|

A

Concise History of U.S.

Banking |

|||

|

|

|||

|

1791 First

Bank of the

United States was funded by taxes and supported by Northern

merchants, but not Secretary of State

1816 Second Bank of the United States, charted due to

difficulty financing the

War of 1812 and inflation,

1901 Panic resulted when the first NY Stock Exchange crashed as

financiers struggled

1907 Bankers'

Panic occurred

when the

New York Stock

Exchange

fell close to 50%,

J. P. Morgan

1920-21 Post War Recession

Government agencies released their controls of businesses,

1929 The Great Depression

was a severe worldwide economic depression that began sudden and

1981-82 Recession was severe

and occurred when the Federal Reserve to began lowering inflation

1980's and 1990's S&L Crisis

saw 747 failures at a cost of

$160 billion($125 billion was a

government bailout).

2000s

A

2007-2009 Great Recession

began in the US and spread to much of the industrial world.

|

|||

|

3. History The First Bank of the United States was chartered for 20 years by the United States Congress in 1791. Officially proposed by Alexander Hamilton, Secretary of the Treasury, to the first session of the First Congress in 1790, the concept for the Bank had both its support and origin in and among Northern merchants and more than a few New England state governments. "The tendency of a national bank is to increase public and private credit. The former gives power to the state for the protection of its rights and interests, and the latter facilitates and extends the operations of commerce amongst individuals." Neither Secretary of State Thomas Jefferson nor Representative James Madison had any particular interest in the chartering of the Bank of the United States or a proposed mint. They believed the South would not benefit from either a central mint or bank as these were mostly to the benefit of business interests in the commercial north. They didn't like Hamilton's desire to increase the excise tax on imported and domestic spirits to pay for the bank. Southern congressmen feared the tax burden would fall disproportionately heavily on the South, where, declared Jackson, 'hard liquor was a necessity of life'.

After Hamilton left office in 1795, the new Secretary of the Treasury Oliver Wolcott, Jr. informed Congress that more money was needed. Selling the government's shares of stock in the Bank, or raising taxes was the choice and Congress quickly, above Hamilton objection, agreed. The bank's charter expired in 1811. First Bank of the United States

Red is editor's opinion

Second

Bank of the United States and

ANDREW

JACKSON fights the Bank of the U.S.

Andrew Jackson and the

Bank war - from Tony D'Urso

See

Panic of 1857 The Second Bank of the United States was chartered in 1816 resulted because of the U.S. had experienced severe inflation and had difficult financing the War of 1812. . Subsequently, the credit and borrowing status of the United States were at their lowest levels since its founding. The Bank of the U.S. was in no sense a national bank but rather a privately held banking corporation. The bank's relationship with the federal government that gave it access to substantial profits. Its role as the depository of the federal government's revenues made it a political target of banks chartered by the individual states. partisan politics highlighted the debate over the renewal of the charter. "The classic statement by Arthur Schlesinger was that the partisan politics during the Jacksonian period was grounded in class conflict. Viewed through the lens of party elite discourse, Schlesinger saw inter-party conflict as a clash between wealthy Whigs and working class Democrats "(Grynaviski) President Andrew Jackson strongly opposed the renewal of its charter, and built his platform for the election of 1832 around doing away with the Second Bank of the United States. Jackson's political target was y the very wealthy Nicholas Biddle, financier, politician, and president of the Bank of the United States. Apart from a general hostility to banking and the belief that specie (gold and/or silver) was the only true money, Jackson's reasons for opposing the renewal of the charter revolved around his belief that bestowing power and responsibility upon a single bank was the cause of inflation and other perceived evils. The Second Bank of the United States thrived from the tax revenue that the federal government regularly deposited. Jackson struck at this vital source of funds in 1833 by instructing his Secretary of the Treasury to deposit federal tax revenues in state banks, soon nicknamed "pet banks" because of their loyalty to Jackson's party. The Second Bank of the United States was left with little money and, in 1836, its charter expired and turned into an ordinary bank. Five years later, the former Second Bank of the United States went bankrupt. Click Panic of 1819 was the first major financial crisis in the United States. It occurred because the Embargo Act and War of 1812 had caused widespread foreclosures, bank failures, unemployment, and a slump in agriculture and manufacturing. Economists who adhere to Keynesian economic theory suggest that the Panic of 1819 was the early Republic's first experience with the boom-bust cycles common to all modern economies. Austrian school economists view the nationwide recession that resulted from the Panic of 1819 as the first failure of expansionary monetary policy. Proposed remedies included increase of tariffs (largely proposed by Northern manufacturing interests), reduction of tariffs (largely proposed by Southerners, who believed free trade would stimulate the economy and increase demand), monetary expansion; i.e., restriction or suspension of specie payment, rigid enforcement of specie payment, restriction of bank credit, direct relief of debtors, public works proposals, stricter enforcement of anti-usury laws. http://en.wikipedia.org/wiki/Panic_of_1819

