|

Chapter 7 Market System Participants |

|

|

II. Business Population is Varied

III. Governments Tax, Spend, Regulate

|

Part 1 Review Notes Chapters 1-7

Return to Economics Internet Library

|

|

1-page printable lecture notes

|

Political Economy

|

|

|

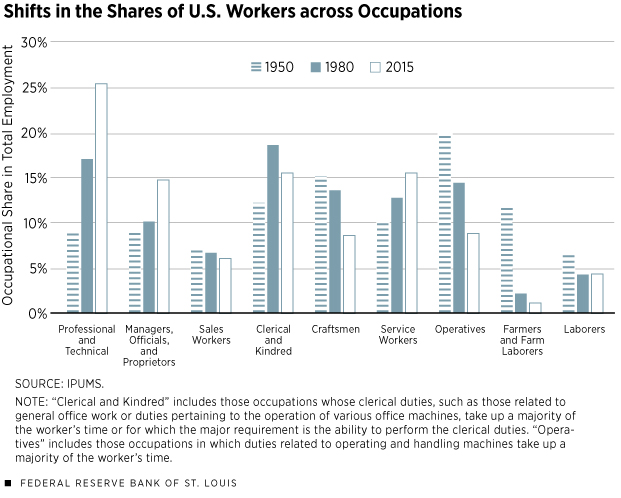

II. Varied Business Population

A. Businesses types 1. Manufacturers 2. Transportation 3. Wholesalers 4. Retailers 5. Services

|

|

|

|

