|

2. Economizing

Scarce Resources

Print one-page

review

Chapter 2

A. Factors of Production

|

Factor |

Definition |

Income |

|

Land |

Anything fixed (natural resources) |

Rent |

|

Labor |

Physical and mental talents |

Wages |

|

Capital |

Something physical to aid production (factories, computers, an

educated/trained labor force) |

Interest |

|

Enterprise |

Initiative, risk taking, innovation |

Profit |

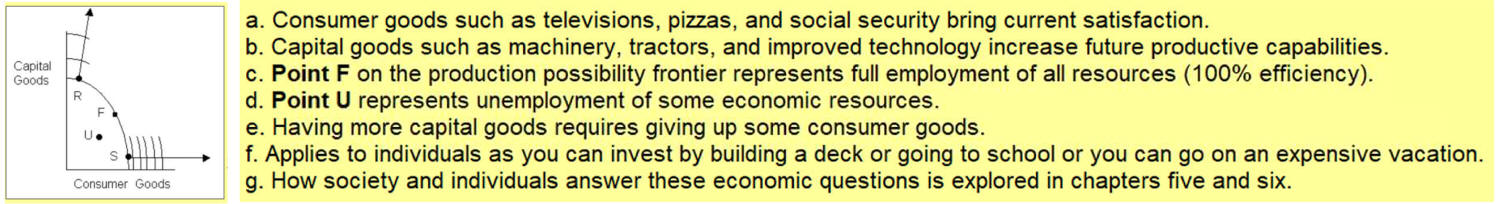

B. The Production Possibility Frontier

(Curve)

measures how many of two types of goods can

be produced.

1.

Static Model (time is

constant, inputs are fixed)

2.

Dynamic Model

(time is not constant,

inputs like factors and technology are not fixed, growth indicated by, arrows

occur

a. As inputs increase, growth

occurs and the curve shifts right.

b. Point S represents slow

growth due to high consumption.

c. Point R represents rapid

growth due to high capital investment.

d. Economic and political

system chosen and run by a society determines the location and movement of

these variables

3.Opportunity costs

a. The cost of Item A measured in

terms of what must be foregone of Item B.

b. When considering doing A, we

consider the highest valued alternative as limited resources means we can't afford

both.

c. For more information visit

the

Production Possibilities Curve from Wikipedia.

d. Politicians seldom talk of the

opportunity cost of what they plan to do.

e. Examples

1.

The opportunity cost of good grades is the value which could have been received by

spending time with family and friends.

2.

The opportunity costs of more capital goods is the value

which could have been received from having more consumer

goods.

4.

Law of increasing opportunity costs

a. Opportunity costs usually increase.

1. To have one unit of

Item A you must give up amount X of Item B. To have a

second unit of Item A you must give up more than amount X

of Item B.

2.

Primary reason for increasing costs is resources are not perfect substitutes.

3. Examples

a)

Training more people in math and science would increase productivity

for a while but eventually people would be trained to be

engineers who would be more productive as managers, teachers, or

entertainers etc.

b) Gains from replacing people with machines may be large at

first but eventually machines would be used to do

what people can do

more efficiently.

c. When

opportunity costs are not increasing, the production possibility

curve is a straight line.

High tech investment may even bend the

curve the other way and have decreasing cost, but not forever!

b. Below

is an example of the trade-off

between investing people in high tech industries versus entertainment

industries.

Alternative Production Possibilities for10 entertainers and no

technicians'.

Units of Production

High tech

0 1

2 3 4

Entertainment

10 9 7

4 0

Cost of an

additional unit of high tech production

1 2

3 4

measured in terms

of entertainment given up

Example

Adam Sandler, a great entertainer, probably would not of been a

great computer programmer,

though his

dad Stan was an electrical engineer, his sister Elizabeth a dentist,

and his brother a Scott a lawyer.

Adam might be the

first resource to move to create more production.

3. Market System

Capitalism Review

Print one-page

review

Chapter

3

A. Economic systems determine what to produce,

how to produce, and ho will receive production.

B. An economic system must also adapt to changing economic environments.

For example, America

must adapt to changes to September 11?

C. Adam

Smith described the beginning of capitalism.

1. His book,

The Wealth of Nations,

was the first description of capitalism.

2. Published in 1776, it described capitalism as it was practiced in 18th

century England.

D. Basic characteristics described by Adam Smith

1. Private property-the right to own resources and bequeath property

2. Freedom of enterprise-own

a business

3. Freedom of economic choice-work/not work, spend/not

spend

4. Role of self-interest

a. People are by nature economic creatures

b. Self-interest is a fundamental characteristic of people

5. Competitive market system

a. Many buyers and sellers

b.

Market participants, buyers and sellers, have little control over price

c. Competition performs the organizing and controlling

functions for a market economy

6. Limited government

("Laissez-faire

")

a. Government

should let

markets be with a hands-off philosophy)

b. Acceptable

government involvement has become an important political question in the

United

States during the last few decades.

