|

Chapter 11 Competing Macro Theories |

||

|

I. Capitalism Theories Overview 1 video II. Classical Economics 1 video III. Keynesian Economics 1 video IV. Classical v Keynesian 1 video V. Quantity Theory of Money 2 videos VI. Monetarism 3 videos |

VII. New Classical Economics 2 videos VIII. Supply-side Econ 3 videos IX. Market Fundamentalism 1 video |

|

|

Unit I Review Full employment was a norm of capitalism,

II. Classical Economics

2. Price-Wage flexibility

C. In France, John Baptist Say produced a very superior work on the subject of Political

Unit II Review

Say's LAW,

Supply created factor income to clear the market |

|

| |

| |

|

|

|

|

III. Keynesian Economics

A. The Great Depression discredited classical economics as equilibrium settled and stayed at high unemployment. B. John Maynard Keynes 1. Wrote The General Theory of Employment, Interest, and Money (1936). 2. Disagreed with Say's Law: savings may not be invested. a. Interest rates are not the sole determinate of savings and investing. b. Saving and investment are done by different people with different motives. Saving may not equal investment causing goods to go unsold and inventories to increase. c. Saving is based upon "liquidity preference," the need to hold money 1) Transactionary Motives: for every day use. 2) Speculative Motives: save because prices may drop (Japan in late 1990's). 3) Precautionary Motives: save for uncertainty (recession, oil prices). d. Investment decisions are based upon profit expectations and interest rates e. Money balances (savings) are also important in determining aggregate demand. |

||

|

3.

Disagreed

with Price-Wage Flexibility: that prices would adjust downward insuring all resources are fully employed. Great Recession data proved Keynes still correct. see wage growth and unemployment, wages did not adjust. 7/16/13, Global Economic Intersection and Why are wages sticky 4. Use deficit spending to stop recessions with a surplus to slow inflation with budget balanced over cycle. 5. Keynesian Thinking Kahan Academy video

Unit III Review

Equilibrium could settle and stay

at high unemployment |

|

Keynes argued against a return to the |

|

IV. Classical vs. Keynesian

Equilibrium

A. Classical explanation 1. Prices are flexible, output is stable. 2. Changes in AD cause prices to change, AS determines Real GDP. |

|

| B. Keynesian explanation 1. Output adjusts, prices are stable. 2. Changes in AD cause changes in employment and Real GDP. |

|

| C. Aggregate supply over the

business cycle 1. QU represents a recessionary level of Real GDP. 2. QF represents a full-employment level of Real GDP. 3. Aggregate supply - Wikipedia |

|

| D. Manipulating equilibrium 1. Classical economists didn't see a need as Real GDP was fixed.. 2. Keynesian economists want to manipulate AD by changing C + I + G + XN to maintain noninflationary full employment. 3. Aggregate demand - from Wikipedia has a more complete explanation of the Keynesian view. |

|

|

E. Comparing Classical and Keynesian macro models 1. Classical and Keynesian Economics is a concise narrative of this material. 2. Aggregate Spending Model from Dr. Barbara Mikalson, Rio Hondo College 3. Elmer G. Wiens: Classical & Keynesian AD-AS Model - An on-line, interactive model of the Canadian Economy. 4. Khan Academy Keynesian vs. Classical Economics video

Unit IV Review

V. The Quantity

Theory of Money

4. Classical theory stated that V was basically stable and 1. If V Picks-Up, Will Inflation Soar 9/27/20 2. Equation Video and Velocity of Money Rather Than Quantity- Diving Prices< 3. Quantity Theory of Money? is a concise narrative. 4.Quantity theory of money - Wiki requires algebra. 5. The money-inflation connection: It's baaaack! 6. Debt-Deflation from Irving Fisher was popular in the early 1930's though Keynes won. Revisited because of the Great Recession 7. Monetary theory is non ergodic as data can't be averaged.

Unit V

Review

Changes in the money

supply would |

The US velocity of money keeps drifting lower. A unit of credit expansion is generating an increasingly smaller amount of economic growth.

Editors Note:

|

|

|

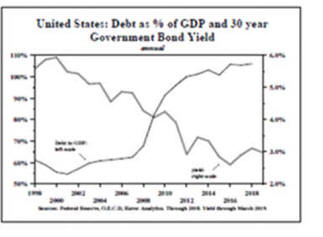

Why Debt Won’t Spark Inflation Government Debt Has Not Affected Yields

|

|

VI.

