|

Author's Comments will be

in red.

Good luck with coming up

with an answer. We know what Joe Six-Pack watches on TV but not how well he lives.

A stratified random sample of those on a few programs by the GAO or the CBO

please.

Massachusetts did a study but I didn't keep it.

|

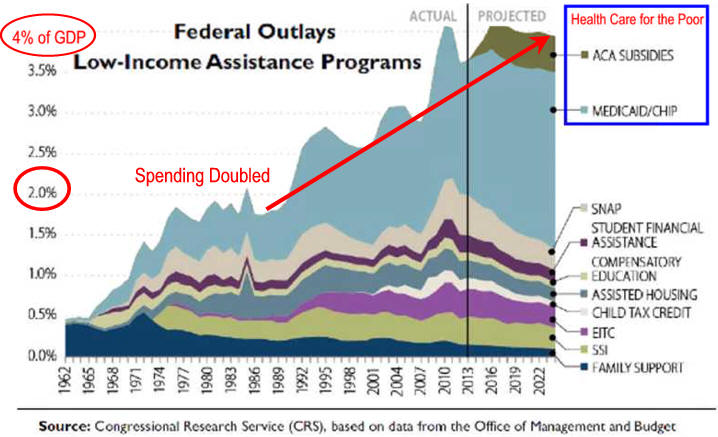

The federal government devotes roughly one-sixth of its

spending to 10 major means-tested programs and tax credits, which

provide cash payments or assistance in obtaining health care, food,

housing, or education to people with relatively low income or few

assets. Those programs and credits consist of the following:

- Medicaid,

- The low-income subsidy (LIS) for Part D of Medicare (the part of

Medicare that provides prescription drug benefits),

- The refundable portion of the earned income tax credit (EITC),

- The refundable portion of the child tax credit (CTC),

- Supplemental Security Income (SSI),

- Temporary Assistance for Needy Families (TANF),

- The Supplemental Nutrition Assistance Program (SNAP, formerly

called the Food Stamp program),

- Child nutrition programs,

- Housing assistance programs, and

- The Federal Pell Grant Program.

As shown in this report and an accompanying infographic,

in 2012, federal spending on those programs and tax credits totaled

$588 billion. (Certain larger federal benefit programs, such as

Social Security and Medicare, are not considered means-tested programs

because they are not limited to people with specific amounts of income

or assets.)

Total federal spending on those 10 programs (adjusted

to exclude the effects of inflation) rose more than tenfold—or by an

average of about 6 percent a year—in the four decades since 1972 (when

only half of the programs existed). As a share of the economy, federal

spending on those programs grew from 1 percent to almost 4 percent of

gross domestic product (GDP) over that period. (For ease of

presentation, this report frequently uses the term “programs” to

encompass both the spending programs and the tax credits.

|