Panic of 1837

was a financial crisis caused

speculative fever.

The bubble

burst in 1837 NY City when every bank

began to accept payment only in

specie

(gold

and

silver

coinage).

Economic

policy of both the previous

administration of Andrew Jackson and

recently elected current administration

of Martin Van Buren, were blamed as

well as bank excesses. Within

two months the losses from bank failures

in New York alone aggregated nearly $100

million. "Out of 850 banks in the United

States, 343 closed entirely, 62 failed

partially, and the system of State banks

received a shock from which it never

fully recovered." The publishing

industry was particularly hurt by the

ensuing depression. According to most

accounts, the economy did not recover

until 1843.

Most economists also agree that there

was a brief recovery from 1838 to 1839,

which then ended as the Bank of England

and Dutch creditors raised interest

rates.

However, economic historian

Peter Temin has argued that, when

corrected for deflation, the economy

actually grew after 1838. Panic of 1857 was brought on mostly by the people's over-consumption of goods from Europe to such an extent that the Union's Specie was drained off, overbuilding by competing railroads, and rampant land speculation in the west.. The recession ended a period of prosperity and speculation that had followed the Mexican-American War (1846-1848) and the discovery of gold in California. Gold poured into the economy causing inflated. After a large increase in state banks in the early 1850's, by July 1856, state banks began to lend far more money than they could back up in specie even as deposits began to fall. The panic began with a loss of confidence in an Ohio bank, spread as railroads failed, and fears that the US Federal Government would be unable to pay obligations in specie. More than 5,000 American businesses failed, the stock market declined by 66% compared with inflation, and unemployment resulted in urban protests. An October bank holiday was declared in England and New York to avert runs on those institutions. The Tariff Act of 1857 reduced the average tariff rate to about 20%. Written by Southerners and supported by most economic interests nationwide, except for sheep farmers and some Pennsylvania iron companies, it had the effect of removing the tariff issue as a major source of North-South contention. The South was much less hard-hit than other regions, because of the stability of the cotton market. No recovery was evident in the northern parts of the United States for a year and a half, and the full impact did not dissipate until the American Civil War. Panic/Depression of 1873-1879 began when the he post civil war rail road boom ended and the passage of the Coinage Act of 1873, which took the United off a bimetallic (gold and silver) money standard. The immediate effect was to depress silver prices which hurt Western mining interests, who labeled the Act "The Crime of '73." It also reduced the domestic money supply raising interest rates and hurting farmers and other large debtors. The resulting outcry created the fear of an unstable money supply and investor shunned bonds and other long-term obligations. This lack of confidence in bonds slowed the railroad boom and exacerbated the economic situation. For example, Jay Cooke & Company, a major component of the United States banking establishment, cancelled plans for a second transcontinental railroad as two major funding sources disappeared. In 1873 he was unable to market several million dollars in Northern Pacific Railway bonds and lost out on a $300 million government loan as reports circulated that his firm's credit was worthless. The firm declared bankruptcy in September of 1873.The failure of the Jay Cooke bank, followed quickly by that of Henry Clews, set off a chain reaction of bank failures and temporarily closed the New York stock market on September 20 for 10 days. Factories began to lay off workers and the effects of the panic were quickly felt in New York, more slowly in Chicago, Virginia City, Nevada and San Francisco. Of the country's 364 railroads, 89 went bankrupt. A total of 18,000 businesses failed between 1873 and 1875. Unemployment reached 14% by 1876. Construction work halted, wages were cut, real estate values fell and corporate profits vanished. See Panic of 1873 |