B. Business Produce

|

|

|

C. Legal Forms of Business

|

|

|

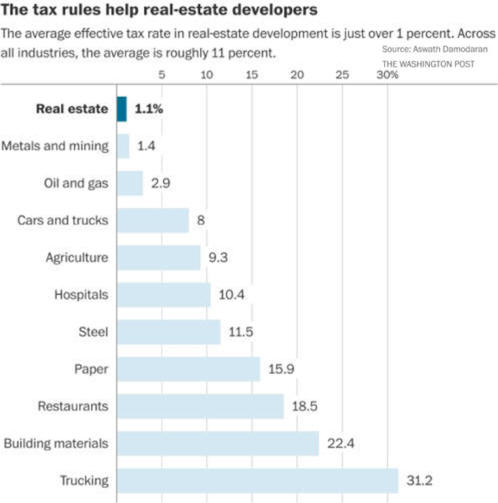

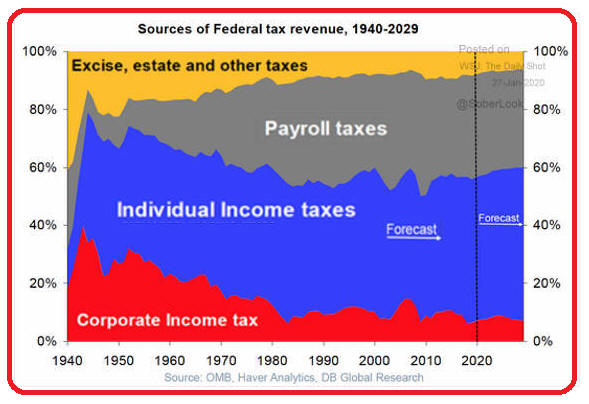

D. Corporate Profits Up Income Tax Paid Down Payroll Taxes Replace Income Taxes

|

|

|

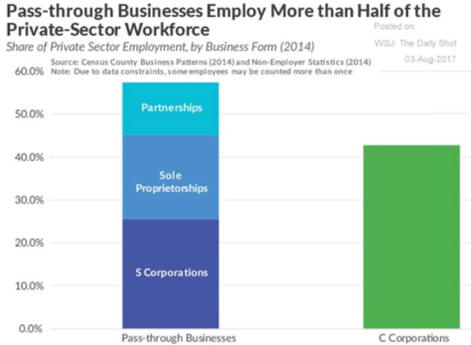

E. Pass through, pay lower personal tax rate.

|

|

|

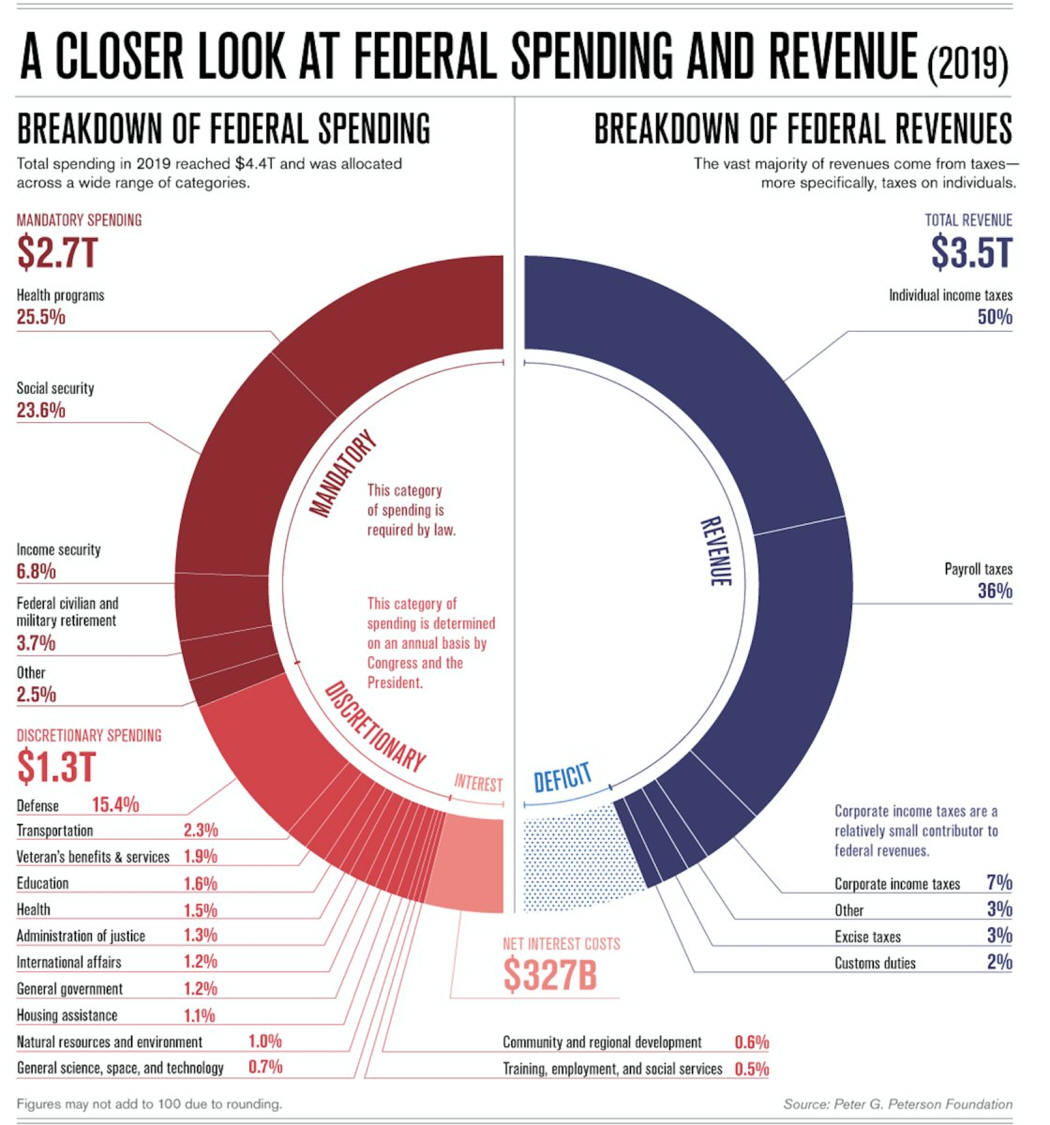

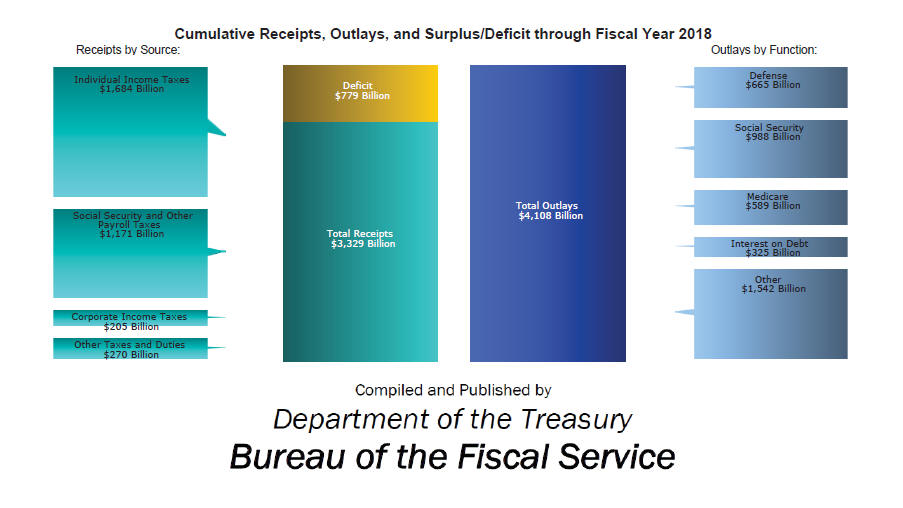

III. Governments Spend, Tax and Regulate

B.

