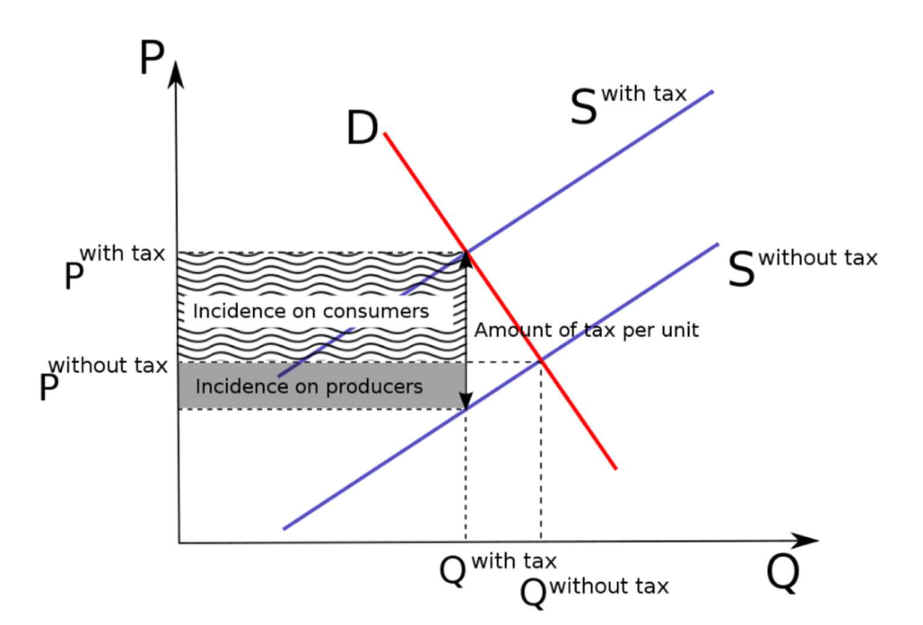

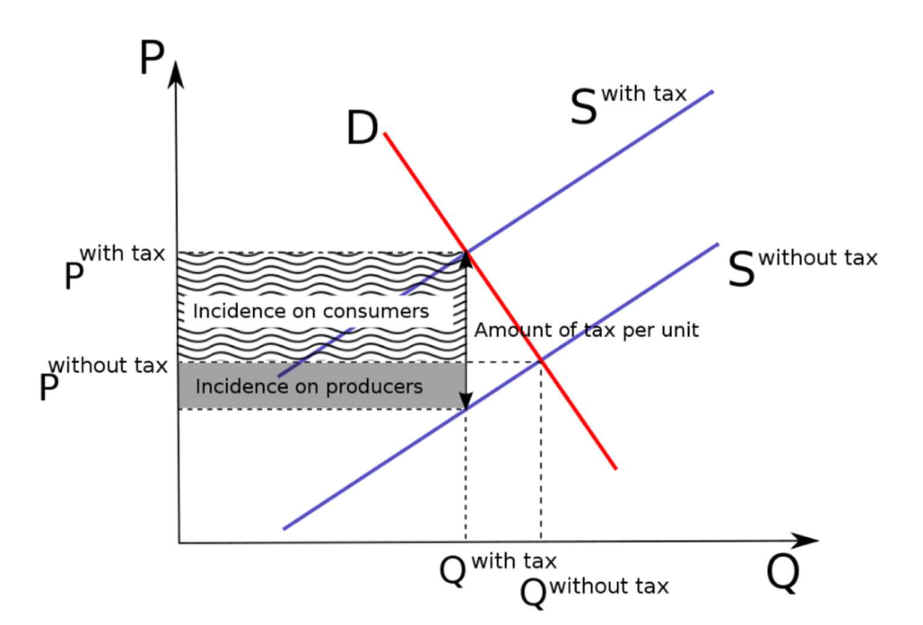

| F. Tax

Incidence Effects

PEDs, in combination with

price

elasticity of supply (PES), can be used to assess where the

incidence (or "burden") of a per-unit tax is falling or to

predict where it will fall if the tax is imposed. For example, when

demand is perfectly inelastic, by definition consumers have no

alternative to purchasing the good or service if the price increases, so

the quantity demanded would remain constant. Hence, suppliers can

increase the price by the full amount of the tax, and the consumer would

end up paying the entirety. In the opposite case, when demand is perfectly

elastic, by definition consumers have an infinite ability to switch

to alternatives if the price increases, so they would stop buying the

good or service in question completely—quantity demanded would fall to

zero. As a result, firms cannot pass on any part of the tax by raising

prices, so they would be forced to pay all of it themselves.[38]

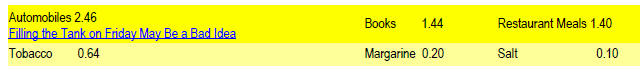

More generally, then, the higher

the elasticity of demand compared to PES, the heavier the burden on

producers; conversely, the more inelastic the demand compared to

PES, the heavier the burden on consumers. The general principle is that

the party (i.e., consumers or producers) that has fewer

opportunities to avoid the tax.

In practice, demand is likely to be only relatively elastic or

relatively inelastic, that is, somewhere between the extreme cases of

perfect elasticity or inelasticity. ACDC Videos Tax Incidence Taxes on Producers Excise Tax

Practice

|

|