Panic of 1907, known as the 1907 Bankers' Panic, was a financial crisis that occurred when the New York Stock Exchange fell close to 50% from its peak the previous year. There were runs on banks and trust companies. Many state and local banks and businesses entered into bankruptcy. New York City bank liquidity problems, loss of confidence among depositor, exacerbated by unregulated side bets at bucket shops caused the panic. The crisis was Triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company, lending banks suffered runs that later spread to affiliated banks and trusts, leading a week later to the downfall of the Knickerbockers Trust Company—New York City's third-largest trust. The collapse of the Knickerbockers spread fear throughout the city's trusts as regional banks withdrew reserves from New York City banks. Panic extended across the nation as vast numbers of people withdrew deposits from their regional banks. Industrial production dropped further than after any bank run before then, while 1907 saw the second-highest volume of bankruptcies to that date. Production fell by 11%, imports by 26%, while unemployment rose to 8% from under 3%. Immigration dropped to 750,000 people in 1909, from 1.2 million two years earlier. The panic may have deepened if not for the intervention of financier J. P. Morgan, who pledged large sums of his own money, and convinced other New York bankers to do the same, to shore up the banking system. At the time, the United States did not have a central bank to inject liquidity back into the market. By November the financial contagion had largely ended, yet a further crisis emerged when a large brokerage firm borrowed heavily using the stock of Tennessee Coal, Iron and Railroad Company (TC&I) as collateral. Collapse of TC&I's stock price was averted by an emergency takeover by Morgan's U.S. Steel Corporation—a move approved by anti-monopolist president Theodore Roosevelt. A commission investigation lead to the Federal Reserve System See Panic_of_1907 Panic of 1893 was a serious economic depression in the United States because of railroad overbuilding and shaky railroad financing which set off a series of bank failures. Compounding market overbuilding and a railroad bubble was a run on the gold supply and a policy of using both gold and silver metals as a peg for the US Dollar value.