Monetarism

A. Monetarists believe that changes in the money supply are both a necessary and sufficient condition to cause inflation. B. If AD was low, increasing the money supply would only increase short-run economic activity. 1. Eventually short-term expansion stops and increasing M only adds to inflation. 2. Public anticipation stops the process from being repeated. 3. Monetarists believe that government involvement in the economy, especially monetary intervention, increases the magnitude of the business cycle. C. Keynes believed changing the money supply would affect interest rates which would affect investment which in turn would affect Real GDP D. To some degree monetarism is an extension of classical economics. Its advocates believe that a competitive market, free from government interference, results in economic stability and a reasonable growth rate.

F. Videos Unit VI. Review: Changes in the money supply are both a necessary and sufficient condition to cause inflation. E. Extra Stuff 1. The Concise Encyclopedia of Economics 2. History of Economic Thought Website 3. Privatize the Gains, Socialize the Losses is a concise history of our 20th century monetary system. 4. Austrian School of Economics are monetarists whose theories are followers by conservative Europeans. Video 1 Video 2 5. Modern Monetary Policy vs. The Austrian Society video 6. Inflation, Fear of Inflation an Public Debt Video Princeton professor and Nobel Laureate Christopher A. Sims 9/2/14 7. Bill Mitchell Demystifies Modern Monetary Theory

VII. New Classical Economics

Unit VII Review

Market forces not government manipulation

of AD

IX.

Markets Fundamentalism

|

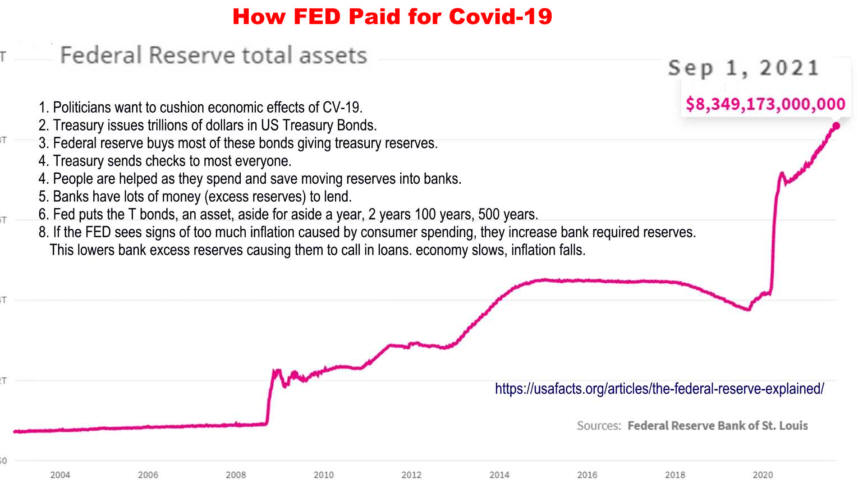

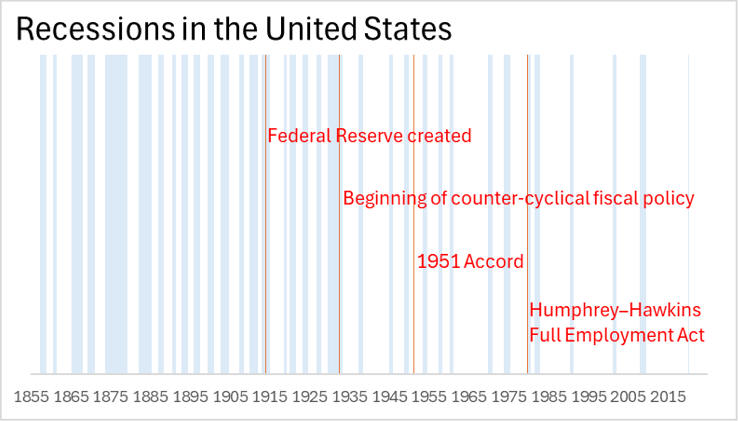

Federal Reserve in Action

Macro Chapters 8) Measuring Total Economic Activity 11) Competing Macro Theories and Issues 11) Competing Macro Theories and Issues 12 Keynesian Economics: An Expanded View

13 Money, Banking, Creation of Money

16)

