|

U.S. Economic History 1900 -2017

Part 1 A New Century Brings Change

Part 3 Appendix |

|

Part 1 A New Century Brings Change |

|

|

Populists

End to the

Gilded Age

but

Business Power Would Return

After WW I.. The 1896

realigning election resulted in a republican forged conservative coalition

consisting of businessmen, professionals, skilled factory workers, and

prosperous farmers. There would be

opposition which created two unsettled decades called the |

1)

The 1898

Spanish–American War

victory resulted from our desires for a colonial empire and business interests.

Business also had pushed for the 1897

Dingley Tariff Act which promoted industry

at the expense of consumers as the tariff was added to the price paid by consumers. The

Gold Standard protected savers

but its inflexible money supply caused hard

times. 2) The Panama Canal acquisition of 1903 eventually resulted in improved transportation. 3) Progressive Republican FDR successfully fought party Trusts. First with the 1906 Meat Inspection Act and Pure Food & Drug Act. The Hepburn Act increased Interstate Commerce Commission regulation of Rail Road Trusts which still managed to control rates and competitors. 4) American Antiquities Act of 1906 created National Monuments and was one of many conservation activities. 5) Panic of 1907 needed help from both J.P. Morgan and the Treasury as more liquidity was needed than his wealth could provide. The 1913 the Federal Reserve System resulted and it became the Lender of Last Resort. Designed by Wall Street bankers the FED would continue under Wall Street's thumb until ... 2015 and counting! Think Great Recession. 6) Democrat Woodrow Wilson would continue progressive the agenda. The Revenue Act of 1913 substituted income taxes for lower tariffs and this lowered the price of consumer goods. The Federal Trade Commission Act of 1914 was a major effort to control business trusts. The Clayton Antitrust Act of 1914 outlawed specific conduct putting teeth into Sherman Antitrust Act. The Federal Farm Loan Act of 1916 increased credit to rural family farmers and the Keating–Owen Act of 1916 temporally lowered child labor abuses.. 7) Segregated government continued as Wilson was like progressives T Roosevelt and T Jefferson in that he felt Americans were not ready for integration. 8) Revenue Act of 1921 and Revenue Acts of 1924,1926,1928 reduced taxes so only richest 2% paid income taxes. Think 2 Bush tax cuts. The Fordney McCumber Tariff Act was one of many protectionist measures during the decade. Smoot–Hawley Tariff Act of 1930 to protect US industries failed to help as Canada, France and others retaliated. A Mexican Repatriation program help unemployed Mexican citizens return home. It represented forced migration. Think current immigration problems. 9) Great Mississippi Flood of 1927 resulted in the Flood Control Act of 1928. It created the U.S. Army Corps of Engineers to watch over public infrastructure.. 10) The 16th, 17th, and 19th amendments made some progressive policies permanent. |

|

Depression Brings Government Safety Net Hoover had trouble helping during the Great Depression. Tension increased when the U.S. Senate refused to agree with the House which had and move up the payment of a WWI veteran bonus. There was much distress from high unemployment. A 1932 Army of U.S, Veterans march on Washington for their bonuses. Trouble resulted. Over the years many have marched, some have died. FDR would bring change. Liberals around the world said socialism was the economic answer to depression. The Share the Wealth movement was founded by Louisiana Governor Huey Long was one of many liberal social activists seeking political power throughout the U.S. and Western Europe. He would later be assassinated.These activities would be countered by conservative banker and business leader oligarchs who backed Herbert Hoover’s use of laissez fair Classical economic policy. Hoover's first policy mistake was to follow the Republican party against his own beliefs of those of many economists. Signed the Smoot-Hawley Tariff Act caused many countries soon followed and the resulting decrease in world trade hurt everyone. The Federal Reserve tried to maintain the Gold Standard with two discount rates increase of 1 point each. Then there was the Revenue Act of 1932 which dramatically increased federal taxes. Both were right out of the Classical Economics toolbox. So was the $200,000,000 U.S. bank loans to keep Brittan on the Gold Standard. All efforts failed. Brittan went off the Gold Standard first followed the U.S. in 1933. The economy hit bottom in 1933 and spending printed money was the only way out of deflation which made existing loans more expensive in real terms and also made business less apt to borrow. Hover lost the 1932 election. as FDR promised to use liberal Keynesian economic government action to solve the continuing economic recession. |