Federal Government Spending

C. Federal Government Receipts

2. Payroll Taxes a. social security and Medicare

a. both employer and employee pay)

3.

Corporate Income Taxes

5. Licenses and Fees

6.

Is

border adjustment good tax policy?

See

Who Owns US Businesses

and How Much Taxes Do They

Pay

|

|

|

The drop in corporate total taxes from 5.5%

to 4.0% was not small. |

|

D. Government Spends More Than It Collects

|

|

|

E. Much is Required by Existing Law

Source:

|

|

|

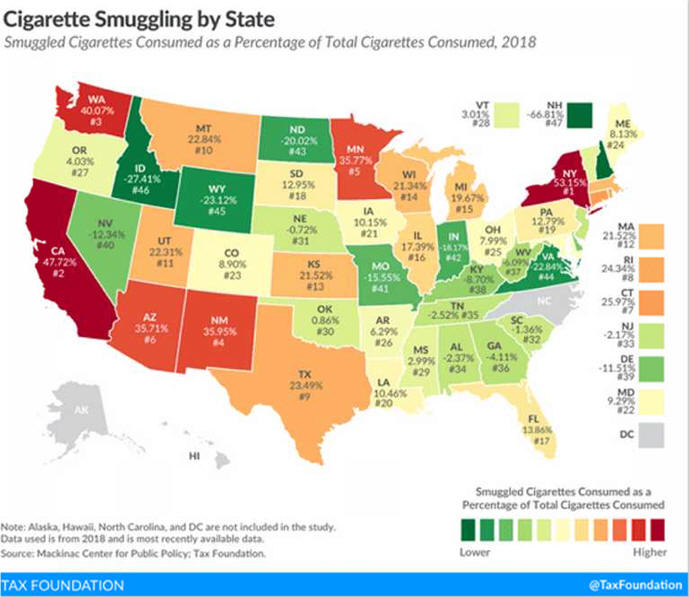

F.

State and local government

2. Property Taxes are differ from state to state

|

What the 2018 elections mean for state and local spending

|

|

|

|

|

|

|

IV.