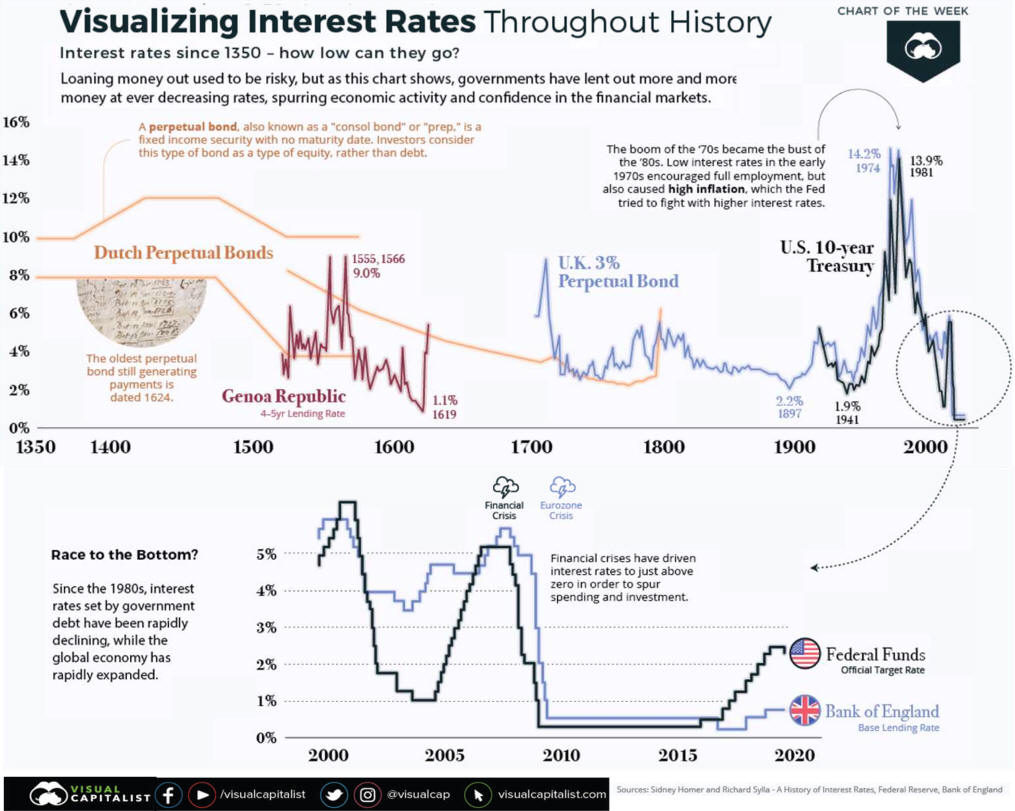

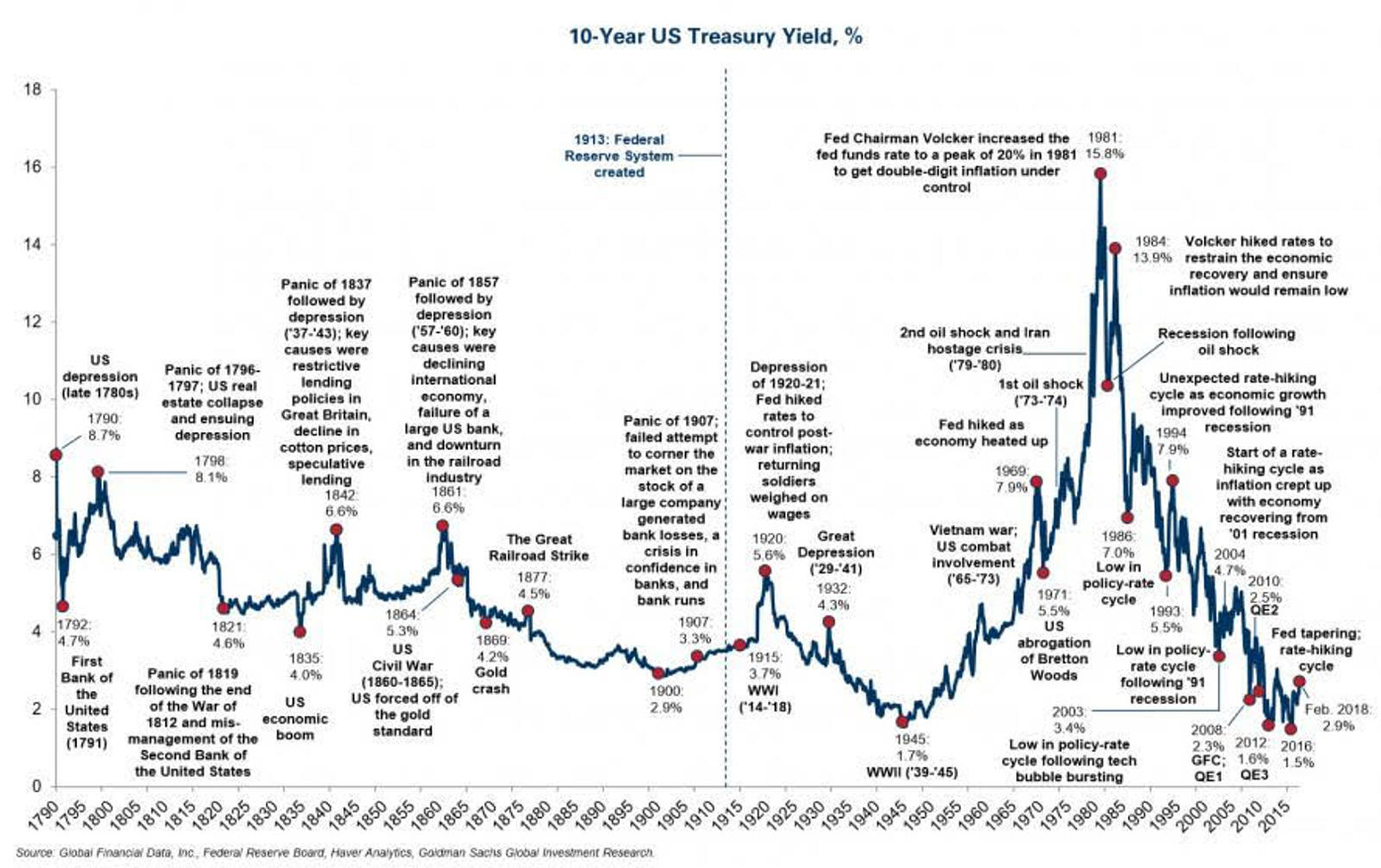

Consider by some as a mistakes in Federal Reserve policy as a key factor in the crisis. In response to post–World War I inflation the Federal Reserve Bank of New York began raising interest rates sharply. In December 1919 the rate was raised from 4.75% to 5%. A month later it was raised to 6%, and in June 1920 it was raised to 7% (the highest interest rates of any period except the 1970s and early 1980s). Depression of 1920-21

1980s and 1990s S&L crisis was the failure of 747 S&Ls aka thrifts that cost about $160 billion, of which about $125 billion was paid for by a US government bailout. Causes included the Tax Reform Act of 1986 which removed many real estate tax shelters thus decreasing real estate values tied to said shelters, the deregulation of S&Ls which gave them many of the capabilities of banks, without the same regulations as banks, the "moral hazard" of insuring already troubled institutions who in order to improve liquidity, made unsound real estate loans on riskier assets, particularly land and a "asset-liability mismatch" at S & L's, who having made long-term loans at a fixed rate, found themselves borrowing at an ever increasing rate and needing riskier loans to cover these higher rates.

Stocks Up Wages Down- What Does It Mean

|

||

|

S ee 1. Causes of the savings and loan crisis2. Lessons from 1987 stock market crash Historical Insights Into Banking Competition 3. The bankers that define the decades: Jamie Dimon, JPMorgan Chase ( Euromoney ) |

|||

|

Expanding US Monetary Base: Question For The FED Law Coding and the Financial Crisis