Stagflation:Rise of Supply-Side Economics

|

|

|

|

|

|

|

XIII. Additional Learning Materials

A. Readings, Videos, Podcasts 1. Reconciling Hayek and Keynes short article 6/7/14 2. GDP A Brief But Affectionate History 7/20/14 3. Democratic Capitalism vs. Capitalistic Democracy 4. History of New Keynesianism/ 5. How Laissez Faire Economics Lead to Inequality Recession 6. Stagflation and the Rise of Supply-Side Economics: the brake-down of the Phillips curve. 7. Progression of Economic Theory, Classical to Keynesian back to Classical 8. Great Recession from a Classical-Keynesian View from Roger Farmer Pepperdine School of Public Policy a. Who are the Academic Scribblers 9.11 b. Refining Classical Economics 9.29 c. Effect of the Great Depression 9.14 d. 1970's oil shock shocks the world of economics 8.52 e. How bad is the economy and where is it going 7.41 9. Crash Course in Non-Equilibrium Economics 6 videos 10. Macro Musings Podcast Claudio Borio one hour B. Current Political Economic Controversies has an interesting economics section. |

|

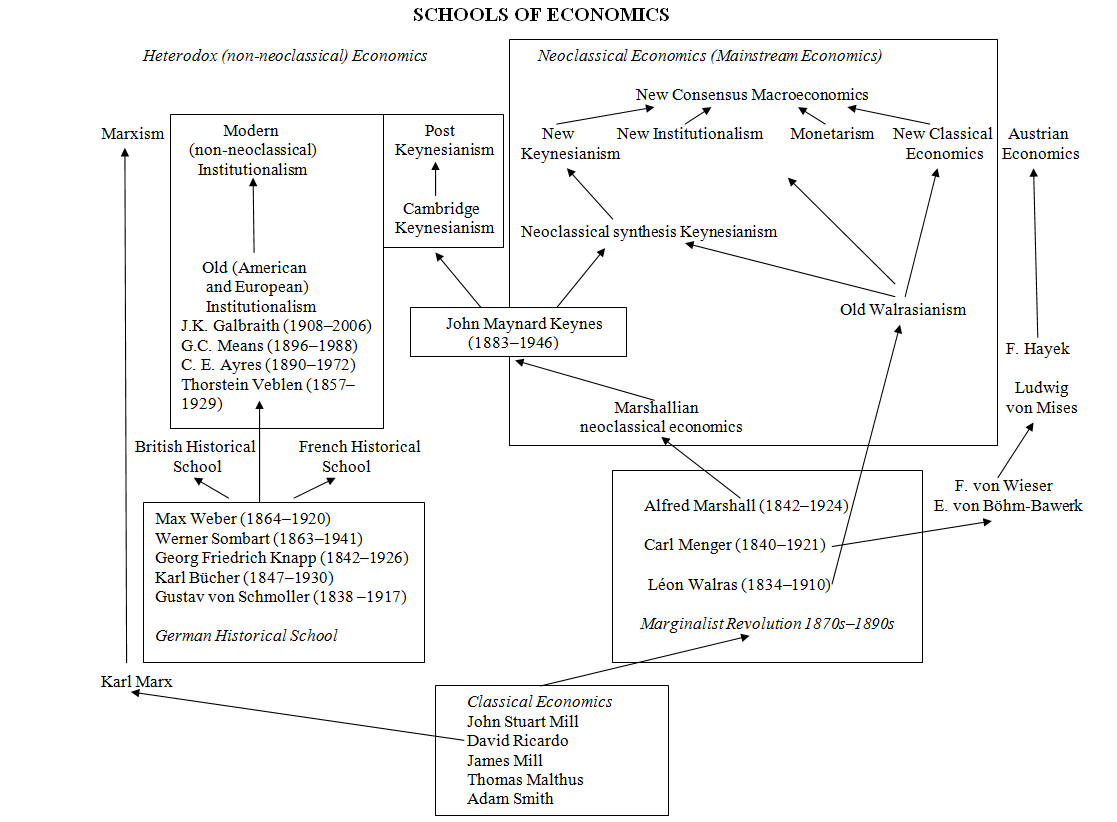

XIV. Schools of Economics Flow Charts

Western Political Economy Since 1843

| Last Chapter | Next Chapter | ||

| Chapter 11 Class Discussion Questions | Table of Contents | ||

| Chapter 11 Homework Questions | Economics Internet Library |