His New Deal employment programs would be the first time U.S. government would use massive debt to solve a major non-military problem. Like the war debt from WWI and following wars, the debt would not be paid back. As debt was retired the funds came from new debt. Inflation and economic growth would ease the pain of interest payments. Major legislation included the Social Security Act which covered Old-Age, Survivors, & Disability Insurance, the Fair Labor Standards Act/1938 which set maximum work hours and minimum wages, the Agricultural Adjustment Act/1938 which provided fair price for farmers, and the Prohibition Discriminatory Employment related to federal employment .The Wagner Act along with other pro labor reforms were also passed. Conservative fought back using a conservative Supreme Court which declared some New Deal legislation illegal. The battle over Keynesian vs. Classical Economics continues today. Many conservatives do not mind government action and debt for military problems but disagree with Liberals who want to use debt to solve economic problems. Both oligarchies to date have not believed that cost effectiveness applies to their perceived governmental responsibilities. Politicians from both political parties act unhappy despite benefiting from an electorate that lives much better because of massive federal annual deficits. Also helping voters is the economic benefits of an annual balance of payments deficit amounting to $1,700 per person. The later represents cheap goods from abroad. Dollars accumulate and eventually return to the U.S. in the form of public and private US financial instruments, US travel and fixed assets. Voters let politicians buy their vote with these debts disliking all members of Congress but their own! After Germany invaded Poland starting World War II President Roosevelt asks the Congress for a defense budget hike and the United States declares its neutrality. Many wanted the U.S. to stay out of the war and just as many profited as U.S. loans to Europe,, Loans were spent with US companies that supplied war arms and food to belligerents. |

Members of the Bonus Army camped out on the lawn of the

Capitol

building |

|

Shacks that members of the

Bonus Army erected on the Anacostia Flats |

||

|

Willis C. Hawley (left) and

|

||

|

A 1936 impoverished American family living in a shanty. click to enlarge |

|

#1 Rising Income

WW 2 generated savings, pent-up demand and few foreign competitors. The result was 25 years of high profits, higher wages, and cooperative unions. Normality ended when Carter appointee FED Chairman Volker found higher interest rates were not enough so he lowered commercial bank reserves. This quickly pushed the Federal Funds Rate to 20%. Banks would not loan. Two recessions followed. The first cost Carter reelection and the second, though severe, was over before Reagan's reelected.

|

|

|

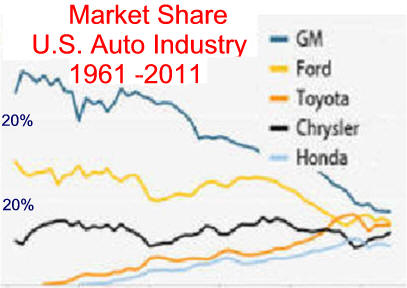

As if Watergate and the Cold War were not enough, an oil cartel called OPEC proclaimed an oil embargo. The embargo was targeted at nations perceived as supporting Israel during the Yom Kippur War. High Oil prices pushed Japan into more valued added exports like automobiles, machinery and computers. This competition caused a stagnate Rust Belt with lower wages and eventually lower employment. Japan's manufacturers got lucky from increased demand for gas efficient small green cars with catalytic converters. Detroit protected profit by seeking tariff protection. Investment needed to lower cost and increase product quality was ignored. Auto union leaders protected their positions. Current worker protected existing jobs and salaries by accepting a two-tier wage system. It minimized the need for new workers who would receive lower wages for a similar jobs. Feeling political pressure Japan built many modern U.S. plants often in the nonunion southern states offering the highest tax incentives. Use PDF for Color Printing. provided by textbooksfree.org |

