Poverty Rate Flat for Fifty Years

Poverty Down 14.2% Points Over Fifty Years

See Source Editors Comments are in red.

|

Current US Political

Economy Problems

Is Enough

Done for the Poor? |

|

Poverty Rate Flat for Fifty Years |

Poverty Down 14.2% Points Over Fifty Years |

|

|

|

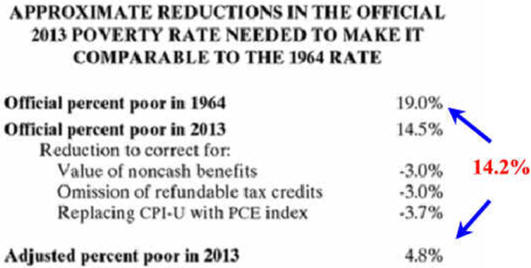

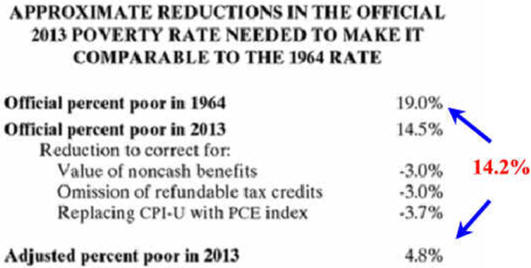

| This chart "...provides a first approximation of how correcting the 2013 poverty rate for noncash food and housing benefits, refundable tax credits, and not using the upward [inflation] bias of the CPI-U would change the 2013 poverty rate. This adjusted poverty rate falls from 14.5 to 4.8 percent, making the 013 rate roughly a quarter of the 1964 rate (19.0 percent). |

If we were to lower the poverty threshold

for cohabiting couples to match that for married couples the 2013 poverty

rate would have fallen even more."

Examples of noncash benefits include food stamps SNAP),

discounted school lunches, subsidized rent, Medicaid, and Medicare. See Source Editors Comments are in red. |

| B. Is Poverty a Condition or a Position? | |

| Observations Growing up in a rural 1950's Massachusetts | |

|

Conditions

Elderly lived with their children, few had health

insurance or much income. |

Position

Almost all people benefited economically

after WW 2, |

| Retiring in rural 2003 Central Florida I observed | |

|

Conditions Elderly live on their own with Medicare and improved SS. Poor families lived in older lowland house or trailers. Poor Children many have an obesity a problem, most finish HS, try college, go into one of many services industries and live at home. |

Position Poverty Rate Stuck is stuck at 15%, but this measure ignores the safety net,

Liberals misuse poverty data |

|

We will need a safety

net until everyone has a Star Track Type Replicators Even then some will lament because only the rich have a transporter. |

|

|

source federal safety net.com |

|

|

|

Are SS and Medicare Liars, Dame Liars and Statisticians This data shows a tremendous increase in our safety net spending but there are two problems. Total spending is not adjusted for inflation which has been was very high in the 1970's and high the rest of the century. Also using appropriate techniques shown above yields a drop in poverty to 4.8%. The More Relevant Question is why isn't the CBO providing and publicizing basic data using appropriate methods to judge specific issues. The CPI-U is an all-purpose index that is very often updated but it is inappropriate for long-term comparisons. Instead liberals use one set of data and conservatives use another set of data. Both are true but do not communicate the truth. |

||

|

Food for Thought |

|

|

And the Answer Is? U.S. Government Defined Poverty from Distributing Income may help with your answer. A Relevant Question How has the lifestyle and wellbeing changed for the bottom decile? See Economic Wellbeing |

"...shows that government transfer payments to individuals approximately doubled, rising from about 7% of GDP in 1970 to nearly 15% in 2014. These transfer payments primarily redistribute income through various social programs, including disability and unemployment insurance, Medicare and Medicaid, and food stamps. As such, these transfers should disproportionately benefit households in the bottom 80% of the income distribution." Rising Income Inequality |

| Editors Note: I am really annoyed at those on either side of an issue that should know which statistics are misleading but are interested in personal gain. Human prejudice for a particular idea causes many to easily accept any data that supports their prejudice. Example is education. Many use the average income of those with a Bachelor's degree as a reason of everyone going to college when the much lower median income of those with just a | bachelor's degree is much more meaningful when considering college for everyone. In addition, STEM majors have always had the highest economic investment return but only recently has this fact been getting publicity. Please e-mail suggestions to antonw@ix.netcom.com |

|

Another Relevant Question

What if people reporting all these people, especially children who are supposedly staving are basing there numbers on the official rate that does not include food stamps and help paying for school lunches? Do you think they do it so you will donate to their nonprofit program to help the poor? To get elected? Have you ever checked out salaries at guidestar.org. See For Poorer and Richer NYT 3/14/15 Source textbooksfree.org/Current U.S. Political Economy Controversies1A

|