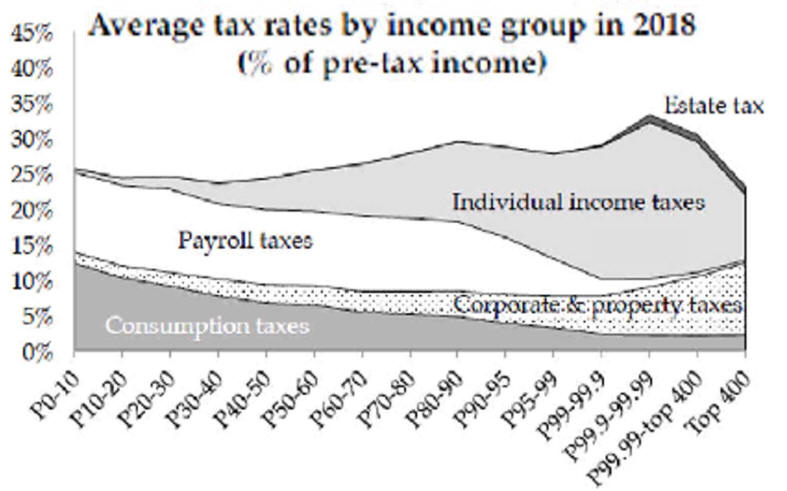

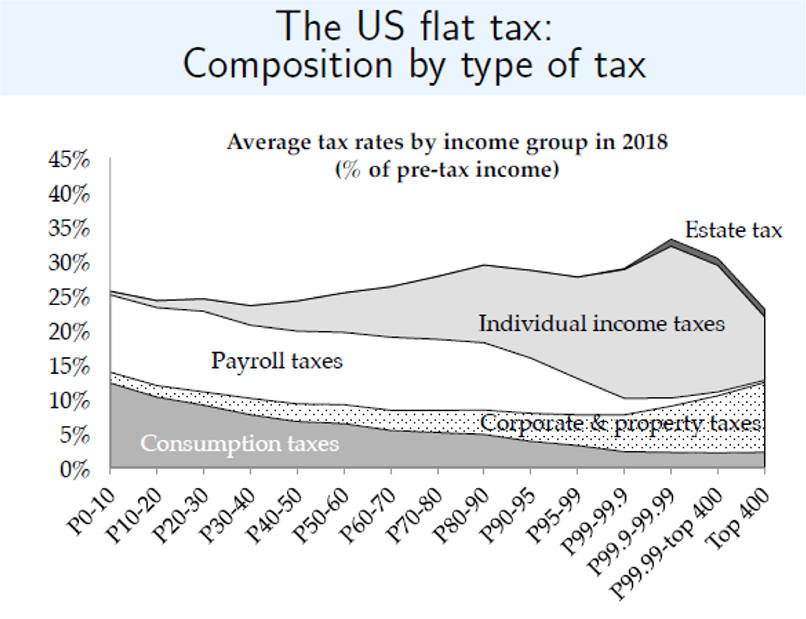

Taxation Philosophies Unit IV Review Ability to pay and benefit received are taxing philosophies

V.

Tax Rate Types

C. Regressive

Very-Rich Top 1% of Income Going Up

D. Passing

Tax Incidence

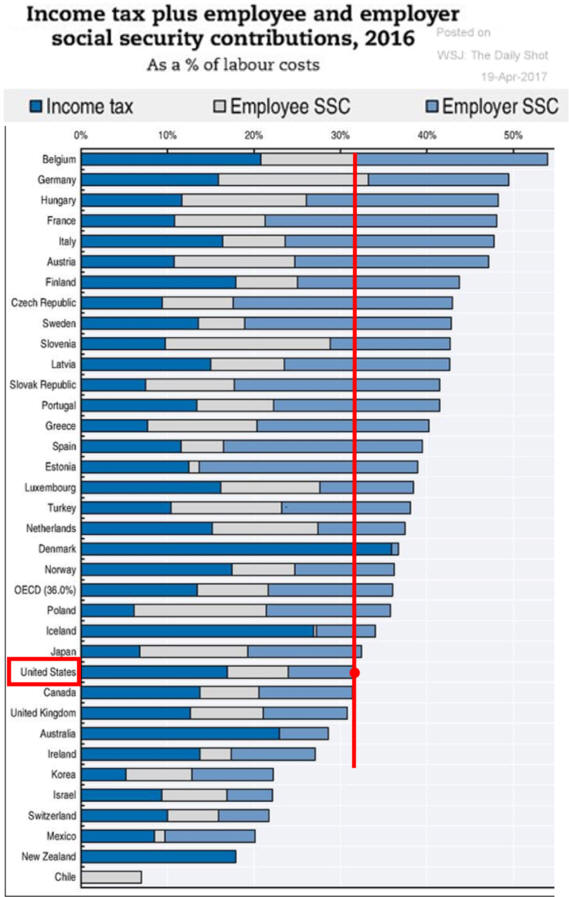

F. "The “tax wedge”, the difference between total labor costs to the

employer

G. Effect Rates

H. Average Tax Rate from Wiki its taxes paid/ taxable income

H.

The-global-cost-of-tax-avoidance

IMF reporting that around $600 billion is lost due to profit shifting every year

|

Tax Rates Have Gone Down.

Some Want Taxes the Wealthy.

Some Sat Tax Where the Money Is!

The Math Problem That Could Sink the Bernie/AOC Agenda

Very-Rich Top 1% of Income

Payroll Taxes are Very Regressive

One important point is people with low

earnings die early then the wealthy

the myth-that-the-estate-tax-threatens-small-farms

|

|

VI.