|

|

|

The

Great Recession of 2007-2009 The latter had become fragile as a result of several factors that are unique to this crisis: the transfer of assets from the balance sheets of banks to the markets, the creation of complex and opaque assets, the failure of ratings agencies to properly assess the risk of such assets, and the application of fair value accounting. To these novel factors, one must add the now standard failure of regulators and supervisors in spotting and correcting the emerging weaknesses. By October 2009, the unemployment rate had risen from 4.9% to 10.1%. In March 2009, Blackstone Group CEO Stephen Schwarmzman said that up to 45% of global (stock market) wealth had been destroyed in little less than a year and a half. Home prices, which didn't move much between 1990 and 1997, dropped dramatically, have come back some, and are about twice their 1997(1990) value. The Great Recession of 2007-2009 triggered by the collapse of a specific kind of derivative, the mortgage-backed security derivatives, which were protected from regulation by some federal regulators who believed the free market could manage itself. The Austrian School of economics blamed "easy" credit-based money caused an unsustainable economic boom. Others blame the extremely indebted US economy. The failure rates of subprime mortgages were the first symptom of a credit boom tuned to bust and of a real estate shock. These low-quality mortgages acted as an accelerant to the fire that spread through the entire financial system. The latter had become fragile as a result of several factors that are unique to this crisis: the transfer of assets from the balance sheets of banks to the markets, the creation of complex and opaque assets, the failure of ratings agencies to properly assess the risk of such assets, and the application of fair value accounting. To these novel factors, one must add the now standard failure of regulators and supervisors in spotting and correcting the emerging weaknesses. By October 2009, the unemployment rate had risen from 4.9% to 10.1%. In March 2009, Blackstone Group CEO Stephen Schwarmzman said that up to 45% of global (stock market) wealth had been destroyed in little less than a year and a half. Home prices, which didn't move much between 1990 and 1997, dropped dramatically, have come back some, and are about twice their 1997(1990) value. /Late 2000's recession

“How Coronavirus Almost Brought Down

"... the fact that the treasury market, Folks at the Fed were most concerned with a general collapse of confidence that was as serious and as rapid as we've probably ever seen. It's clear that people had been worrying about the news out of China throughout February, but they'd been thinking about what a hard landing in China would do to the world economy. At the end of February the Italian lockdowns made people begin to realize that we were in a global pandemic. The entire global economy may be suffering a hard landing. The result was a flight into dollars with pressure on everyone both in the United States and outside to meet their dollar funding needs. One need was to buy Treasures — a typical flight to quality with interest rates going down. But by mid March, even the treasury market was having problems as people were selling everything including Treasuries to get into cash so interest rates began going up rather. than down. In other words, prices are going down because people are trying to sell them for cash. This counterintuitive move indicated the extent of financial system stress and it drove the Fed to lead mammoth bond and asset buying binge. Recent came the extraordinary extension of backstops to all sorts to private credit markets. Source 6/1/20 adam-tooze-dollar-dominance-eurozone-and-future-global-finance

See

Quick Notes:

The

Great Recession

Late

2000's recession

The rise of asset manager capitalism and the financial crisis of 2008

|

|

|

Expanding Monetary Base: Question for FEDS

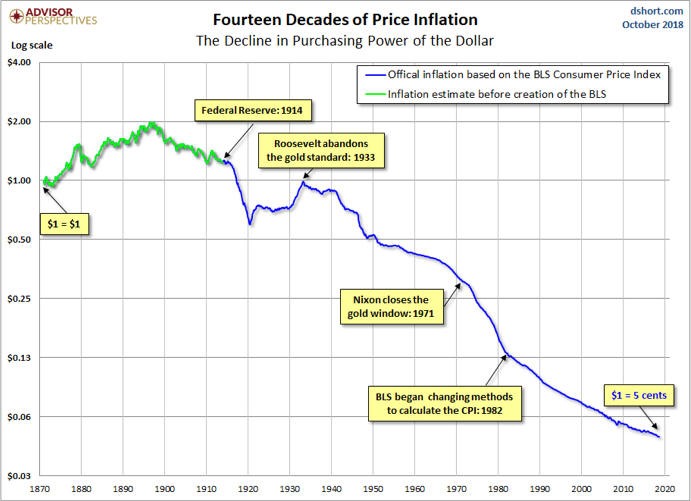

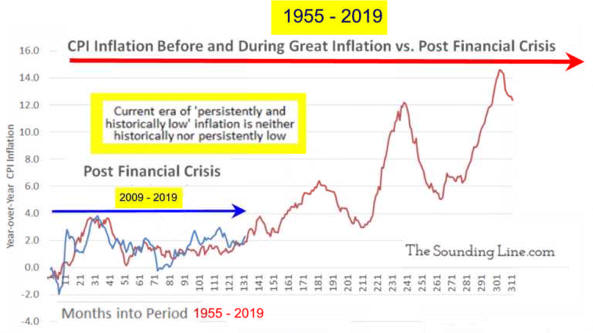

Central bankers belief we have ‘historically and persistently low inflation,’ ignore that Inflation was actually lower during the decade that proceeded the ‘Great Inflation ’ of the 70's and 80's. From 1955 through 1965 CPI inflation averaged just 1.5%. From 2009 through 2019 CPI inflation has averaged 1.8%. Today’s ‘low’ inflationary environment has not been historically low or long. Technological advancements do not automatically mean low inflation growth.

FED chair Jerome Powell feel that inflation is historically and persistently low, that the return of interest rates and inflation to 0% is inevitable, and this is the “greatest monetary policy challenge of our time.” He is wrong! Inflation remained lower for longer in the past and the last increase was a 20 years of disruptively high inflation. Low inflation has not been an impediment to growth. Nearly the entire 19th century saw rapid technological advancement, industrialization, and general economic growth despite outright mostly deflation. The high growth 1950s and 1960s witnessed lower inflation than today. Growth is not dependent on a PCE of 1.6% to 2.0%. Reaching these goals at any cost is not appropriate PCE inflation target, especially those that do not have control of the currency. Central Bankers believe today’s roughly 2% real GDP growth rate to be inline with long term potential and still they expand the monetary base to close a 0.4% shortfall in PCE inflation. This process may end the way it did last time when we had the "Great Inflation." Or maybe our inaccurate inflation measures is understating today’s true inflation rate and maybe the low inflation has not been an impediment to growth. Nearly the entire 19th century saw rapid technological advancement, industrialization, and economic growth despite mostly outright deflation. The high growth 1950s and 1960s also witnessed lower inflation than today |

|

The Code of Capital:

Law Coding

Summary

and

the Financial Crisis |

|

Legal System Design foster bubbles Application 2: Debt and the Financial Crisis

Preface: Legal Coding of financial assets

Legal System Design foster bubbles 1. Legal Privilege Attributes Conferred on Financial Assets

Priority:

rank order,

asset A is stronger than asset B

Durability:

a hierarchical

ranking limiting counterclaims

Convertibility: securing

past gains by assigning or flipping to a safer asset

Universality:

extending

attributes to space:

2. Legal Tools

3. Modern Legal Institutions

|

|

|

After the 2008-9 financial crisis

Katharina Pistor

formed a group to analyzed what happened. Backing of state power

was the essential building block of the endless supply of

legally created complex financial commitment. The states is deeply involved in the creation of

legal privilege at every level of all markets. How private

parties use the coercive |

|

Globalization has evolved the legal sphere of private actors who can now pick and choose from two legal systems of England , New York state, and for corporate law you can add Delaware. Most financial assets are coded in one of the legal systems and are managed by the top 100 law firms. All have angel Saxon names, many merged with European and Japanese firms and all are located in NY. Private individuals

can easily avail themselves of State Power to enhance mostly

their own private wealth with little concern for the public

good. Lawyers of these firms are masters of the financial code which is designed not for economic efficiency but to control, about power.

Foreign courts provide vindication to protect property

interests. This interferes with the ability of a society to

seek and govern A balanced approached related to

all assets is required. We need a balance between private autonomy with

the prerogative of legislature- |

|

Law Flexibility The plantation with slaves could now be sold at auction to satisfy creditors. Not until 1925 did England complete property rights. Property rights development was a

political process and not always the same in countries A and

B. But this flipping could cause problems.

In medieval England, the

legal power structure consisted of lawyers who were mostly

noblemen and relegiouse leaders. This power structure "frames" the law. Over time, property rights associated with land could be transposed. Think moved like in sold. Being politically desirable, this right was backed by the state, think king. It was declared legal and defended by state coercion. Think Obama declaring that the priority rights of secured creditors would be ignored and the Union pensions would be first to receive bailout funds. Think auto bailout. Think Trump blackballing those who do not cooperate with the United States policy

Economists believed that markets existed outside a legal

framework. The law helps and supports market structure but is

not essential.