|

New Normal #3 Philosophical Change Cause Financial Instability

During the 1980's,

U.S. and England Returned to Conservative Lax Business Regulation. |

From Financial Crisis to

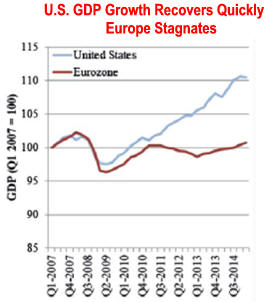

Recession to Great Recession 1. 2007-8 Financial Crisis was tamed by the Federal Reserve. 2. 2008-9 Recession was tamed by monetary and fiscal policy. 3. European financial instability and world-wide austerity slowed economic recovery which added to slow secular income growth for all but the very, very, very wealthy. Think top 1/10th of one-percent. 4. Great Recession Recovery Has Varied Around The World |

||

|

1980 Depository Institutions Deregulation and Monetary Control Act

began a return to

Conservative Business Regulation caused by

adverse voter reaction to increased government regulation and welfare

spending.

Think Great Society and lax derivative regulation. |

1986

Big Bang deregulated London's financial services

industry. Other followed. 1999 Gramm–Leach–Bliley Act Increased Systemic Financial Risk limited by the Glass-Steagall Great Depression Act. passed by a Republican majority and signed by President Clinton. Think financial industry expansion. See Five Bad Bush/Clinton Policies 2004 Uptick short rule of 1938 rescinded. Think stock market gambling. 2006 FASB requirement that housing assets be mark-to-market lowered financial system collateral. Action resulted from a 1991 Government Accountability Office investigation of $160,000,000,000 savings and loan crisis bailout. Think moral hazard. Neoliberalism Capitalism

2007 Uptick Short Rule of 1938 rescinded. |

||

|

4 Financial Bailouts and Economic Recovery Bailout History The $700 financial-sector billion 2008 rescue plan is the latest of many bailouts that go back to the Panic of 1792 when the federal government bailed out states over-burdened by their Revolutionary War Debt. Thereafter private banks and investment bankers took over financial bailouts until the Panic of 1907 when the economy was so big that even J.P. Morgan needed U.S. Treasury help. This led to the 1913 Federal Reserve System designed to be the lender of last resort. Recently the 1987 Savings and Loan Crisis bailout cost about $160 billion. Other recent government private sector bailouts have included: 1970 Penn Central 1971 Lockheed 1980 Chrysler 1984 Continental Illinois 1991 Executive Life Insurance Company by states that assessed other insurers and the 1998 Long-Term Capital Management bailout by commercial and investment banks. Think overcoming greed is difficult. U.S. does better than most! 12/28/15 See History of U.S. Government Bailouts. Great Recession Cost Were High But Growth Cured Budget Problems Economic Cost of Great Recession Estimated at 12.8 Trillion. Some add home values losses, but this is a reach since the housing bubble had inflated values. The bailout cost was recovered as U.S. FED Profit were up from $47b in 2009 to 2010-14 profit of $ 420b. Source See Treasury Financial Analysis of Great Recession in Charts Hear Recession, Stagnation, and Monetary Policy EconTalk Podcast 1/9/17

|

US Federal Debt Returns to Normal

|

|

Think

many use true but not necessarily appropriate data to foster their POLITICAL

beliefs. Example: With our obesity problem how could anyone have believed

that many went to bed hungry during the Great Recession. Calculation ignored

food stamps and subsidized school lunches. |

|

|

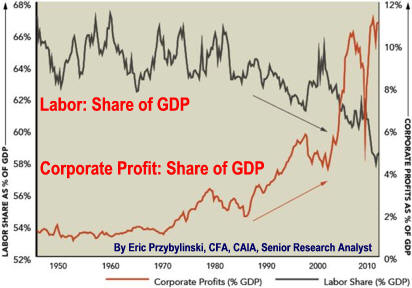

New Normal # 6 as the New Century Arrives Profit Beats Real Wages Twenty-first century war expenditures helped profit recover after a dot-com bubble recession, then crash with The Great Recession and then grow to new heights. US Companies have competed very well in a flat world using technology, outsourcing to Asia, Mexico...and by keeping wage increases low. Source Total compensation has done better although Obama Care gave companies an opportunity to again lower compensation. Source More Data 1 Data 2 Think Rust Belt then NAFTA and soon TPP? See How Democratic Failed Workers 11 min Short Term vs. Long Term Returns 52 min