Federal Revenues and Expenditures

|

Federal Spending Up blogs.wsj.

|

|

Taxes Flat

|

||||||

| C. Outlays

Because Tax Revenues have changed little,

|

1999 | 2002 | 2005 | 2008 | ||

| Social security, Medicare, and other retirement | 35% | 38% | 37% | 37% | ||

| National defense in 1999 (15%) , veterans benefits and services (2%), and foreign affairs (1%) | 18% | 20% | 24% | 24% | ||

| Social programs: in 1999, 12% for Medicaid, food stamps, temporary assistance for needy families, supplemental security income and related programs and 6% for health research and public health programs, unemployment compensation, assisted housing, and social services | 17% | 21% | 20% | 20% | ||

| Net interest on the debt | 12% | 8% | 7% | 8% | ||

| Physical, human and community development (agriculture, natural resources, environment, transportation, aid to elementary and secondary education and direct assistance to college students, job training, deposit insurance, commerce and housing credits, community development, space, energy, and general science) | 9% | 10% | 10% | 9% | ||

| Surplus to pay down debt | 7% | None | None | None | ||

| Law

enforcement and general government

|

2% |

3% |

2% |

2% |

||

|

D.

Tax

Expenditures

is a kind of spending in that it is revenue not collected.

|

pewresearch.org/fact-tank/2016/04/06/the-biggest-u-s-tax-breaks/

|

|

VII. Are Taxes Fair?

People Are Paying

Less

D. Comparing Regressive Payroll Tax US Has Low Safety Net

Follow the Money

|

Partial Reversal of Bush II Tax Cuts 1/2/12 from WSJ

Some Couldn't Afford Safety Net

by 2018 Many

Questioned

Additional Reading:

C. Household Income and Tax Distribution-in 2010 5/12/13 CBO

E. Great Recession Lowers Government Employment

|

|

|

|

|

Calculating 2000 Tax Rates for a Single Filer |

|||

| Taxable Income | Marginal Rate | Bracket Taxes Paid | Average Rate |

| 0 to 26,250 | 15 | .15(26,250) = 3,937.50 | 3,937/26,250 = .150 |

| 26,251 to 63,550 | 28 | .28(63,550-26,250) = 10,444 | (3,937 + 10,444) = 14,381/63,550 = .226 |

| 63,551 to 132,600 | 31 | .31(132,600-63,550) = 21,405 | (14,381+ 21,405) = 35,786/132,600 = .269 |

| 132,601 to 288,350 | 36 | .36(288,350-132,600) = 56,070 | (35,786 + 56,070) = 91856/ 288,350 = .319 |

| 288, 351 and over | 39.6 | ||

|

Calculating 2003 Tax Rates for a Single Filer |

|||

| Taxable Income | Marginal Rate | Bracket Taxes Paid | Average Rate

Calculation Add previous bracket total to bracket this total and divide by bracket upper limit. |

| 0 to 7,000 | 10 | .1(7,000) = 700 | 700/7,000 = .10 is average rate on $7,000. |

| 7,001 to 28,400 | 15 | .15(28,400-7,000) = 3,210 | (700 + 3,210) = 3,910/28,400 = .138 is the average rate on 28,400. |

| 28,401 to 68,800 | 25 | .25(68,800-28,400) = 10,100 | (3,910 + 10,100) = 14,010/68,800 = .204 is the average rate on 68,800. |

| 68,801 to 143,500 | 28 | .28(143,500-68,800) = 20,916 | (14,010 + 20,916 = 34,926/143,500 = .243 is the average rate on 143,500. |

| 143,501 to 311,950 | 33 | .33(311,950-143,500) = 55,589 | (34,926 + 55,589) = 90,515/ 311,950 = .290 is the average rate on 311,950. |