E. Modern Capitalism has additional features

1. Complex Market System Setting Prices

2. Importance of Capital Goods and

Technology

3. Specialized

a.

Complexity

requires company produce limit their product lines

b. Division of

Labor allows specialization by ability ad training.

F.

Creative Destruction

described by 20th century

sociologist/economist

Joseph Schumpeter

was an important addition

to the idea of

capitalism.

1. Change involves the creation of improved economic

structures based on technology and the

destruction of inefficient economic structures.

2. Capitalism allows this

destruction to take place.

G. Economic Systems

A. Pure capitalism as described by Adam Smith

never existed.

B. Recent economic systems have

are Mixed Economies

(a mixture of Capitalism

and Socialism)

1. Socialism

emphasizes collective ownership and management of economic resources that are equally distributed.

2. Democratic

Socialism, as practiced in Western Europe, has public ownership of key industries such as transportation and

communication

a. The economic systems of Europe began moving away from socialism toward capitalism in the late 1970's

b. Margaret

Thatcher, former prime minister of England, started this trend.

c. Ronald Reagan

agreed and stressed the market system during his presidency

(1981-89).

3.

Democratic Capitalism Vs. Capitalistic Democracy

4. Communism

is the

ideal of those practicing a "Marxian system."

a. Named after 19th century philosopher

Karl Marx

b. The public owns almost all wealth which is centrally managed, i.e., a

planned economy

c.

Presidential

Courage explores how Ronald Reagan deplored Communism.

C. Traditional

economy, where customs determines the economy activity, is practiced by many developing countries.

4. Demand

and Supply Review

Print one-page

review

Chapter 4

A. A market is defined

as an institution or mechanism which promotes trade

by bringing together buyers (demanders) and sellers

(suppliers).

1. Replaced barter which is the direct exchange of

goods.

2 Modern market brings money and prices into the

circular flow of goods.

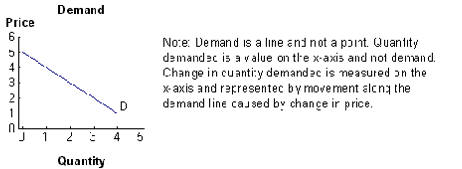

B. Demand is willingness to buy.

1. Demand is a

schedule of the amounts of goods and services consumers

are willing and able to buy at a set of prices.

2. Total demand is the Horizontal

Summation of

individual demand.

3. Law of demand:: price

and quantity are inversely related and as price goes up,

quantity demanded goes down and vice versa

4. Why more is bought as price drops.

a. Income

Effect: as price drops, consumers feel richer and buy more.

b. Substitution

Effect: as price drops, it becomes cheaper relative to

other goods and consumers buy more

C. What determines demand

1.

Tastes

or preferences of consumers

2.

Number of consumers

3.

Incomes of consumers

a.

normal (superior)

goods

such as steak and vacations - more is purchased as income

increases.

b

inferior

goods such as bread and hamburger

- less is purchased as

income increases.

4.

Consumer expectations

5.

Price of related goods

a.

Substitutes

are goods that compete with each other such as hot dogs

and hamburgers.

If the price of a good increases, the demand for its substitutes will increase.

b.

Complements

are goods that are purchased together like

hot dogs and rolls.

If the price of a good

increases, the demand for its

complement will decrease.

5.

''Ceteris

Paribus''

is Latin for all other variables remain the

same. So we change one variable at a tome.

D. Changes (shifts) in Demand

1. A decrease in demand shifts the demand curve to the left

2. An increase in demand shifts the demand curve to

the right

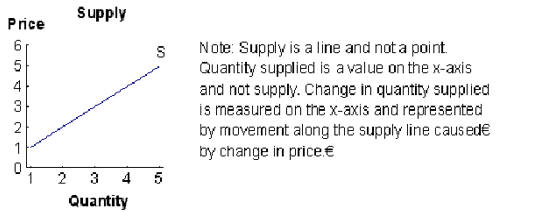

E. Supply is willingness to sell

1. Supply is a schedule of the amounts of

goods or services producers are willing and

able to sell at a set of prices.

2. Law of supply:

price and quantity supplied are directly related because price and

expected

profit are directly related

a.

As price goes up, quantity supplied goes up

b.

As price goes down, quantity supplied goes down

F. What determines supply

1. Product costs

as affected by technology, resource prices, government involvement with taxes

and subsidies

2. Price of related goods

a. If 2

goods are substitutes, price up for one will increase supply of the other (price of gasoline up,

supply of alternative

fuels increases) as

companies see more potential profit

b. If 2

goods are complements, price down of one will increase supply of other (price of PC's

down,

supply of computer software up) as the

expected increase in sales of the first item should increase

sales of the

complement.

3. Number of producer

and their expectations concerning the

above listed variables will affect supply

G. Changes (shifts) in supply

1. A decrease in supply shifts the

supply curve to the left

2. An increase in supply shifts the

supply curve to the right

H. Equilibrium is where suppliers and demanders agree

on price and quantity as depicted

by E.