|

|

|

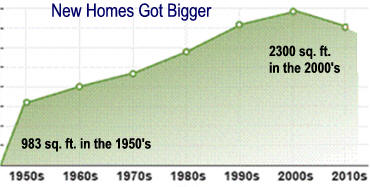

New Normality #7 1. Society's continued stability has resulted in tremendous economic growth which is the key determinate of well-being. Public safety net, child safety, and adjusted poverty rate have all improved dramatically since the Gilded Age.

3) Personal Income increased continuously if not always rapidly because nature and nurture improved the personal characteristics needed to enhance wellbeing. Think Russia, China, and Europe's really slow recovery from the Great Recession. |

|

|

|

|

4) Many use inappropriate economic

statistics. Source Is The Country In Trouble Will Stagnate Income Hurt Our Children Recent Decades Ranked By Problems.

|

|

||

|

Will

New Normal #8 Be

|

|

Understanding Balance Sheet Recessions They are infrequent, severe, and long-lasting. Understanding them is necessary when judging society's efforts to manage The Great Recession. It is like understanding a doctor's attempt to relieve a headache requires knowing the level of difficulty. Was it a Migraine Headache? A balance sheet is caused by high levels of private sector debt. Assets must equal liabilities plus equity. If assets values like housing collateral fall below their associated debt, equity must make up the difference or insolvency results and debt must be repaid. Think 1837, 1873, 1890 & 1929 See Most Severe US Recessions.

Financial Crisis to

Recession to Great Recession to Recovery |

Great Recession Stages

from

The Shifts and the Shocks by Martin Wolf 1. A more complex unstable financial/credits system resulted in extreme optimism in good times and panic in bad times. Think Derivatives, securitization, credit default swaps managed by hedge funds. 2. Savings glut created as emerging countries lowered borrowing and increased trade surpluses after the 1997 Asian Debt Crisis made their foreign dollar dominate debt unsustainable. They expanded trade and kept personal consumption below economic growth. Less consumption and borrowing plus a trade surplus increased Dollar, Euro, and Yen reserves. Like the Petro Dollars in the 1980's this excess savings would be loaned for poor investments (housing). Think savings from China and Russia and other re. 3. Aggregate demand stagnated as trade surplus countries didn't spend. Germany's 2005 economic renewal was saved and Japan's private sector saved much more after their 1990's credit bubble exploded. Adding to the demand shortage were companies who maintained profit by decreasing capital investment spending despite historically low interest rates. Globalization and technology also helped them maintain profit as wage increases were limited to most valuable employees. State and local governments, especially those with underfunded pension systems, also cut expenditures. Think Mercantilism 4. Increased current account deficits by wealthy nations balanced world trade. Higher demand for foreign goods was made possible by massive central bank supported low interest loans. The FED's historic monetary expansion was made possible by continued low inflation caused by expanded Flat World competition and low oil prices. Innovative financing and lax financial regulation also fostered expanded financial asset demand. Think excess OPEC savings financed the 1970's Latin American Debt Crisis leading to Savings and Loan Crisis. 5. Real Estate and Stock bubbles came as expected from low long-term real interest rates. New home buyers borrowed surplus savings and investors devoured growing unique debt securities created by an expanding finance industry promising insured difficult to understand almost guaranteed financial instruments. Leverage rose dramatically. Fraud, near fraud and data manipulation exploded as mortgage servicers, banks, and the law firms broke the law to force people out of their homes. See Chain of Title and Brief History of Financial Bubbles.

6. Poor Crisis Management by politicians as

their economic advisors believed market capitalism would prevent

serious recessions. The

Great Moderation solidified this view. Possibility of new financial

instrument contagion were not understood. When panic started,

political, intellectual and bureaucratic leaders resisted quick action in areas

that required cooperation. A

US depression was avoided by FED, Treasury and Congressional efforts

that were slowed by austerity. Iceland, Ireland, Greece, Spain and

Portugal experienced economic depression.

|

||||