structural is caused by

changes in consumer demand and technology.

a. Result

is an oversupply of workers with a particular skill.

b. This unemployment is often

concentrated in a particular area, associated with a

particular industry,

and is

often permanent.

c. Increased economic activity

will not decrease this type of unemployment as training

and/or

relocation are

required.

d.

Happened in the 1970's and early 1980's as consumers decided to buy small foreign

built cars

and other products produced

in the Rust Belt. Now it is happening because

NAFTA and foreign competition

are causing industries

to restructuring is

needed because of foreign competition.

3. Cyclical

a. Caused by a lack of total demand

at the end of an economic expansion

b. Temporary

c. Recession of the early 1990's was due to a drop in demand caused by a debt

buildup in the

1980's by individuals, businesses, and the federal government.

Apprehension caused by high

structural unemployment of both blue and white

collar

workers slowed the recovery.

d. Recession of 2001 was caused

by debt build up of individuals resulting from the

long period of

prosperity and

the stock market bubble, excess capital investment

caused by Y2K and

internet optimism, and

September 11.

e. Great Recession of 2008-09 was caused by the end of an excessive

building

boom

compounded by a banking and stock market crisis.

4. Special

topics

a. Natural unemployment (frictional + structural unemployment)

is

usually 4% to 6%

of the labor force

b. Full employment is when cyclical unemployment equals zero

c Okun's Law: a 1% increase in cyclical unemployment will cause a 1% increase in

cyclical unemployment will cause given a 2.5% annual drop in GNP

1) GNP change = 2.5

(unemployment rate change)

2) If unemployment goes up 2% as it did in the 1990-91 recession then the

drop in

GNP would be 2.5 X 2% or 5%.

3). Cost to a 6 trillion dollar economy of 250 million people

(5% X

$6,000,000,000,000) / 250,000,000 = $1,200/person/year.

E. Inflation is an increase in prices

as measured by a price index such as the

consumer producer index, CPI and

the Producer Price Index, PPI.

1. The PPI measures the

change in wholesale

prices.

2 The PPI is a

leading indicator for CPI as

wholesalers can usually pass price

changes on to retailers who pass them to consumer.

a. Recent increases in

foreign competition made passing price increases on difficult.

b. The internet

had the same kind of affect in the late 1990's.

3. The inflation rate for a year when a basket of

consumer goods increase from

$400 to $420 would be calculated as follows.

4. Causes of inflation

a. Demand-pull inflation

1. Increases in C + I + G + XN will cause GDP to increase.

2. As the economy nears full employment, the prosperity caused by high

employment increases demand and put upward pressure on prices.

3. When this happens, the

economy is said to be overheated.

b. Cost-push inflation

1. As the economy approaches full employment factor resources become

scarce

allowing their owners to increase prices.

2. Supply-side shocks can cause high resource prices even if demand for

resources is low, i.e., OPEC's two oil embargoes of the 1970's

5. Economic effect of inflation

a. Both income and resource allocations are affected by inflation

as the market tries

to

adjust to the loss in value caused by inflation.

1. High gas prices in

the 1970's caused a switch to small cars and many people

bought wood stoves.

2. Low gas prices in the

1990's made RV's less expensive to run.

b. Debtors (homeowners, businesses, government) are helped by high inflation

because they pay back with dollars worth less than those

borrowed.

c. Creditors are hurt by inflation as they are paid

back in less valuable dollars.

d. Those on a fixed income are also hurt by the

cheaper dollars.

d. Cost-of-Living Increases (COLA's) were instituted in the 1970's

to negate

the severe effects of that period's high inflation.

e. Deflating GDP

1. Inflation can be taken

out of growth in GDP by expressing later year production

at earlier year prices.

2. In the following

chart, letters Q, P and T are quantity, price per unit

and total respectively.

Macro Equilibrium

Chapter 10

exists when

the demand and supply variables affecting total economic

activity are in balance

and under no pressure to change.

A.

Macro equilibrium exists even though

the more slowly changing variables affecting long-term

activity are still

in flux. Said

long-term activity is called a long-term secular trend.

B. Aggregate demand, AD,

is

a schedule matching the Real Gross Domestic Product a country purchases at

various price levels.

1. As prices drop, the amount of

real gross domestic product purchased (AD) increases.

AD = C + I + G + XN

2. Like all demand curves, AD increases to the right

and decreases to the left

3. Price level is the key determinate of aggregate demand. Holding

non-price level determinants constant

yields the

following analysis of why price levels and aggregate

demand are inversely related.

a. Interest rate effect

1. If the price (inflation) is low, interest rates will be

low causing

consumption and investment to be high

increasing AD.

2. This is especially true now that home mortgages are easily refinanced at

lower interest rates.

b. Real asset balance effect as low inflationary expectations

cause people think their past accumulations

(savings) will maintain their value. causing people to

spend more which increases AD.

c. Low domestic inflation relative to foreign inflation results in low-priced

exports selling better which

increases AD

d. High price levels will bring opposite results

4. Non-price level determinants of aggregate

demand and

their determining characteristics

a. Consumption (C). Increased expectation of wealth caused by more overtime, debt decreasing

by

refinancing a home at lower

interest and taxes going down all increase consumption.

b. Investment (I) Increased profit expectations, decreased business

taxes, low excess capacity, and

positive technology outlook

all increase investment. .

c. Government Spending (G)

d. Net

Exports (XN) (exports minus imports) are determined by economic activity abroad

and exchange rates

5. Price level and non-price level factors

together determine aggregate demand which interacts with aggregate

supply to determine total economic activity.

C. Aggregate Supply

is a schedule of the amounts of Real Gross Domestic

Product companies are willing to

produce at various

price levels.

1. Holding non-price

determinants constant yields

the following analysis of how different price levels affect AS.

2. Keynesian Range: increases in AD increase real GDP and prices do not

change

3. Intermediate Range: both prices and real GDP change

4. Classical Range: increases in AD increases prices and real

GDP does not change because full

employment exists

5.

Non-price factors affecting aggregate supply factor

price decrease, productivity increases and

increased domestic and foreign tranquility all will increase AS

1.

Laffer Curve

1.

Laffer Curve