1. If the price is too high, a surplus results

and price must be lowered

2. If the price is too low, a shortage results.

This happens with toys every Christmas

(Cabbage Patch Dolls)

3. If they can not agree, as happened with

Beta videotape machines,

then the curves do not intersect

and the goods are not sold.

4. Rationing function of price

makes for an efficient allocation of resources.

When competitive forces of supply and demand result in an

equilibrium, a

rationing function of

goods produce to

consumers has occurred.

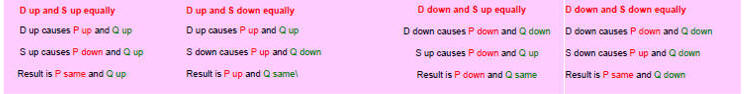

I. How changes in supply and demand affect equilibrium price and quantity6

J. Government Imposed Price Ceilings and Floors

1. A price ceiling keeps prices from rising (rent

control) helping renters but often

resulting in a

shortage of housing as

investors seek higher returns elsewhere.

2. A price floor keeps prices

from falling (farm price supports)

helps farmers

though a surplus often results as more of supported crops are

produced.

V. 5 Key Questions Society Must Answer Review

Print one-page

review

Chapter 5

A. What to produce?

1. Which goods

a.

Those that can be sold at a profit, consumers vote with dollars

b.

Accounting

Profit: The amount by which total revenue exceeds

accounting costs (rents,

wages, and interest)

c.

Normal

Profit

1. Amount received for enterprise

2. Considered by economists to be a cost

d. Economic

Profit

1.

The amount by which total revenues exceed all "Factor" costs.

2. Some

think of it as a surplus.

3.

Expanding industries have economic profit.

a) Bill Gates, founder of Microsoft, has earned many billions

of dollars.

b) So has Sam Walton of Wal-Mart

2. How many goods

a.

Level of demand and efficiency of supply determine output.

b.

Society determines total demand (who works, how often and

for how many years).

c.

Success of economic system determines efficiency of supply.

B. How to produce?

1. Companies must be competitive

2. Competition is the "Invisible

Hand" assuring

a. High quality

goods are produced.

b. Efficient

production methods are employed.

c. Prices and profits are reasonable.

d. For more

read

Adam Smith and the invisible hand

by Helen Joyce

of

Plus magazine.

3. Technology and innovation are

instrumental to success.

C. Who will receive production?

1. Those willing and able to

pay

2. Function of income, savings,

and attitude toward debt financing

D. How will the economy adapt to changing environments?

1. Today's economic

environment is changing more rapidly because

of the communication

revolution.

2. Magnitude of these changes is similar to

that which occurred in the

last quarter of the 19th century.

3. Companies and individuals must "adapt or be

gone."

4. Capitalism allows creative destruction to

work.

5. Recently technology has changed rapidly and people

are being

adversely affected

a. Normally, political forces

would attempt to slow creative destruction.

b. But, the 1990's was the

decade of free enterprise so creative

destructions moved on.

c. Perhaps the next recession

will slow down the free market

revolution.

E. Market system evaluated

1. Advantages are resources allocated efficiently,

economic freedoms (enterprise,

choice)

2. Disadvantages

a. Too

dependent upon competition eroded by monopoly power resulting in waste

and inefficiency

result because of monopoly power exercised by business,

unions, governments, and interest groups.

b.

Inequitable distribution of income (economic survival of

the fittest)

c. Market

failure occurs

1. Not

all costs (pollution) and benefits (public health) are properly accounted

for.

2. Why?

because measuring their cost and benefits in dollars is difficult and

subjective.

d.

Political process sometimes interferes with creative destruction.

VI.

Government's Economic Function

Print one-page

review

Chapter 6

A. Provide

a proper legal atmosphere (rules) for capitalism

B. Insure competition

1. Antitrust laws

protect against abuse of monopoly power.

2. Natural

(justifiable) monopolies such as AT&T were allowed because

duplicating high-cost fixed investments is illogical.

3. The emphasis on free markets discussed

in chapter 3 has resulted in some natural

monopolies being broken into smaller companies which had to

compete against

new companies touting new technologies.

C. Provide for an equitable distribution of income

1. Transfer

payments where a government moves general revenue to a

specific group, i.e., Aid to Families with Dependent Children,

students...

2. Market Intervention

(affecting supply and demand)

a.

Minimum wage decreases supply raising price and lowering quantity.

b. Excise

taxes on alcohol, cigarettes, jewelry, etc., deceases supply.

c. Farm

price supports, aid to small business and education increases supply.

D. Adjust for market failures

1. Adjust for spillovers

(externalities)

a. Effects of a market

system often spillover onto non-participants who are

external to the market

transaction.

b.

Both costs and benefits result.

1. Pollution hurts (costs) society so government tries to affect

the supply of,

and demand for, pollution causing products such as automobiles.

For automobiles, they lower supply by requiring catalytic converters and

they

lower demand with high excise taxes.

2. An educated workforce benefits society so government increases demand

(aid to

students) and supply (aid to colleges).

|