In-depth analysis of credit default swap, collateralized debt

obligation, asset backed securities... revealed that everyone

trying to enforce The framework of law/economics needs to be scrutinized by the academy. Land, a piece of dirt, a field, ... began having a

property right during in the 16th century Feudal England. Land use was

such that when noble landlords The law had created a

priority right

which

allowing landlords to get the mortgages needed to commercialize the

land. Sheep herding expanded During difficult

times and to prevent client loss of their to creditor, Feudal lawyers created the

12th century

entail.

It was a kind of trust which made

Protection

of a property rights had been socialized.

Think late

20th century bank bailouts.

The law had created a durability right.

Sale and commercialization of the land had created convertibility. In protecting land owners from trespass, the law created universality.

Specifically, we have to limit the

flexibility of coding that occurs outside the legislature and increasing

outside the courts.

The concept of

numerus clausus

is the concept of property

law which

limits the number of types of right that the courts

We should not blindly

guarantee the

"enforceability of private rights," the punch bowl. We

might and we might not. Example: When

banks do not check the income and sustainability

of mortgage payments, these mortgages may not be

enforceable. When judges created feudal English

common law, they made political decisions which was not neutral

allocation of rights

Application 2: Debt and the Financial Crisis

In California the crisis began with a loan mortgage originated by New Century. They collected a bunch of mortgages and sold them wholesale to a New York located City Group subprime mortgage subsidiary. They put the mortgages into a trust which got the cash flow from mortgage payments irrespective of the City Group's and her subsidiaries finances. JP Morgan with be the trustee for this City Group trust and vice versa. This securitization began in the 1970's after the 1968 Federal Housing Act allowed government sponsored entities, Fannie Mai in particular, to securitize (group and sell) securitized mortgages. She had guaranteed mortgages and now while she could not to originate mortgages, she could buy them on the secondary market, package them, and sell the package. This securitization diversifies the risk, lowering interest rates, and increases mortgage availability. Freddie and Ginnie just put the mortgages into a pile and sold equal portions. Private companies soon followed but they created trenches (slices) with different priority rights. Seniors got cash in first and were last to incur a loss. Juniors tranches were second, third ...in the middle. People knew this and bought based on risk aversion.

Guaranteed pensions might always buy senior trenches. Fannie

also bought only senior securitized debt. In the book

example, To produce buyers City set up

a shell corporation located in the Carmen Island tax haven sell

mortgages tranches. This shell

solicited funds to invest in low level trenches from

different sellers to diversify risk They could then rate

some

|

How the U.S. Treasury avoided Chronic

Deutsche

Bank Said to Securitize Corporate Loans to Offload Risk (Bloomberg)

Deutsche Bank AG, under pressure to bolster its balance sheet before resolving

a U.S. mortgage probe, is working to securitize billions of dollars of corporate

loans to offload risk, according to a person with knowledge of the matter. The

bank is structuring the transaction as a synthetic collateralized loan

obligation, which means the firm would keep servicing loans while transferring

risk to investors, said the person, who asked for anonymity because the deal is

pending. Germany’s biggest bank has been doing similar deals for years to manage

risks from corporate lending, the person said.

Proposed Solutions is Under

Constructions

Deflation by Relinquishing Monetary

Control to Wall Street

2/17/17

Send thoughts to

antonw@ix.netcom.com

1)

Insurable interest required for

financial activities like selling short.

2) Flash trading made illegal

3) All activities involved with

financial markets be taxes as short or

long term investments.

4)

Ratio of total mortgages to total

value of U.S. housing stock

5) Average ratio to GDP of unsecured and mortgage bank credit refinancing?