| 311951 and over | 35 |

Economics AP Reviews from amazon.com |

|

| Last Chapter | Next Chapter |

| Chapter 7 Class Discussion Questions | Table of Contents |

| Chapter 7Homework Questions | Economics Internet Library |

VIII. Visual Learners

|

|

|

|

|

how-america-spends-money- |

|

|

A sea-change in household-deleveraging? 6/9/13

|

|

|

|

|

|

|

|

|

|

|

|

b

|

The 2018 Tax Bill

|

|

|

|

The Very High Earners Earn Very, Very, Very Very Much

|

|

|

b

|

The 2018 Tax Bill

|

|

m

|

See |

|

|

|

|

|

|

|

|

|

m

k

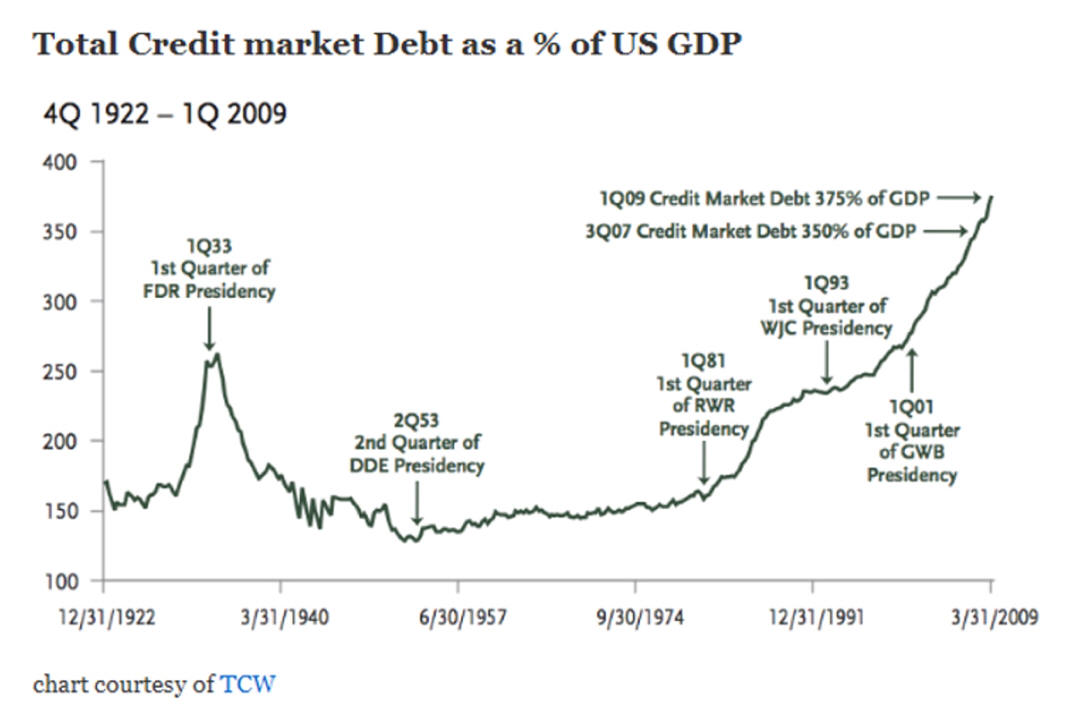

As Corporate

Debt Increases,

So Do the Frequency of Financial Crisis

Trump Made Changes

Trump Estimated Income Tax Savings Changes on 10 Years

See Fiscal Math Is Daunting For The Aging Population 4/9/16 Atlanta FED]

m

|

Analysis: One of the weaknesses of National Income Accounting, covered in the next chapter, is it doesn't measure everything. Here, we see negative saving because expenditures from the underground economy have been included but income has not been included as people illegally avoid taxes. Also, expenditures on home improvements count, but gains when the home is sold are not personal income

but capital gains. SS and Medicare tax rates go up continually and aren't help when people get older and aren't savings. Economic Well Being of U.S.-2014 Households FED survey |

Tax Expenditures Helps Many

To get revenue loss from tax

expenditures

|

|

|

|

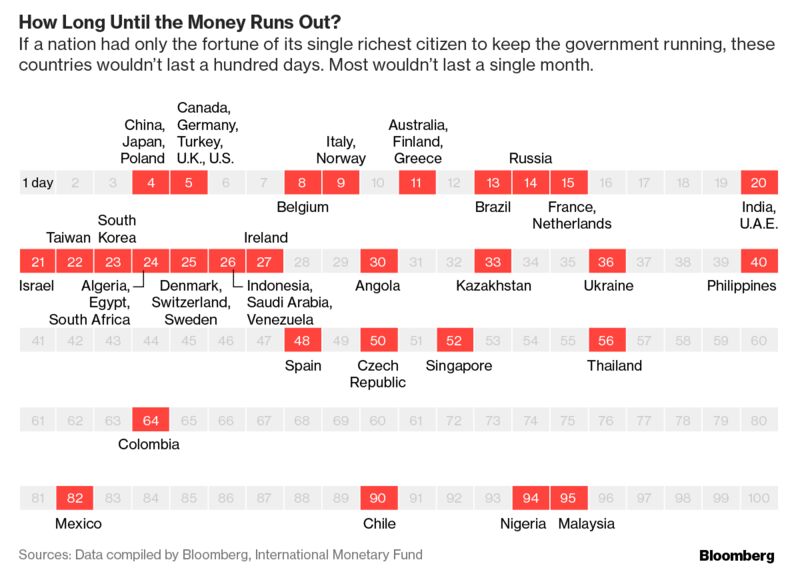

What If-the World's Richest Paid For Government Spending